Prices

April 26, 2020

HDG Coil Steel Futures Will Help with Price Risk

Written by Josh Spoores

By CRU Principal Analyst Josh Spoores and CME Group Commodities Research Analyst Gregor Spilker

The CME Group recently launched a new steel futures contract which follows the U.S. hot-dipped galvanized (HDG) coil market. The U.S. Midwest Domestic Steel Premium (CRU) Futures is financially settled against the difference between U.S. Midwest hot-dipped galvanized coil (base) steel (HDG base) and hot-rolled coil steel (HRC). By offering this Premium futures contract, CME Group is expanding its product offering in the U.S. ferrous space, which includes the established U.S. Midwest Domestic Hot-Rolled Coil Steel (CRU) Index Futures contract.

Since October 2008, the CME Group has used CRU’s market leading U.S. Midwest HRC index to settle their HRC futures contract. Market adoption of the HRC futures contract has been strong, particularly as steel price volatility remains high and volumes and open interest reached record levels in March this year. However, due to this increased volatility, the premium of HDG coil over HRC prices has also widened, leaving market participants in a risky position if they only using HRC to hedge their exposure to HDG coil products. Indeed, if a market participant were to hedge their HDG coil exposure using only HR coil, any change in the premium of HDG coil over HRC prices is an added risk that may eliminate any benefit from their hedge.

DATA: CRU.

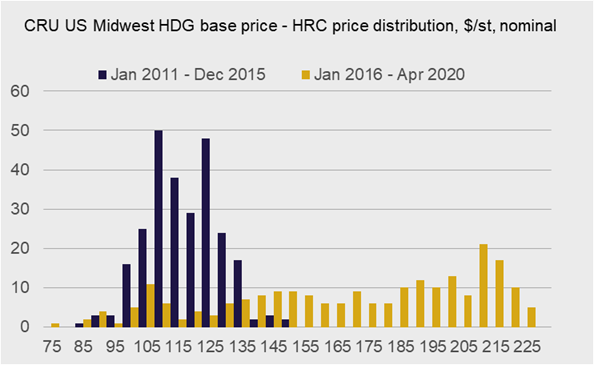

The preceding chart shows the weekly premium of HDG coil over HRC prices over the past few years. This has varied over time since 2016, with the average weekly premium from 2011-2019 at $138 /s.ton.

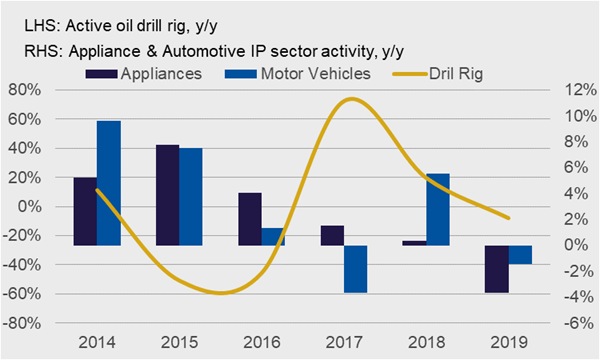

In 2016, the premium started to widen due to differential changes in end demand for HRC and HDG coil. During this time, oil prices had weakened which led to lower demand for HRC products into the energy sector, which is more HRC-intensive. Meanwhile, demand for lightweight vehicles and appliances continued to grow, albeit at a slower rate from the prior two years. The automotive and appliance markets are more HDG coil-intensive. This relationship is shown in the following chart where active drill rigs reflecting trends in oil prices are a good proxy for energy-related HRC demand.

DATA: Baker Hughes, OE, CRU.

The HDG premium then slowly fell back below historical levels from 2017 Q4 through 2018 before again rising from 2019 H1 to the present. From 2019 through 2020 Q1, this premium has again widened to an average of $171 /s.ton. This most recent increase was again due to differences between supply-demand fundamentals for HR coil versus the HDG coil products, this time on the supply side where there was more limited supply of HDG coil products versus HR coil.

Breaking down the weekly premium levels in two separate periods highlights the increased volatility over the past few years—emphasizing the need for a new risk management tool to hedge a much more volatile HDG premium.

DATA: CRU.

Due to this volatility in the premium, market participants have been unable to use the CME Group’s HRC futures contract to fully hedge their higher-value HDG coil product sales or purchases. Through the introduction of the new HDG-based product from the CME, market participants will be able to better manage their steel price risk.

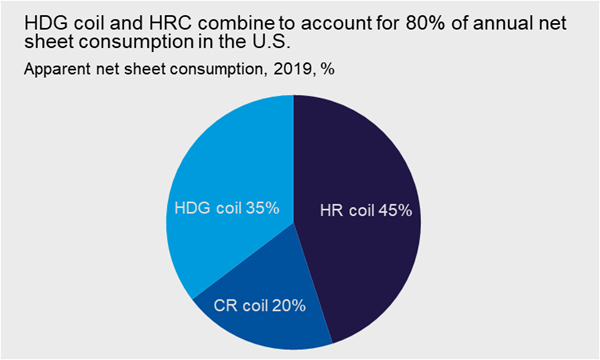

HDG Coil Market Size Substantial and Rivals HRC

While all steel sheet products start out as HR coil, much is used directly. In terms of this apparent net consumption (i.e. demand for the product excluding that used in the production of downstream products) HRC accounted for 45 percent of all HR, CR and HDG coil carbon sheet consumption in the U.S in 2019. HDG coil held the second largest share at 35 percent while CR coil made up the balance of 20 percent. Based on this data, it is clear that the HDG coil market is significant.

HDG coil is steel sheet with a zinc coating. The application of zinc provides protection from corrosion (rust). HDG coil is typically used in applications that demand this corrosion protection such as lightweight vehicles, appliances, HVAC applications and many other manufactured products. HDG coil products are also used in metal building components and roofing products, which are often painted while still in coil form.

Multiple mills that sell HDG coil are also large buyers of HR or CR coil products that they then process into HDG coil and sell. Other mills convert slab purchased from elsewhere to eventually convert into HDG coil products. Therefore, the larger audience for this new product is not only the mills or converters, but also end users. In sum as the following chart shows, 80 percent of sheet products consumed in the U.S. in 2019 consisted of HRC and HDG coil. Steel mills, service centers and end users with exposure to HDG will now be able to manage their price risk using the CME Group’s steel futures products.

DATA: CRU.

Hedging Strategy Depends on Position in Supply Chain

The CME’s new HDG coil futures production will now allow participants throughout the HDG coil supply chain the ability to better manage their price risk. The following points cover general strategies based on where a market participant sits in the supply chain. Of course, for specific advice, participants will want to work closely with an experienced broker.

For HDG coil producers, the price risk is often seen in future selling prices. Using the CME’s suite of steel futures products can allow sheet mills to lock in a portion of forward sales to either help limit the volatility of spot or index-linked future sales or they can be used in conjunction with fixed price contracts to guard against potential risk.

As previously stated, a significant portion of HDG coil production comes from mills that procure the substrate as HR or CR coil. In these instances, HDG coil producers can now use the CME Group’s futures products to better manage their cost risk and/or volatility in their final sales. For CR coil procurement, these coil coaters may be best off purchasing CR coil from a mill as a HR coil price plus a constant premium. This would allow the coater to manage the variable portion of this cost.

Service centers or anyone in the supply chain that holds inventory can be more dynamic with their risk strategy. Not only can these participants occasionally hedge the value of their inventory, but they can also use futures to offer stably-priced steel for their current or prospective customers.

The primary strategy for end users is to use these futures products to lock in a known value for their steel costs for a set period. Manufacturers that have a fixed sales price of their final product to distributors or into the retail market have long struggled to control the volatility in their steel costs. The ability of these manufacturers to more accurately forecast their costs will directly translate into a more competitive product to the final market.

Hedging Strategies – Applied Examples

Hedge outright HDG exposure: In the past, market participants who had exposure to HDG prices had to rely on proxy-hedging their price risk using HRC futures. This hedge strategy would give exposure to adverse movements in the premium between HDG and HRC.

In a more volatile market, movements in the premium can significantly impact the hedge effectiveness. For example, a consumer needs to procure HDG steel in the physical market and decides to hedge his or her risk with a long position in HRC futures. If HDG trades at $700/s.ton and HRC at $550/s.ton, a premium of $150/s.ton results. At hedge expiry, HRC has strengthened to $600/s.ton, and the premium also increased to $200/s.ton. The HRC financial hedge returned +$50/s.ton (increase in HRC prices from $550 to $600/s.ton), which is not enough to offset an increase in the price of HDG of +$100/s.ton (which increased from $700 to $800/s.ton).

Market participants who want to long hedge outright HDG exposure need to simultaneously buy an HDG Premium futures contract and an HRC futures contract. The Premium futures can be interpreted as a long position in HDG Base and a short position in HRC. By going long on the Premium and an additional HRC futures contract, the net position is long HDG Base with no exposure to HRC – the required hedge position.

Hedge the difference between HDG Base and HRC: Spread trading is a widely used strategy in commodity markets. In ferrous trading, participants may already be familiar with the busheling-to-HRC spread. This metric is widely followed in the industry, since busheling is an important input good for electric-arc furnace (EAF) steelmakers using scrap material to make flat steel products.

The U.S. Midwest Domestic Steel Premium (CRU) Futures is a hedging tool that allows market participants to trade and hedge the spread, or premium, between HDG Base and HRC. In theory, the premium between the two products represents the operating costs of transforming HRC into HDG Base and any logistics costs if material needs to be transported from one mill to another. Because HRC and HDG have different supply and demand drivers, the price difference between the two will sometimes move away from its theoretical value – as we have seen repeatedly in the last few years and as described above.

The Premium futures contract may be important for intermediaries who procure HRC and sell HDG material. The contract allows hedgers to lock in a margin between the two products. For example – a mill that buys HRC and sells HDG on a spot basis requires a certain price differential between input HRC and output HDG to operate profitably. The company is exposed to a weakening in the premium. The firm can sell the Premium futures contract for hedging purposes. A weakening premium will have a detrimental impact on its physical spot sales, but this is offset by a profitable hedging position in the Premium futures contract. The mill has an effective hedge against a future decrease in the premium – it has now locked in the price differential required for its physical business.

Proxy-hedge cold-rolled coil sheet exposure: The Premium futures contract refers to the base price of HDG, meaning the price of HDG sheet without zinc coating. Most HDG steel is made using cold-rolled coil (CRC) sheet. This means that historically, prices of HDG Base and CR were very similar since the market assessed these two products as virtually interchangeable. Since CRU started assessing those markets, the average price difference between HDG Base and CR has been -3$/ST (CRC 3$/ST more expensive than HDG Base), with a minimum of -$42 and a maximum of $21.

Customers that need to hedge CR price exposure can choose to use the Premium futures contract as a proxy-hedge. The relationship between HDG Base and CR was stable in the past, but hedgers would need to factor in the risk of a change in this relationship – even though it is very unlikely to ever come close to the volatility witnessed in the HDG Base to HRC premium.

DATA: CRU.

Conclusions

The premium of HDG coil over HRC prices has been more volatile over the past four years versus the prior five. We do not expect this price difference to settle into a tighter range for any extended period, especially as new steelmaking capacity comes online. Therefore, this new steel futures contract from the CME Group now allows steel producers, converters, processors and end users to properly manage price risk associated with HDG coil products. Continued volatility between the HDG base price and HR coil price will no longer hinder these market participants from hedging price risk in an efficient manner. The contract is a welcome addition, opening new hedging strategies in their own right and in conjunction with the existing U.S. HRC futures contract.

To learn more about CRU’s US Midwest and other North American prices click here. To become a CRU data provider, please contact dewayne.tuthill@crugroup.com. For more information on CRU’s price, analysis and forecasting services and how they can help your business, please visit our website or email steel@crugroup.com. For more information on CME Group, please email metals@cmegroup.com.