Overseas

July 12, 2020

CRU: Global Price Recovery Stalls

Written by Josh Spoores

By CRU Principal Analyst Josh Spoores, from CRU’s Steel Sheet Products Monitor

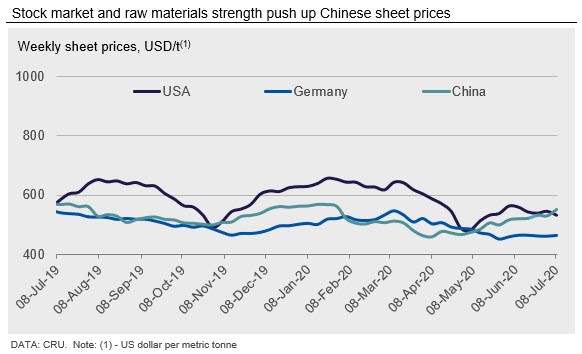

Sheet prices in July at best rose very weakly, or else only held steady or fell in a number of markets versus our June 10 price assessments. The domestic Chinese market was alone in showing more than just a slight m/m gain.

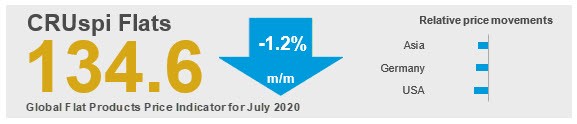

CRU’s Global Flat Products Price Indicator (CRUspi flats) reflects this mixed, yet in aggregate slightly lower price trend. After rebounding in June from the four-year low in May, the CRUspi Flats has fallen back to 134.6, a m/m decline of 1.2 percent.

In 2020 Q2, global sheet prices started to bottom and then turn higher once the most severe of the Covid-19 containment efforts started to lift. Domestic Chinese and Far East Asian import prices started to rise in mid-to-late April. These limited gains were followed by an early May price bottom in the U.S. Price gains from trough to recent peak in these markets were around $60-$75 /t.

While a clear price rebound was seen in the U.S. and Asia, domestic European prices are only now turning upward, and only weakly. Indeed, HR coil prices in Italy and Germany have moved by no more than €4 /t over the past five and seven weeks, respectively. Prices in Europe have been slow to recover, primarily due to supply side dynamics. Not only has inventory remained high versus recent underlying demand, but mill production levels had exceeded demand, particularly for non-automotive sheet products.

In China, economic data points have not only risen since the end of 2020 Q1, but many activity indicators such as electricity generation are now higher than year-ago levels. Sheet consumption has been supported not only by strong construction activity but also by improved manufacturing output, including automotive and appliances.

The upward price trend in the USA was short lived as HR coil prices peaked in early June and have since fallen by $25 /s.ton. Demand here has picked up alongside improved economic activity, yet some of the initial demand gains likely reflect a release of pent-up demand once the regional lockdowns started to lift, and automotive demand has been a highlight and due to gains here. Meanwhile, two blast furnaces that support this industry are undergoing restart operations now, while a third furnace has already been brought up to support the construction and appliance markets.

We continue to publish a weekly Covid-19 disruption tracker online available via this link. This follows changes in hot metal and steel production, most recently highlighting the restart of the previously mentioned U.S. blast furnaces. This report will cover further changes in production as end demand continues to recover.

Outlook: Stronger Demand Recovery Required for Higher Sheet Prices

The global sheet price recovery has likely stalled for now. Demand gains that materialized with the easing of Covid-19 containment restrictions may have reflected a mix of pent-up demand as well as a rebound in activity. However, underlying economic activity in most markets will take time (measured in quarters if not years) to return to 2019 levels. Further, our base case outlook is subject to considerable risk and we have developed an analysis of possible economic outcomes, which you can read here: Covid-19 economic scenarios: the good, the base, and the ugly.

Even as demand continues to return, seasonal pressures as well as the inevitable restart of idled blast furnaces will inevitably limit the duration of sheet price gains. This has been seen in the USA where two furnaces have restarted with one more starting now, while over the next several months two brand new EAF-based mills will start up.

High raw materials costs, particularly iron ore, have supported steel sheet prices so far this year, though perhaps not for much longer as Brazil is set to visibly increase shipments in 2020 H2, and certainly with prices near $100 /t, all other miners will continue to maximize shipments as well.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com