Long Products

November 3, 2020

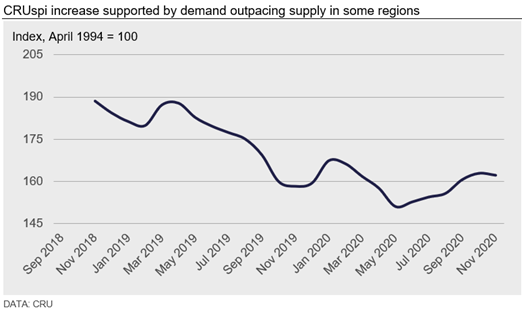

CRU: Longs Prices Rise as Demand Outpaces Supply in Some Regions

Written by James Campbell

By CRU Principal Analyst James Campbell, from CRU’s Long Products Monitor

Most long product prices around the world increased this month as the recovery in demand continues. For some markets and products, the increase in supply has been outpaced by demand. Wire rod remains the strongest product right now as the increase in construction activity combines with better manufacturing activity. Demand in China has been strong after the national holidays, although there is a risk of oversupply

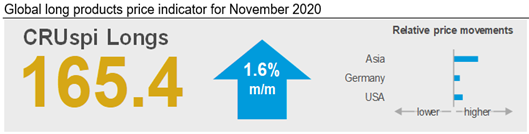

Overall, the Global Long Products Price Indicator (CRUspi Longs) increased by +1.6% m/m to 165.4 in November 2020. The index was pushed higher by price increases across Asia, Germany and the U.S. this month.

Prices Have Increased in All Regions…

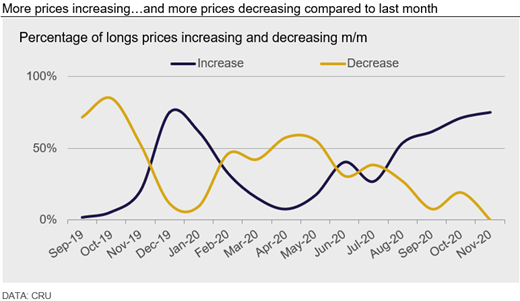

2020 is a year of surprises. In November, longs prices have increased in most regions across the world. About 75% of longs prices increased, compared to 71% in September. More interesting is that no prices fell (last month: 19%). The last time that happened was in December 2016, and then for only one month. This suggests we may have reached or are close to the peak—but maybe not everywhere.

…as the Recovery in Demand Gathers Pace

A common theme this month is the strength in construction demand. It is not the only source of growth right now. Manufacturing demand was hit hardest from the first Covid lockdown, but is now also on the road to recovery. This dual source of demand growth is felt most in the wire rod market.

This is currently most acute in the U.S. as domestic production is struggling to keep pace with demand while imports are at a low level. Imports are unattractive, not just on price, but also due to the long lead times on offer. Many buyers are unwilling to commit further ahead until the uncertainty surrounding the U.S. presidential election is resolved.

But Demand Alone is Not Enough to Push Prices Higher…

In Brazil and India, the growth in construction sector demand has outpaced supply, but this has combined with other factors to push prices higher. In India, there has been a shortage of domestic iron ore following mine auctions earlier in the year. This has had the dual effect of constraining supply and pushing up costs for producers who were able to purchase more expensive seaborne iron ore supplies. In Brazil, the rise in domestic prices was also supported by a weak Brazilian real. While Southeast Asian construction demand is not yet strong enough to support prices, support still came from higher scrap prices and a strong Chinese domestic market following the national holidays.

…and Buying is Weaker in Some Regions

The strength in demand is not uniform. Middle East prices were stable as the weak energy sector is counterbalancing strength in infrastructure and housing sectors. Construction activity in Russia has wound down for winter and continues to struggle in Japan. The main support for growth of Japanese long products comes from demand for exports of manufactured goods.

European demand is strong at the moment and, like the U.S., mill orderbooks have found support from construction activity and better automotive demand for some products. However, most buyers have restocked so the latest price rises are based on lower levels of transactions compared to normal—little buying is needed until the new year.

Outlook: Lockdowns are Returning the Direction

The big uncertainty last month was Chinese demand after the national holidays. Short-term demand in China has remained strong following the holidays and this is providing support to Asian markets. However, there is a risk of oversupply in the winter months, especially as current margins mean production cutbacks are less likely. Winter Heating Season production cuts are also unlikely to cause a shortage.

Uncertainty is greatest in Europe and the USA. Europe is currently experiencing a strong second-wave of Covid-19. Although the new lockdowns are attempting to support continued construction and manufacturing activity, some demand is likely to be lost. Although U.S. demand is strong right now, investments are being delayed until the outcome of the U.S. presidential election is known. If the period of uncertainty is protracted, construction demand may be weaker than expected in 2021 Q1 and prices may fall.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com