Market Data

May 26, 2020

CRU: How the Oil Price Shock is Impacting Steel Costs

Written by Ryan Smith

By CRU Analysts Ryan Smith, Andrew Gadd and Ben Carstein

Oil markets have had a torrid 2020, with the combination of demand losses due to Covid-19 and the breakdown of coordination between major producing countries resulting in plummeting prices. In this Insight, we assess how the oil price shock influences steelmaking costs through both raw material prices and the direct mill impacts.

Impacts on Steelmaking Raw Materials

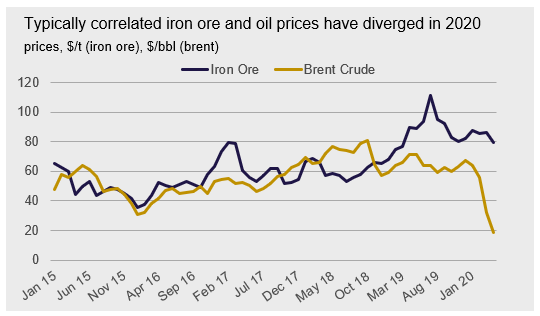

Oil prices play an important role in steel costs, particularly through raw materials prices. We see a strong correlation between the oil price and the iron ore price over long periods of time (e.g. through the super cycle since the ’90s). There are a range of reasons for this, some are very direct in nature, and some indirect. A significant proportion of iron ore production costs are directly linked to oil prices (e.g. diesel for mining trucks and fuel oil for shipping), while other components of mining costs are partly linked to oil (e.g. consumables that need to be transported to site, which needs oil, or electricity which has some correlation to oil due to energy substitution).

Demand is an important factor in the observed correlation. When consumer demand and economic growth is strong, so is the demand for steel, crude oil and other commodities. The level of correlation is typically higher where industrial production and investment are a higher share of the economy. For example, in large emerging market economies such as China, economic growth has a stronger impact on both oil and iron ore, whereas U.S. growth primarily influences oil and has very little effect on seaborne iron ore prices.

In this current market, Chinese demand is performing well, while demand outside of China is suffering, so China-centric iron ore spot prices are diverging from oil. This in turn means that global steel costs are seeing less benefit from the lower oil price.

DATA: CRU Steelmaking Raw Material Monitor, IEA

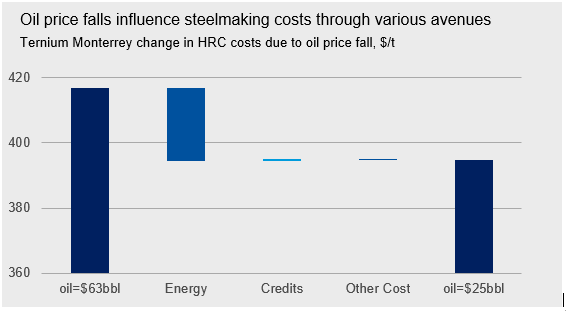

Using CRU’s Iron Ore, Metallurgical Coal and Steel Cost Models, we have analyzed how the fall in crude oil prices translates to cost changes and then price changes. Iron ore prices have been situated around the 95th percentile of CRUs iron ore cost curve. A fall in oil prices from $63/bbl to $25/bbl translates to a $5/dmt reduction in costs at the cost curve percentile which informs prices. We have not seen this drop in costs translate to a fall in iron ore prices, however, due to other important market factors (the aforementioned demand dynamics as well as weak supply and additional supply risks developing in Brazil).

DATA: CRU Iron Ore Cost Service

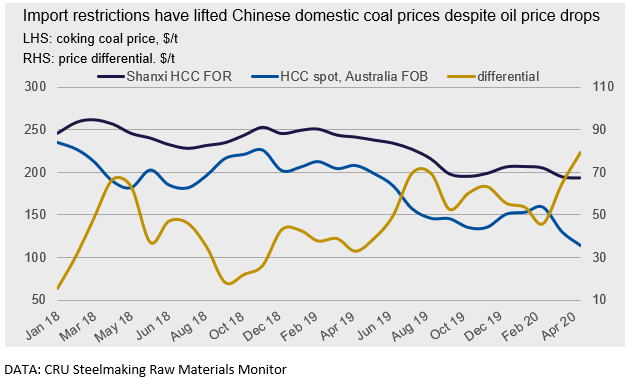

For metallurgical coal, prices tend be informed by the 90th percentile of the Business Cost curve over the medium-term. A fall in the Brent crude oil price fall of $38/bbl results in a $6/t reduction in the 90th percentile of the metallurgical coal Business Cost curve. It is important to note that many Chinese mines sit near the 90th percentile and as Chinese oil prices are set annually by the Chinese government, their costs are less responsive to changes in international prices.

Despite similar reductions in costs, the recent divergence between iron ore and metallurgical coal prices demonstrates that oil prices are playing a minor role in price trajectories in the current market—oil is having an effect, but divergent price trends are more due to the contrasting role of China and other key markets for import demand. In iron ore, China represents around 70 percent of import demand. In contrast due to significant domestic coal resources, China only accounts for only around 20 percent of import demand. By comparison, India, Japan and Europe combined account for over half of import demand. Falling demand in these markets has driven prices down far more than the cost reductions which are attributable to oil price falls.

We have also not seen the immediate or full translation into domestic Chinese conditions from the weak seaborne market (i.e.) the import arbitrage is not closing due to Chinese import restrictions (even though Chinese imports were strong YTD April). This in turn is meaning that Chinese steel mills are currently facing higher domestically sourced fuel costs relative to their competitors outside of China.

Direct Impacts on Steelmaking Costs

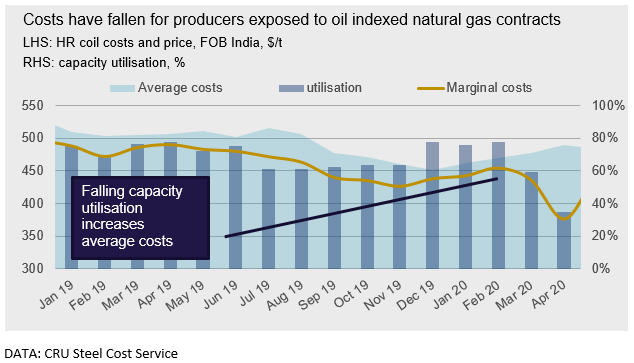

The effect of an oil price fall on steelmaking costs varies depending on where the steel mill is located and the iron and steelmaking technology being utilized. In addition, the degree to which regional natural gas prices move with respect to oil prices is also important.

The direct use of oil in steelmaking is limited, with only a small number of operations globally employing tuyere injection of heavy fuel oils into blast furnaces or utilizing oil for heating and electricity generation purposes. Natural gas, on the other hand, is widely utilized by steelmakers, for example as a reductant in the case of a natural gas-based ironmaking process or a fuel supplement in reheat furnaces to enrich lean steelmaking gases. The chart below shows the variation of natural gas pricing mechanisms globally. The extent of oil price indexation for natural gas contracts has been growing over the past decade, however market-based natural gas pricing dominates in North America and Europe, while in South America, Asia, Russia and the Middle East prices are largely regulated.

Consider India, a country where natural gas prices are indexed against Brent crude prices. India’s marginal steel producers play an important role as swing suppliers to regional export markets like South East Asia, and these marginal producers rely heavily on natural gas. As a result of oil price and resultant natural gas price falls, these producers are benefitting from reduced variable costs, allowing them to remain more competitive than usual in Asian export markets, which we observe to be weighing heavily on export steel prices in the region.

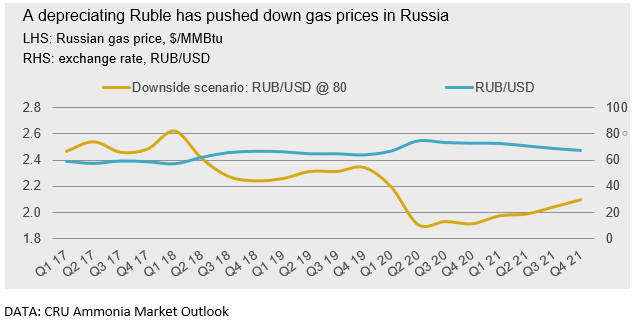

In Russia the responsiveness of Russian NG prices to global oil benchmarks is limited by the dominance of Gazprom in the regional market, which is majority owned by the Russian government. Gazprom set natural gas prices annual in Rubles, this has meant that the recent depreciation of the Ruble has decreased prices in U.S. dollar terms, further improving the competitive position of low cost Russian steel exporters and intensifying price competition in key export markets.

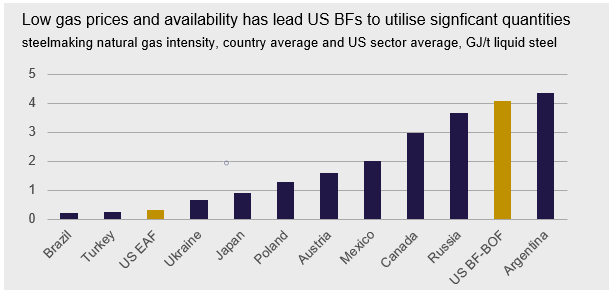

For U.S. producers, the extent to which costs will fall varies considerably between BF-BOF and EAF. BF-BOF steel producers in the U.S. utilize higher amounts of natural gas on a per tonne basis compared to U.S. EAFs but also other steelmaking operations globally. The natural gas intensity of steel produced in the U.S. via the BF-BOF route is some of the highest in the world and this is primarily due to the widespread practice of injecting natural gas via the tuyeres into blast furnaces, a practice which is economical in limited countries. Due to the higher natural gas intensity of U.S. BF-BOF producers, their costs would fall further than their EAF counterparts when natural gas prices fall.

EAF producers with integrated natural gas-based ironmaking facilities will have a greater natural gas intensity versus mills buying all their metallics from third parties and will realize a greater decline in costs.

It’s important to note that oil price falls in the U.S. do not translate to a direct fall in U.S. natural gas prices. Supply and demand dynamics specific to natural gas therefore drive prices relatively efficiently. While a growing share of U.S. natural gas supply is associated natural gas (n.b. gas produced from U.S. oil wells), which implies the possibility of an inverse correlation between oil and gas prices, other gas market factors in the lead up to Covid-19 such as record production and months of mild winter weather had already put Henry Hub prices on the decline.

Summary

Oil price falls have varying direct and indirect impacts on steelmaking costs. In steelmaking raw materials markets, a fall in oil price has not directly translated to a fall in mining costs due to oil price regulation and supply/demand factors outweighing deflationary cost pressure. For steel producers, the direct impact on steelmaking costs also varies; direct use of oil in steelmaking is limited while natural gas usage is widespread. Regional price linkages between natural gas prices and oil prices in combination with the natural gas intensity of the steelmaking process being employed will determine how much a steel producer will see their costs fall as a result of an energy price fall. Recent price falls have resulted in an improvement in competitive position for some producers. But at the same time, while competition in export markets intensifies, it’s also resulting in a falling price floor for many regions.

For more information on how oil prices impact steel and steelmaking raw materials, or how the cost structures of specific mills are changing in response to the rapidly changing macroeconomic variables, please reach out to ryan.smith@crugroup.com.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com