Prices

June 12, 2020

Apparent Steel Supply Tumbles in April

Written by Brett Linton

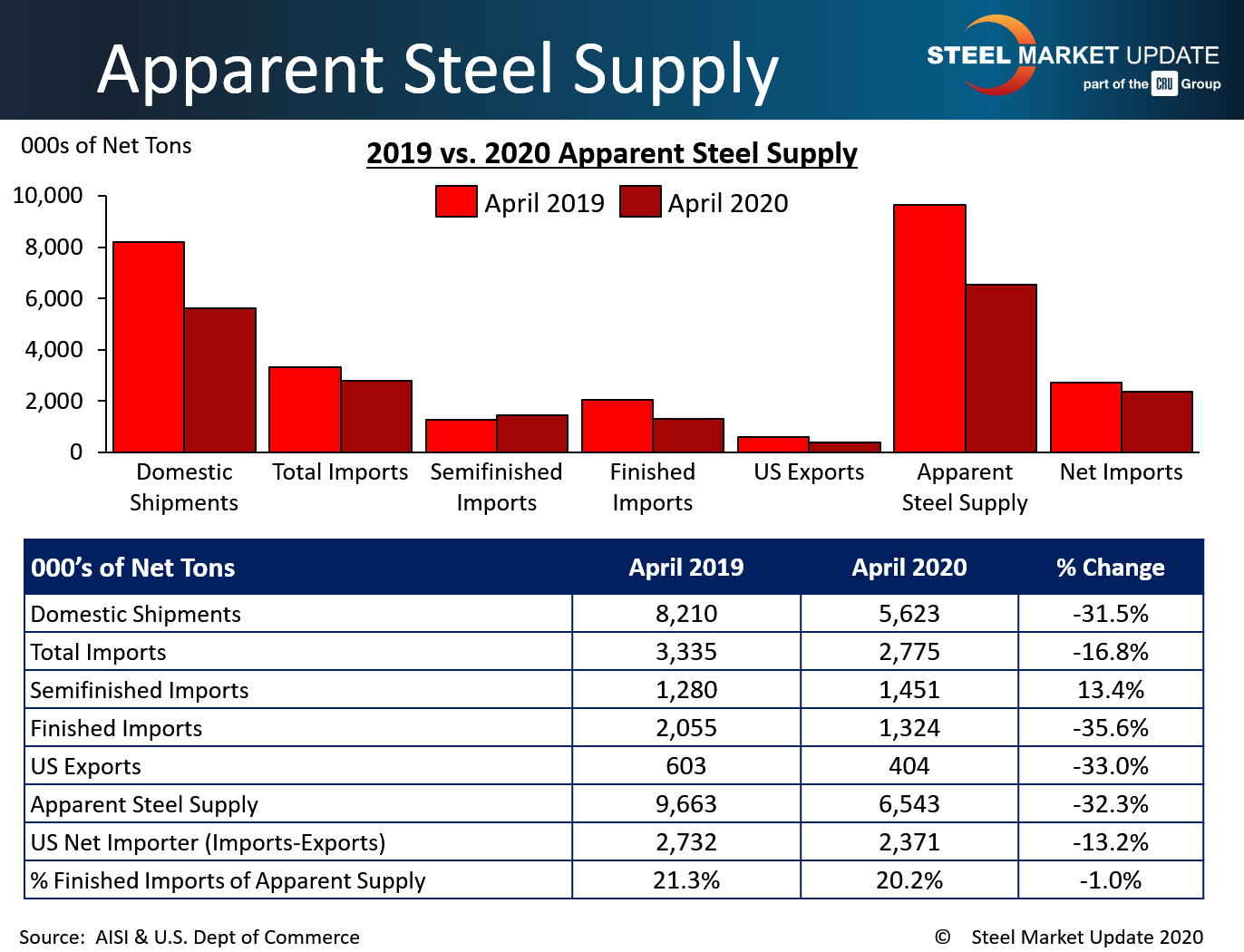

U.S apparent steel supply fell to 6.54 million net tons in April, according to recent U.S. Department of Commerce and American Iron and Steel Institute data. This is the lowest supply level in our limited 10-year history. Apparent steel supply, a proxy for demand, is determined by combining domestic steel shipments and finished U.S. steel imports, then deducting total U.S. steel exports.

April apparent supply was down 3.12 million tons (32.3 percent) compared to the same month one year ago, when apparent supply was 9.66 million tons. This change was primarily due to a 2.59 million ton decline in domestic shipments and a 731,000 ton decrease in finished imports, while a 199,000 ton decline in total exports slightly lessened the overall decrease.

The net trade balance between U.S. steel imports and exports was a surplus of 2.37 million tons imported in April, up 118.0 percent from the prior month, but down 13.2 percent from one year ago. Finished steel imports accounted for 20.2 percent of apparent steel supply in April, up from 17.6 percent in March, but down from 21.3 percent one year ago.

Compared to the prior month when apparent steel supply was 8.66 million tons, April supply fell 2.12 million tons or 24.5 percent. The decrease was primarily due to a 2.18 million ton decline in domestic shipments. Note that total exports declined 260,000 tons and finished imports declined 201,000 tons.

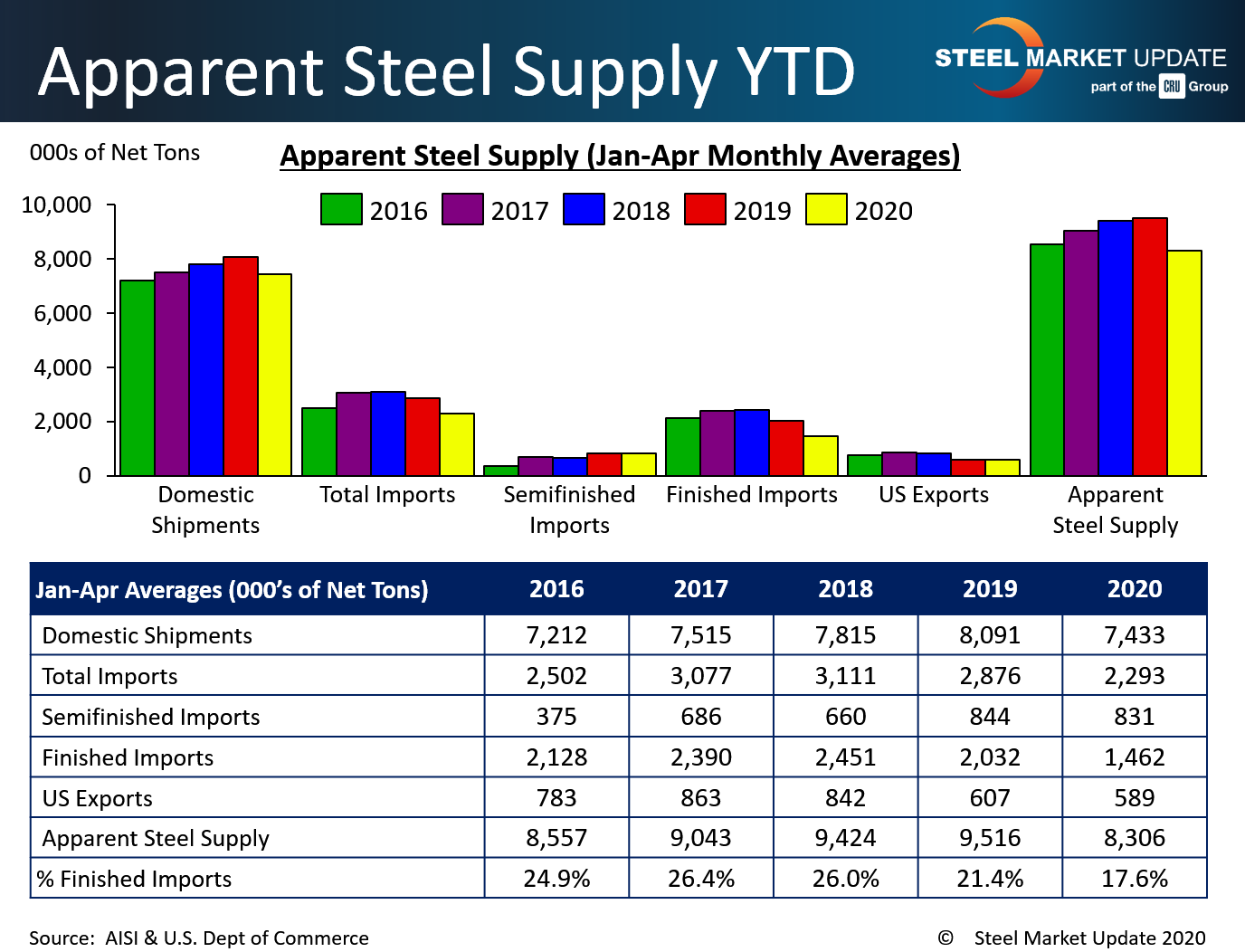

The figure below shows year-to-date averages for each statistic over the last five years. 2020 apparent supply is now down compared to the first four months of all previous years shown.

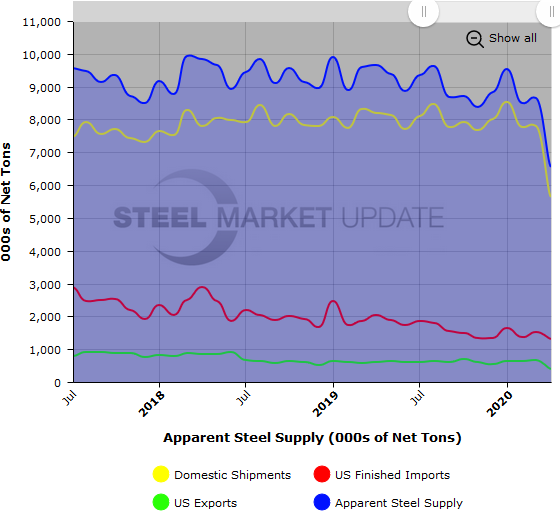

To see an interactive graphic of our Apparent Steel Supply history, visit the Apparent Steel Supply page in the Analysis section of the SMU website. If you need any assistance logging in or navigating the website, contact us at info@SteelMarketUpdate.com or 800-432-3475.