Prices

October 22, 2020

Hot Rolled Futures: Now What?

Written by Tim Stevenson

SMU contributor Tim Stevenson is a partner at Metal Edge Partners, a firm engaged in Risk Management and Strategic Advisory. In this role, he and his firm design and execute risk management strategies for clients along with providing process and analytical support. In Tim’s previous role, he was a Director at Cargill Risk Management, and prior to that led the derivative trading efforts within the North American Cargill Metals business. You can learn more about Metal Edge at www.metaledgepartners.com. Tim can be reached at Tim@metaledgepartners.com for queries/comments/questions.

HRC futures have been continuing to move up over the past week, but less violently than in the recent past. The chart below shows the curve in 2021, and prices in most months rose $10-30/ton from last week. The market has been faced with continuing supply issues from the U.S. mills and a lack of available imports. Buyers have been stuck between a rock and a hard place trying to secure enough steel to keep their lines running and customers with enough material.

With the steep “backwardation” in the curve, there have been some buyers looking to buy futures in farther out months that appear to be at a nice discount relative to where spot tons can be secured from mills at the moment. While still painful to be buying at prices that have gone stratospheric versus August levels, this is where some of the buying interest has come from. From an inventory hedging perspective, futures can offer sellers some “protection” when the market turns lower. By selling futures contracts, service centers can set up “short” positions in futures that will provide profits if prices move down, which offsets some of the risk of loss in physical inventory once the cycle rolls over. The key question is, when will this cycle end? Cleveland Cliffs has been emphasizing “value over volume” in recent conversations with analysts. One has to wonder what they will do with their new asset footprint now that their deal with Arcelor has closed. We see this as a key piece of the puzzle in terms of trying to determine when this current cycle will end. The other key piece is the international markets, which have shown no signs of letting up.

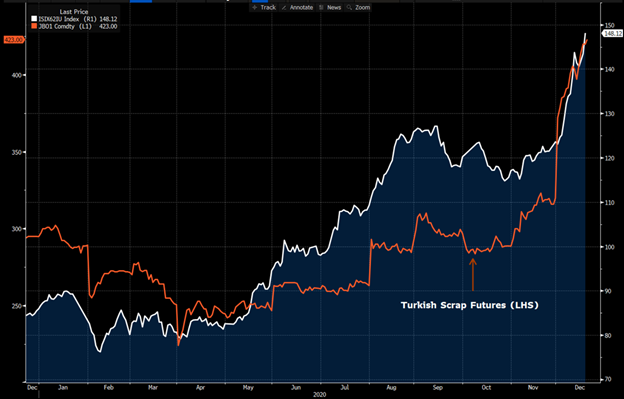

Iron ore has seen additional advances take place, as there was another accident in an important iron ore mining district in Brazil. This has traders on edge as we are entering the rainy season in Brazil, and also the time of year that typhoons can disrupt supplies of ore and met coal from Australia. You can see the white line on the chart below is ore prices—and they are not providing any relief from the raw materials inflation picture. Turkish scrap is also moving up significantly in tandem with ore.

Prices in Europe have also rocketed up recently, with Arcelor reportedly moving offers up to 700 euros on HRC. The below chart compares the European futures to U.S. HRC futures (3rd month contract, U.S. prices are in blue). The European prices are per metric ton, and I’ve changed the currency to USD.

It is also worth noting that volumes are picking up on the European contract, offering mills, service centers, and OEMs more options to hedge those exposures.

Shifting over to U.S. scrap, busheling prices have moved up across the curve, around $5-18 across most of the months in 2021. The physical scrap market has clearly tightened up here in the U.S. as we’ve had Big River Steel start up its Phase II operations, and other minimills have been running full out given the high prices. That, combined with ore prices moving up, has provided strong support for the raw material markets domestically.

From a risk management perspective, the futures offer ways to help buyers and sellers manage the risks in an extremely volatile market. OEMs can use a long futures position to hedge against rising costs, service centers can “sell short” futures to hedge the risk of inventory losses, and also can structure fixed price deals using these tools to bring customers certainty in their costs. When different entities come together in the market to hedge risk—there is a buyer for every seller and vice versa. Recent volatility has presented new and greater challenges for both sides, but this is what makes a market work.

Enjoy the Holidays and stay healthy!

Disclaimer: The information in this write-up does not constitute “investment service,” “investment advice” or “financial product advice” as defined by laws and/or regulations in any jurisdiction. Neither does it constitute nor should be considered as any form of financial opinion or recommendation. The views expressed in the above article by Metal Edge Partners are subject to change based on market and other conditions. The information given above must be independently verified and Metal Edge Partners does not assume responsibility for the accuracy of the information