Long Products

May 7, 2020

CRU: Weak Demand, Declining Scrap Market Force U.S. Longs Price Fall

Written by Ryan McKinley

By CRU Senior Analyst Ryan McKinley, from CRU’s Long Products Monitor

U.S. domestic long product prices were forced lower across the board as demand weakness caused by the Covid-19 pandemic combined with a substantial m/m decline in scrap prices. Construction activity in many states was either curtailed or prohibited entirely as local governments took measures to control the outbreak, and imports booked earlier in the year continued to arrive. Mill output has fallen in response but has not been enough to offset the demand weakness.

Wire rod prices fell as order activity weakened and import orders placed in February began to arrive. Some mills have either entirely stopped production or are producing at only half capacity, but this was not enough to buoy prices given that many fabricators had sales volumes decline by 25 percent or more. The most impacted were orders from sectors like furniture, appliances and automotive. Aside from the pandemic, one fabrication facility was impacted by a tornado. Although these events have taken material out of the market, many buyers are holding off on making major purchases until things become clearer for the economy more broadly.

While demand falls, CRU understands that at least one 20,000 t cargo of wire rod is set to arrive in May from the EU. This deal was completed around the February time frame when market sentiment was becoming more bullish, and we do not expect similar cargoes to be booked in the near term. Market participants said this material has also likely contributed to muted buying activity in recent weeks. Still, imports for both March and April are down markedly y/y, with total volumes down by 10 percent and 63 percent, respectively.

Domestic rebar prices fell by 5 percent m/m for similar reasons, although a decline in scrap prices provided the most leverage for buyers looking to secure discounts. There were pockets of demand weakness—such as in the northeast where construction activity has been curtailed by government order—but overall, the sector has been less impacted than others. With the lockdown orders being slowly rolled back, we expect demand to return to a more normalized level in affected areas.

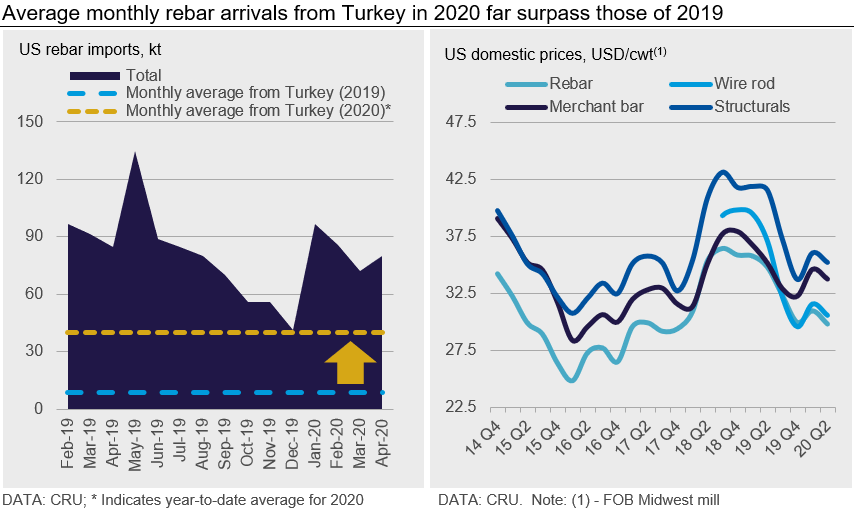

Turkey has retained its growing market share in 2020 compared to the prior year so far, with total monthly imports from that country averaging 40,000 t (see chart). Offers for July import prices currently stand around $27.50 /cwt loaded truck in Houston, but market participants do not expect prices to move much lower for the foreseeable future.

Mills announced price decreases for both beams and merchant bar of $1.25 /cwt in late April, putting both at their lowest level so far for the year.

Outlook: Most Products Have Found a Price Floor

After falling by $30-50 /l.ton m/m in April, it now appears that scrap prices have reached a floor—possibly for the balance of the year. The market sentiment is that scrap prices will rise by $30 /l.ton or more in May, and we suspect this will help stabilize long product prices.

Meanwhile, as pandemic-related business restrictions start easing moving into June, we expect demand to rise in the near term. In tandem with higher scrap prices, we expect that a price floor has also been reached for most long products. Even so, there is potential downward pressure for grades like high carbon wire rod or tire cord, which are more exposed to consumer-driven sectors like automotive, appliances and furniture.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com