Prices

October 15, 2020

CRU: Multi-Commodity Outlook: Fundamental Disconnect?

Written by Zanna Aleksahhina

By CRU Multi-Commodity Analysts Zanna Aleksahhina and Will Young

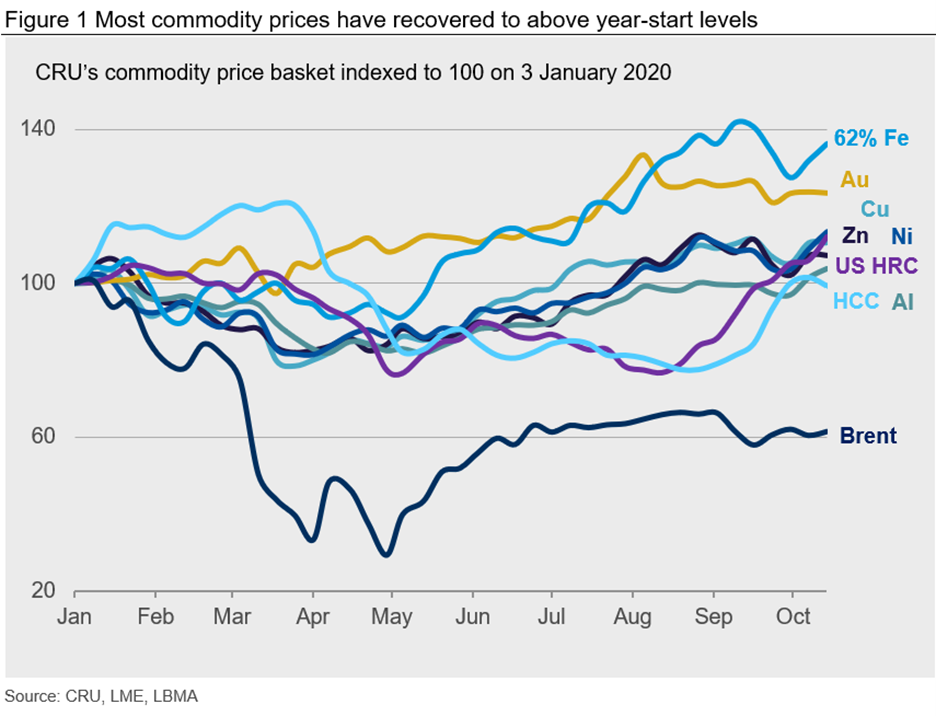

Over the summer and into Q3 2020 commodity prices staged a remarkable recovery from Q2 lows and in October many prices are comfortably above where they started the year. Given that the major economies are still struggling to control the spread of Covid-19, underlying demand is weak, the recovery is slowing, and a vaccine remains distant, are commodity prices disconnected from market fundamentals?

Commodity Prices Came Out of Lockdown on a High

The path of commodity prices this year can be broken into two halves and we must look at China and the rest of the world separately to explain commodity prices’ paths.

From the emergence of Covid-19 in Wuhan province through to mid-April, most commodity prices fell by between 10% and 25%. There were two notable exceptions: Gold rallied due to its safe-haven status (by August this year, the gold price reached record highs breaching $2,000 for the first time), and oil plunged to new depths in April as lockdowns halted local, regional and global transport sending WTI prices negative for the first time.

The price recovery for commodities (such as the base metals) came fast. The explanation for the recovery is twofold: first, China has suffered less than was feared and, second, industrial and manufacturing sectors have been hit less hard than in previous downturns.

Covid-19 Supply Disruption Has Been Limited

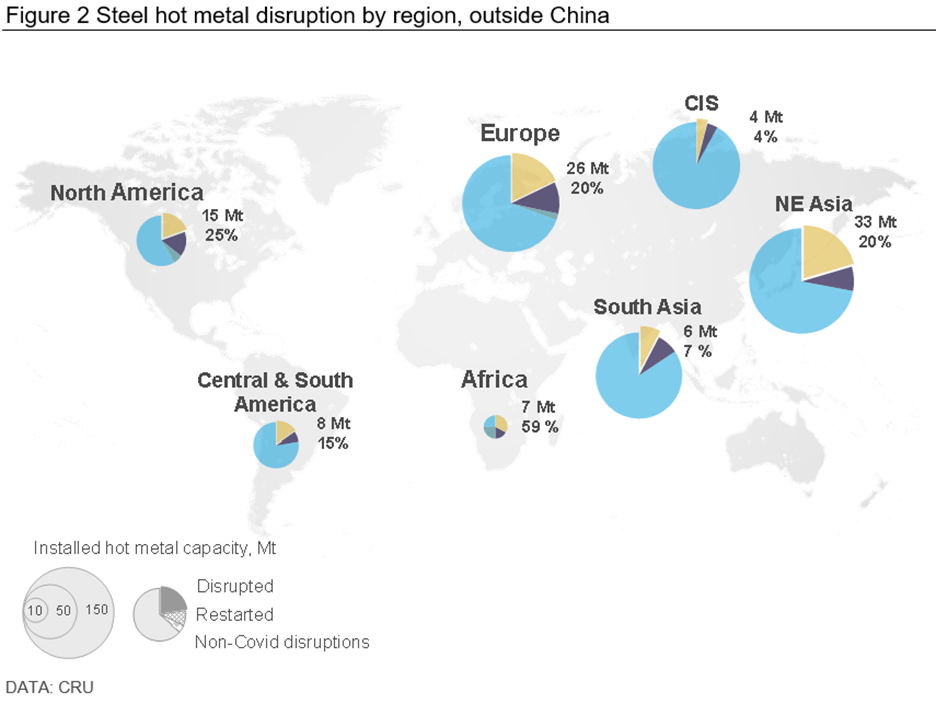

Although the impact on supply from the pandemic was felt globally, supply disruptions were by and large short-lived. CRU has tracked the supply disruptions closely across commodities as they happened in our “disruption trackers” and we have partnered with Deloitte to provide a global dashboard, updated weekly. Click here to see the CRU/Deloitte Covid-19 disruption dashboard.

The supply response in steel has been greatest. Mills globally instituted capacity curtailments; however, restarts happened quickly and at the time of writing just 7% (176 Mt annualized capacity) remains disrupted including 10 Mt of non-Covid-19 related disruption.

In aluminum, just 2% of production capacity was disrupted by Covid-19-related smelter curtailments or closures, with much of the surplus metal heading into warehouse financing (as we have seen occur in previous downturns) and just 4% of copper mine supply has been lost thus far in 2020.

Path of the Economy Depends on the Course of the Virus

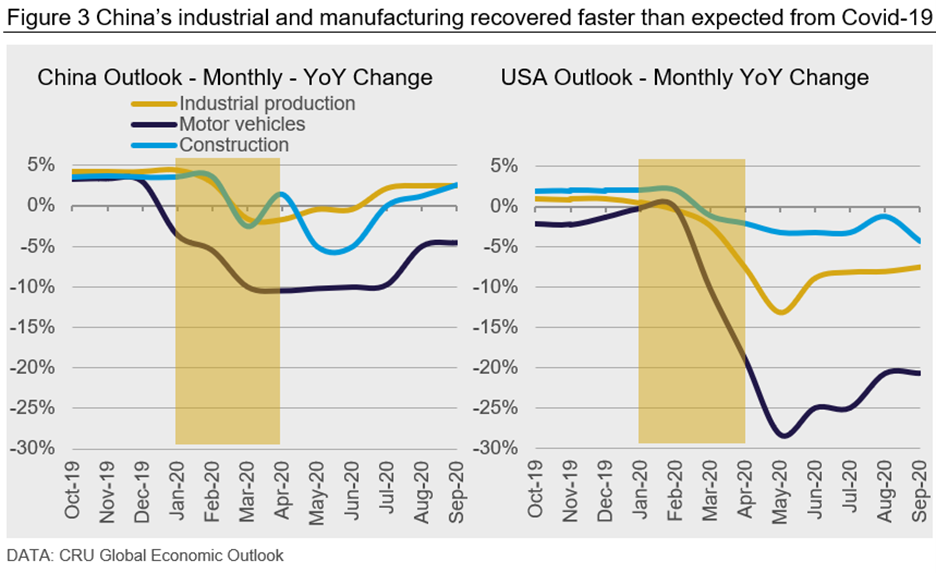

When it comes to the impact Covid-19 has had on demand and for demand expectations, the impact has been dramatic. We need to look at what is happening in China and then the rest of the world separately. In China, demand in Q1 dropped spectacularly, as metal fabricators ground to a halt. Copper and aluminum demand recorded sharp declines y/y and steel demand suffered substantially as well.

However, the bounce back in Chinese metals demand has been startling, with recovery across construction and automotive supported by infrastructure stimulus. Recent work by CRU on the Chinese construction sector by our construction group has shown how strong construction starts have been in recent years, which bodes well for completions in the next couple of years. For China then, demand is starting to return to pre-Covid-19 levels.

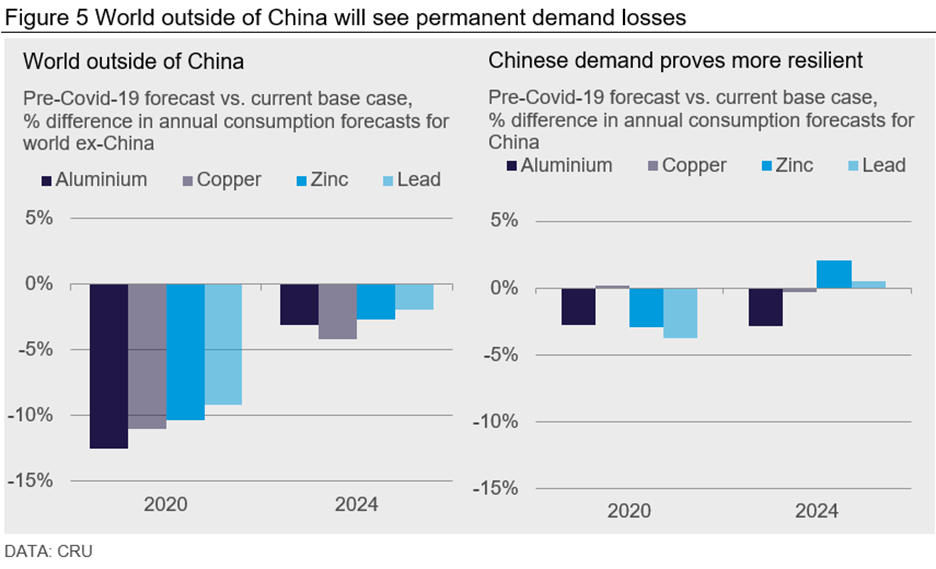

Outside of China, metals demand collapsed in Q2 following the lockdowns and their impact on activity. We saw massive double-digit y/y declines in demand in Q2. While demand outside China is now recovering, the pace of the turnaround is looking much slower than in China, and there are more headwinds ahead going into 2021. The failure to eradicate rising infection rates of Covid-19, unlike in China, is one factor that could hold back recovery.

Q3 activity has been boosted by the release of pent-up demand, but demand has still been weak on a y/y basis. Indeed, the recovery is “U shaped,” and the key point is that we are facing a long slog as far as recovery is concerned. We certainly will not get back to pre-Covid-19 levels of demand outside China until after 2021.

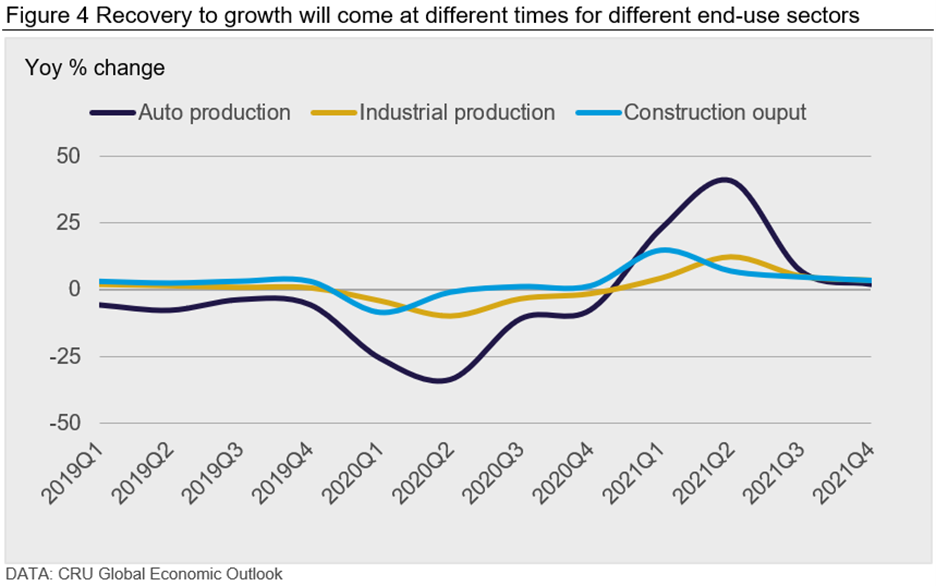

Auto Sector Has Been Hard Hit by Covid-19 While Construction Weathered Lockdown Comparatively Well

The initial automotive supply chain disruptions and closure of assembly plants placed an intense pressure on an industry that was already suffering from a downshift in global demand in 2019. Auto sales collapsed through the lockdown, which was a familiar story globally. Meanwhile in April 2020, China announced new policy outlining details of new energy vehicle subsidies through 2022. CRU expects global vehicle production to fall 19.3% in 2020 and recover to 16.2% in 2021.

Most regions will see signs of improvement in 4Q 2020 vehicle sales. However, the release of pent-up demand masks real underlying demand, which will come into focus only as delayed purchases are completed.

Unlike manufacturing, construction activity largely continued throughout the lockdown. Therefore, for the two major end-use sectors for metals, CRU has individual recovery paths.

China’s Quick Recovery Contrasts with ROW Scarring

The speed and robustness of China’s recovery this year following the initial Covid-19 lockdown surprised many market analysts, and further good news for commodity markets (since China accounts for roughly half of global commodity demand) is that CRU expects China’s demand to be more resilient throughout the medium-term forecast. The emerging story is of a divergence between Chinese demand versus the rest of the world, where CRU expects to see demand lower in the medium term against the pre-Covid-19 levels.

Chinese Economic Stimulus Increased Construction and Infrastructure Demand More Than Previous Stimulus Episodes

The steel industry in China has been performing well through the pandemic, with Chinese port stocks of iron ore at low levels, and increased demand from domestic steel producers. Copper imports were also at record high levels, likely due to Beijing publishing its investment plan into infrastructure, such as railways and ultra-high voltage power lines. The China Railway Corporation expects a 41% increase in total new mileage and a doubling in high-speed mileage through to 2035.

Outside of China, the recovery is weaker – the construction sector recovery in the U.S. and Eurozone is going to take another two years and the transport sector – driven largely by the automotive market – will take some years to return to pre-Covid-19 levels.

Margins Recovered Due to Price Rebound and Lower Costs

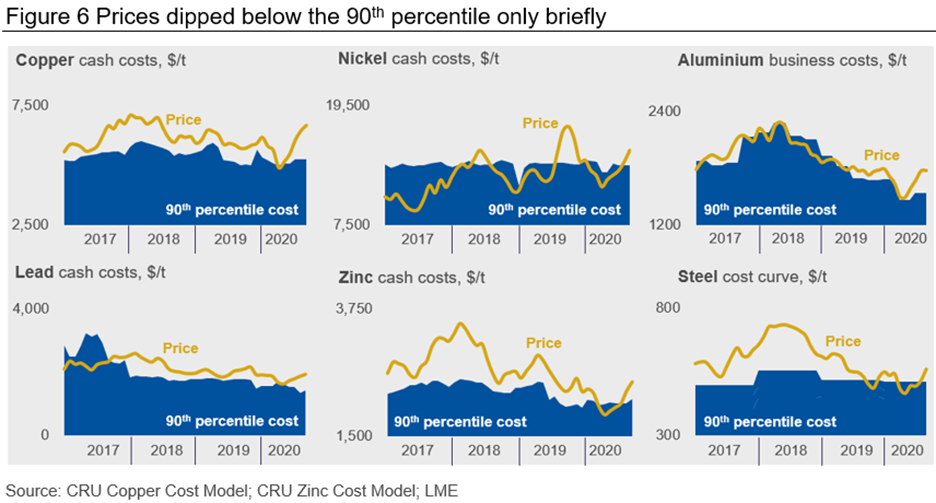

Producers saw prices fall below the 90th percentile on global cost curves – a key price point and a general indicator of supply response for many commodities – but prices rebounded quickly, and producers’ margins have been shielded by falling costs.

Miners and metal producers’ margins have been supported by costs tracking prices lower; the oil price has stayed low and the U.S. dollar exchange rate moved in producers’ favor. Copper mine costs, for example, have reached their lowest levels since 2011 driven by a stronger dollar, multi-year low realization costs due to low TC/RCs, and record gold prices.

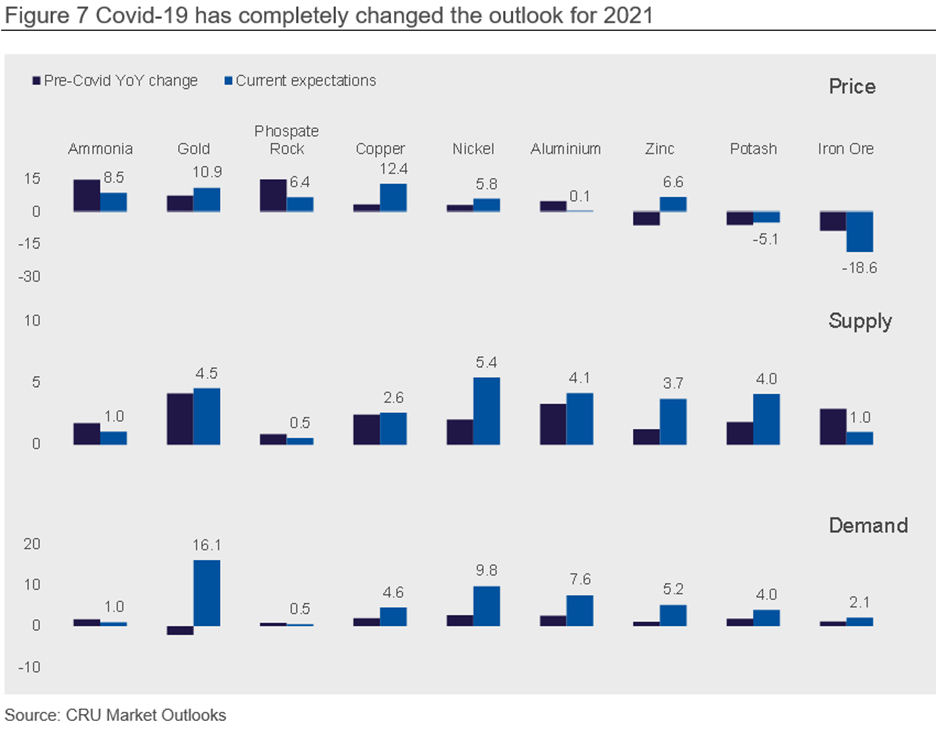

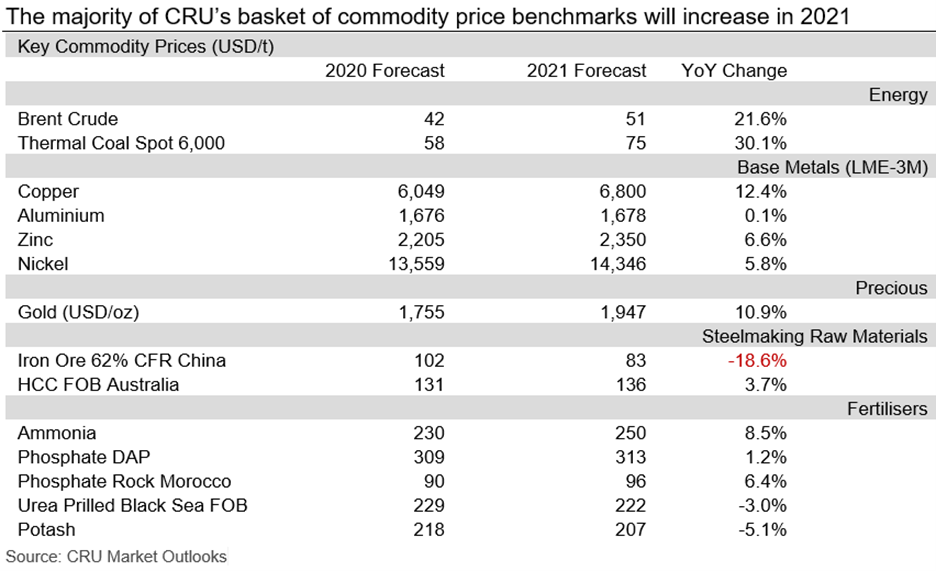

Prices Have Rebounded But What’s the Outlook for 2021?

Prices across base metals improved as the market recovered from Q2, led by the rapid recovery of China, which pulled prices higher. There has also been significant investor influence on LME metal prices, which has caused some dislocation between price and market fundamentals.

For steel, however, flat products producers have had a very tough year. The global steel price has sat around the 90th percentile of cost over the last 12 months and, at times, below the 75th percentile. During the lockdown months of April and May, prices in Southeast Asia even dipped below the 25th percentile. For steel, the fact that prices have been hovering around the 90th percentile and below for much of this year is the key reason why we have seen significant cutbacks to production in steel.

It is important to focus on the fact that we see an upturn in prices (particularly for LME prices) at a time of weak global demand. At times like this, there is a heightened risk of oversupply and in all the base metal markets that we are discussing today – a global surplus has developed in 2020. So, while prices are sufficient to cover the 90th percentile at present, the question is will it last in 2021?

The low oil price, strong dollar and generally favorable by-product combination in 2020 may not continue into 2021; this implies that LME prices will need to be maintained at current levels if positive margins are to be preserved. We do expect prices to hold and for positive margins next year, although the size of those margins is variable and not assured.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com