Prices

September 8, 2020

CRU: Upswing in Metallics Prices Accelerates

Written by Ryan McKinley

By CRU Senior Analyst Ryan McKinley, from CRU’s Steel Metallics Monitor

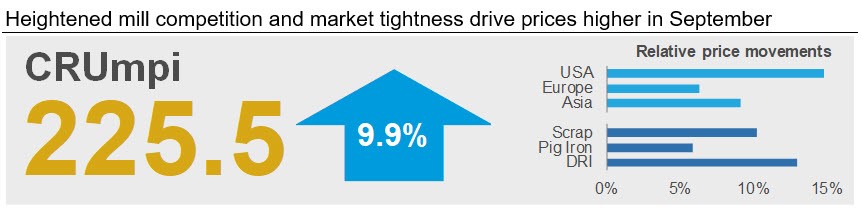

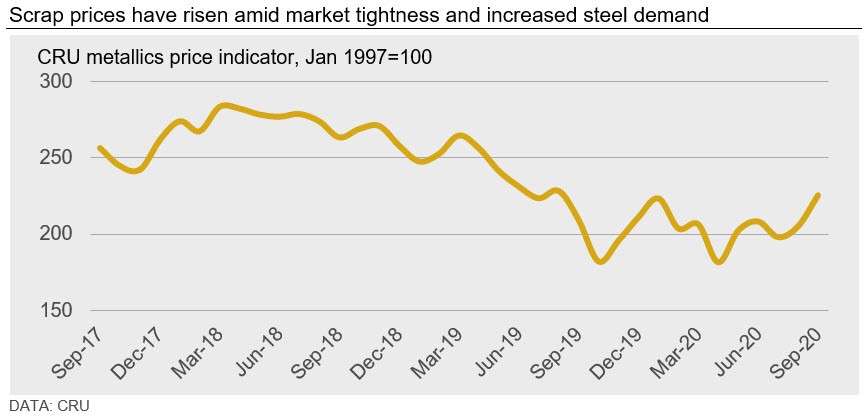

The CRU metallics price indicator (CRUmpi) rose by 9.9 percent m/m in September to 225.5. Rising steel demand internationally in combination with tighter markets has driven relatively large price increases in every market we assess. Market sentiment is bullish for October and, barring any major changes in trade flows, we expect upward price momentum to continue.

Finished steel demand continues to strengthen around the world and mills in every region we cover raised metallics prices in September to keep material flowing. The most dramatic of these increases were in North and South America. In the U.S., for example, some obsolete grade prices rose by over 20 percent m/m, while those in Brazil hit a record after rising by 37 percent m/m. Restocking at European mills coincided with yet higher Turkish import demand, resulting in higher prices in both locations. Meanwhile, Chinese demand for semifinished products supported scrap prices in other parts of Asia, and Chinese demand for ore-based metallics—alongside new purchases in the U.S. and Europe—again resulted in higher prices m/m.

Price increases in the U.S. were greater than expected by most market participants. As finished steel demand and prices rose, domestic competition between mills for material became much more aggressive in September. The intensity of this competition was exacerbated by a strong pull from the east coast by exporters, who had already decreased obsolete scrap availability in the country amid strong international demand. A similar situation took place in Brazil, where subdued scrap availability coincided with strong steel demand in the construction sector and allowed prices to rise to a record high.

In Europe, mills had reduced scrap inventories over the summer and are now in a restocking phase. Scrap demand in Germany, particularly the Ruhr area (northwestern Germany), forced mills in the south of the country and in Italy to raise bids. Spain was less active in the market due to low demand for steel long products. In Russia, prices increased even as scrap supply continued to enter the country from Kazakhstan. The low availability of Russian scrap continued to cause atypical trading patterns domestically as mills in the Urals region reached into other areas to meet their aggressive procurement plans.

Much like the U.S., mills in Europe and Russia also had to increase prices because of strong import prices in Turkey. Demand for Turkish steel domestically and internationally has been strong in recent months, with order books now extending out to at least November. As such, import prices for HMS 1/2 80:20, CFR Turkey, have now breached the $300 /t mark. A major reason for increased demand for Turkish steel internationally has been the absence of Chinese exporters in the market.

Chinese domestic integrated mills have been operating at nearly maximum capacity to meet high domestic demand and are using higher-than-usual scrap volumes in their melts. Meanwhile, adverse weather conditions continue to hamper scrap deliveries in the country, so mills increased their buying prices again m/m.

Steel demand also continues to be strong in other areas of Asia, and scrap prices there have also risen. In Japan, domestic mills have had to compete with exporters for scrap and have increased prices despite weakness in the country’s construction sector. Meanwhile, strong Vietnamese domestic steel demand and higher billet exports to China have driven scrap prices higher m/m—especially given that steelmakers in Vietnam are capturing healthy margins.

In contrast to August, European and U.S. importers returned to the pig iron market even as buying interest in China intensified. Lead times are increasing, and Brazilian exporters are now negotiating December shipments to China for February arrival. For DRI/HBI, the market tightened further as U.S. buyers re-entered the market and had to compete with high buying activity in China. Still, European buyers have yet to return to that market.

Outlook: Indicators Point Towards a Bullish October Market

International steel demand, and by extension scrap and metallics demand, is likely to remain at elevated levels in October. U.S., Russian and European markets are likely to face more upward price pressure given increased domestic demand, and we expect this to help push Turkish scrap import prices even higher. For pig iron, Chinese buying interest is likely to persist. Should traditional pig iron importers also remain in the market, prices should also get a boost again in October.

There are a few downside risks at present, but they do not yet appear to be materializing in the short term. The first is a possible fall in iron ore prices, which could cascade into other markets by lowering pig iron costs and prices, which could then put downward pressure on prime grade scrap. Second, should higher scrap levels draw out substantially more obsolete scrap in the U.S. or Europe, we could see an oversaturation of the market, which would result in lower domestic prices and allow Turkish importers to decrease their buying prices as well.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com