Overseas

October 8, 2020

Domestic HRC Prices Slowly Losing Edge Over Foreign Imports

Written by Brett Linton

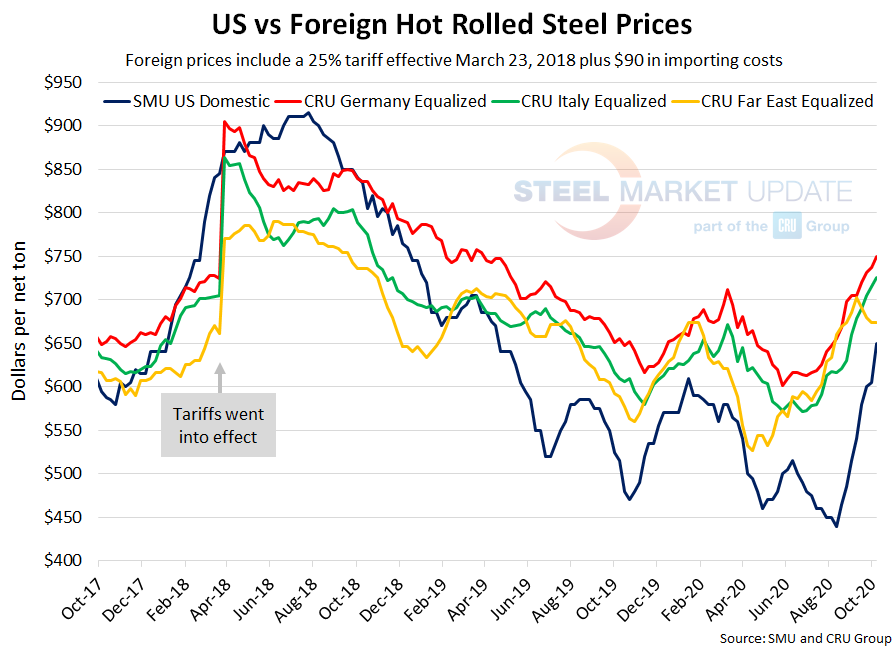

This week’s foreign vs domestic hot rolled steel price comparison shows that U.S-producers are moving closer to losing their price advantage over foreign imports, according to SMU and CRU indices released this week. The price differentials between domestic HRC compared to foreign imports had widened through mid-August to reach record highs, but have since declined between 53 and 89 percent.

The following calculation is used by Steel Market Update to identify the theoretical spread between foreign hot rolled steel prices (delivered to U.S. ports) and domestic hot rolled coil prices (FOB domestic mills). This is only a “theoretical” calculation as freight costs, trader margin and other costs can fluctuate, ultimately influencing the true market spread. We are comparing the SMU U.S. hot rolled weekly index to CRU hot rolled weekly indices for Germany, Italy and the Far East (East and Southeast Asian ports).

![]() SMU includes a 25 percent import tariff effective on foreign prices after March 23, 2018. We then add $90 per ton to the foreign prices in consideration of freight costs, handling, trader margin, etc., to provide an approximate “CIF U.S. ports price” that can be compared against the SMU U.S. hot rolled price. Note that we do not include any antidumping (AD) or countervailing duties (CVD) in this analysis.

SMU includes a 25 percent import tariff effective on foreign prices after March 23, 2018. We then add $90 per ton to the foreign prices in consideration of freight costs, handling, trader margin, etc., to provide an approximate “CIF U.S. ports price” that can be compared against the SMU U.S. hot rolled price. Note that we do not include any antidumping (AD) or countervailing duties (CVD) in this analysis.

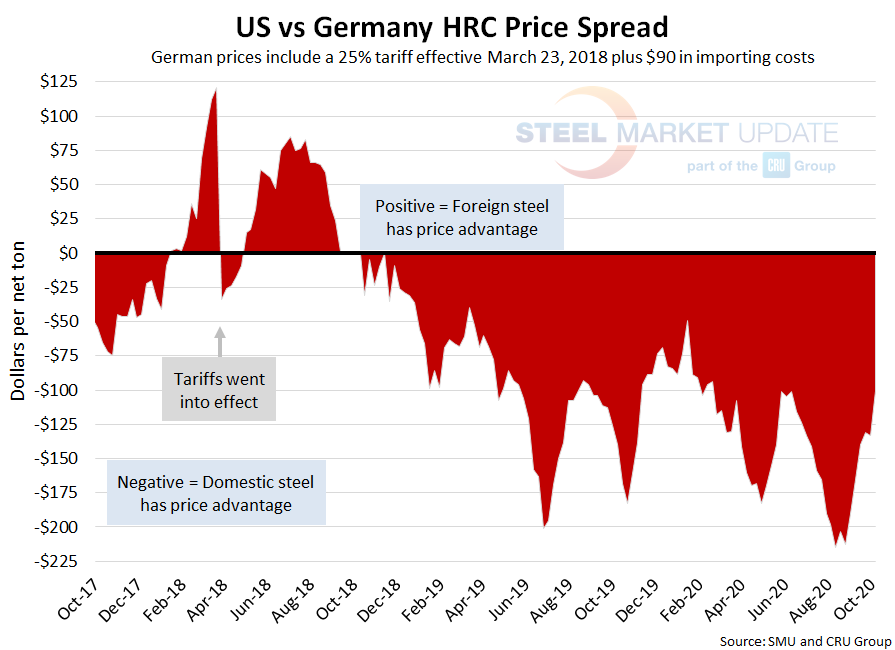

German HRC

As of Wednesday, Oct. 7, the CRU German HRC price was $528 per net ton, up $10 from the previous week and up $15 from two weeks prior. Adding tariffs and import costs, that puts the German price at $750 per ton delivered to the U.S. The latest SMU hot rolled price average is $650 per ton, up $45 over last week and up $50 over two weeks prior. Therefore, domestically sourced HRC is theoretically $100 per ton cheaper than imported German HRC; the spread was $133 last week and $131 two weeks ago. Recall the record high spread of $215 per ton seen on Aug. 12. U.S. prices have held this price advantage for over a year and a half.

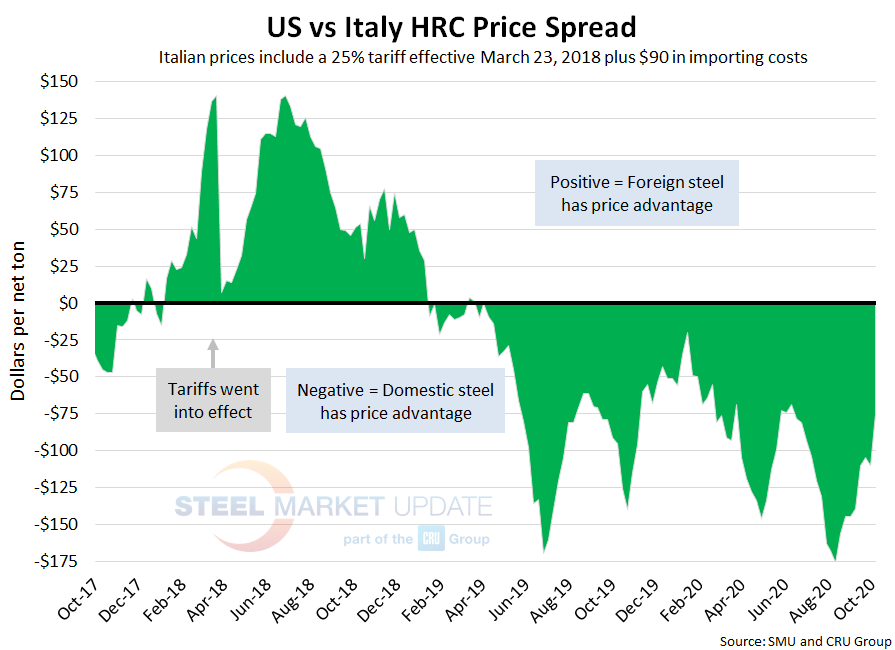

Italian HRC

CRU published Italian HRC prices at $508 per net ton, up $8 from last week and up $16 over two weeks ago. After adding tariffs and import costs, the delivered price of Italian HRC is approximately $725 per ton. Accordingly, domestic HRC is theoretically $75 per ton cheaper than imported Italian HRC; the spread was $110 the previous week and $105 two weeks prior. Recall the record high spread of $176 per ton seen in mid-August. U.S. prices have held this price advantage for over one year.

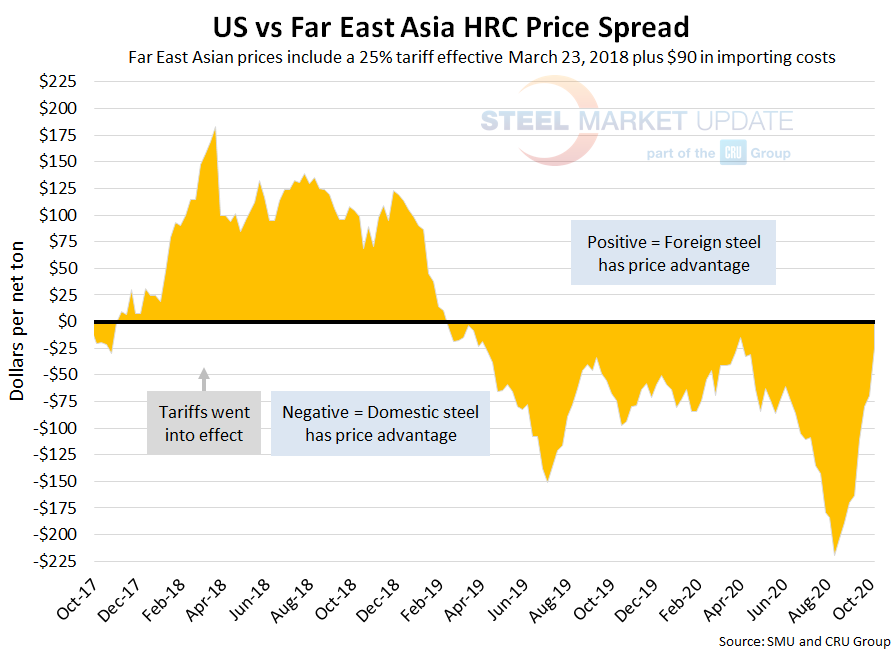

Far East Asian HRC

The CRU Far East Asian HRC price remained unchanged over last week at $467 per net ton, $5 lower than the price two weeks ago. Adding tariffs and import costs, the delivered price of Far East Asian HRC to the U.S. is $674 per ton. Therefore, U.S.-produced HRC is theoretically $24 per ton cheaper than imported Far East Asian HRC; the spread was $69 last week and $80 two weeks ago. Recall the record high spread of $220 per ton seen on Aug. 12. Domestic prices have held this price advantage for over a year and a half.

The graph below compares all four price indices and highlights the effective date of the tariffs. Foreign prices are referred to as “equalized,” meaning they have been adjusted to include tariffs and importing costs for a like-for-like comparison against the U.S. price.

Note: Freight is an important part of the final determination on whether to import foreign steel or buy from a domestic mill supplier. Domestic prices are referenced as FOB the producing mill, while foreign prices are FOB the Port (Houston, NOLA, Savannah, Los Angeles, Camden, etc.). Inland freight, from either a domestic mill or from the port, can dramatically impact the competitiveness of both domestic and foreign steel. When considering lead times, a buyer must take into consideration the momentum of pricing both domestically and in the world markets. In most circumstances (but not all), domestic steel will deliver faster than foreign steel ordered on the same day.