Prices

October 22, 2020

Hot Rolled Futures: Anatomy of a Short Squeeze

Written by Tim Stevenson

SMU contributor Tim Stevenson is a partner at Metal Edge Partners, a firm engaged in Risk Management and Strategic Advisory. In this role, he and his firm design and execute risk management strategies for clients along with providing process and analytical support. In Tim’s previous role, he was a Director at Cargill Risk Management, and prior to that led the derivative trading efforts within the North American Cargill Metals business. You can learn more about Metal Edge at www.metaledgepartners.com. Tim can be reached at Tim@metaledgepartners.com for queries/comments/questions.

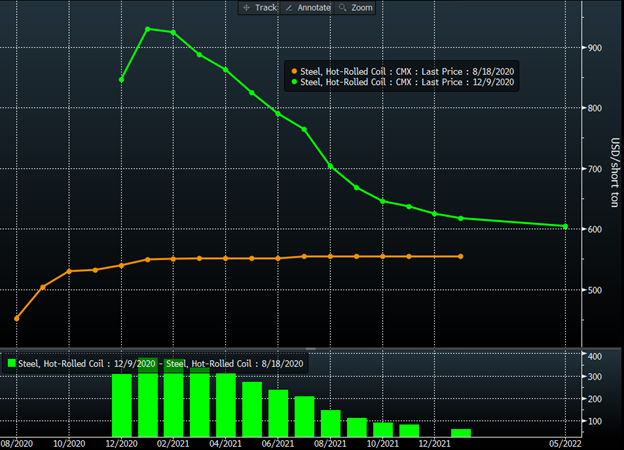

Many of us have been sitting in stunned amazement, watching the steel futures gap move higher on almost a daily basis—$600, $700, $800, then $900—and it doesn’t seem to want to slow down! So how did we get here? What caused this and what can “fix” it?

In my mind, we sowed the seeds for this current spike with a number of events over the past 12 months:

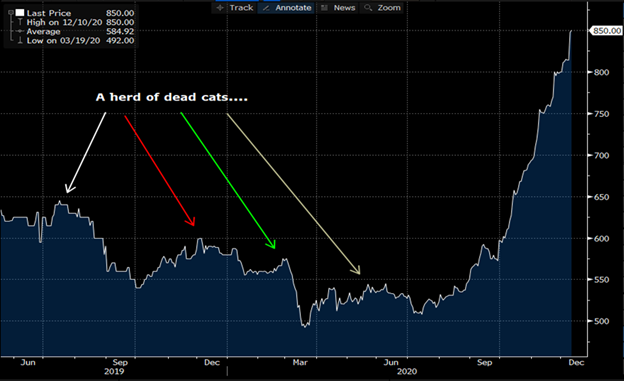

• We had a few weak rallies, or “dead cat bounces” as some people call them. This created complacency in the minds of buyers. “Rallies aren’t sustainable so why get sucked in.”

• Lead times were extremely short mid-year, giving service centers very little reason to build inventories.

• Outside of the steel production and distribution industry and further downstream, the same “just in time” inventory mantra continues to be preached.

• We are in the middle of a global pandemic. The shutdowns caused an unprecedented drop in GDP—the size of which we haven’t seen since the Great Depression.

• Lots of mills took extended capacity shutdowns in response to the virus.

• China embarked on some significant stimulus spending to offset the virus’ impact on their economy.

• In the doldrums of summer, a number of mills scheduled maintenance outages for the October/November time period as lead times were extremely short.

• The auto companies lost about three months of production due to COVID-19-related shutdowns, and when auto sales came back stronger than expected, production rates came back strong.

• Even now, auto dealership inventories are too low, somewhere in the low to mid 50-day range.

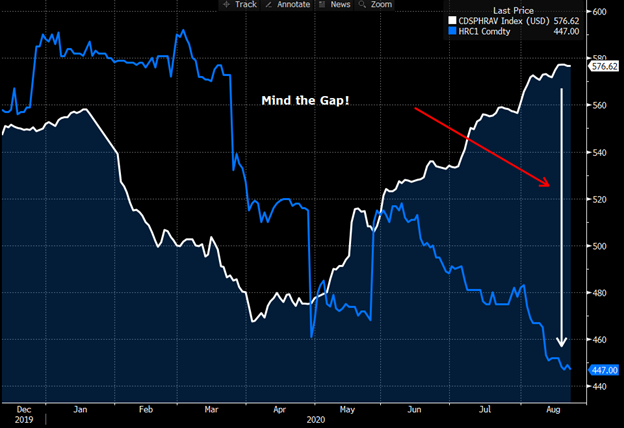

• Steel prices in China started to run well in advance of the U.S.; there was a lot of catching up to do. Keep in mind this chart ends in late August (Chinese steel prices are in white, the U.S. in blue):

• Cleveland-Cliffs agreed to buy a number of mills from Arcelor. This one event likely froze the restart decision on a significant amount of potential capacity.

• Very recently, one of the major iron ore producers gave a disappointing production outlook, sending ore much higher.

This confluence of events has led to an unprecedented steel rally. The market is short physical steel, and some players in the financial markets got caught short HRC futures as well. The rise has been meteoric since mid-August.

How can this happen? Aren’t markets efficient and doesn’t the forward curve predict the future? The answer to this is no, futures don’t predict what will happen tomorrow. They are just what investors and traders think will happen in the future. When new information comes into the market or unforeseen events happen, prices change without warning.

Just for fun, I’ve included a busheling chart using the same dates. While the move in scrap has been big, it is dwarfed by the $300-350 increase in HRC! This obviously means major margin expansion for the steel mills.

The chart below also shows that Turkish scrap has been running as well. Note that busheling usually trades above the Turkish price, and right now Turkish is at a slight premium. This could signal that there is more room to go in the domestic scrap market.

So, we had an almost perfect setup for a major short squeeze. And now that the powder keg has gone off, it’s hard to say just how high this market can go. What can fix it? We need supply desperately. Mill restarts….imports….anything. Or we need demand to slow dramatically in order to bring things into balance. As far as lessons learned—it’s important to realize that we just don’t know what is going to happen in the future. We can make educated guesses, but figuring out how to mitigate risks that we can’t control is a good part of any long-term business plan. Futures may not predict the “future,” but we can use them to lessen the impact of unforeseen events. Stay healthy!

Disclaimer: The information in this write-up does not constitute “investment service,” “investment advice” or “financial product advice” as defined by laws and/or regulations in any jurisdiction. Neither does it constitute nor should be considered as any form of financial opinion or recommendation. The views expressed in the above article by Metal Edge Partners are subject to change based on market and other conditions. The information given above must be independently verified and Metal Edge Partners does not assume responsibility for the accuracy of the information