Prices

April 16, 2020

CRU: Iron Ore Prices Steady Despite Vale’s Lowered Production Guidance

Written by Eduardo Tinti

By CRU Research Analyst Eduardo Tinti, from CRU’s Iron Ore Market Outlook

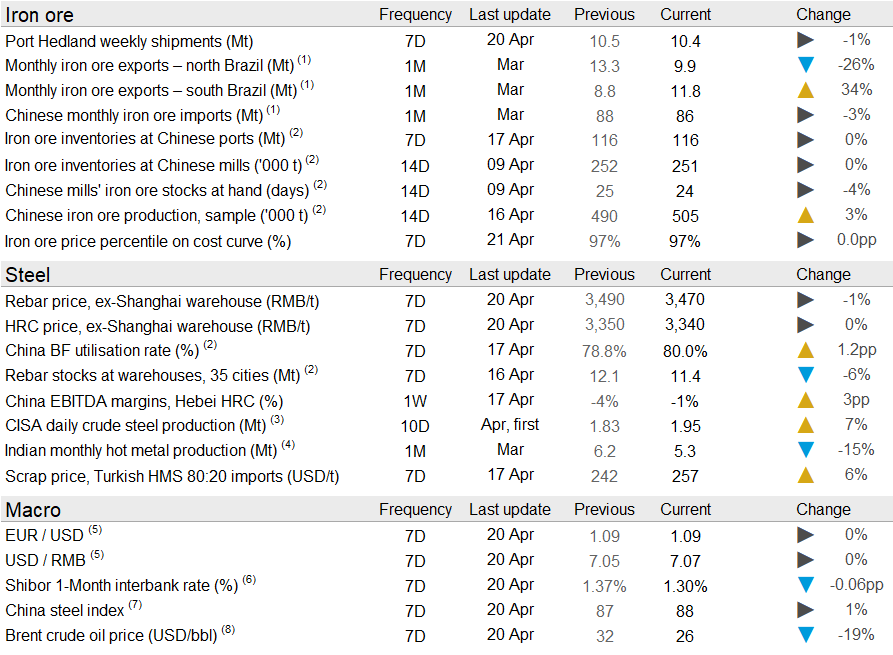

Despite some volatility driven by divergent signs related to supply and demand expectations, iron ore prices were flat w/w. On Tuesday, April 21, the 62% Fe fines price was assessed at $86.0 /t.

Last week, Chinese steel demand was robust as the country recovers from the Covid-19-related lockdowns. Supported by demand, Chinese daily crude steel output reached a level close to the 2019 average in the first week of April as capacity utilization continues to rise, both in EAF and BF. Steel inventories remain high in the country, but destocking has gained pace. On the metallics side, Turkish scrap price bounced back from the bottom reached two weeks ago as European scrap supply fell sharply due to Covid-19 containment measures.

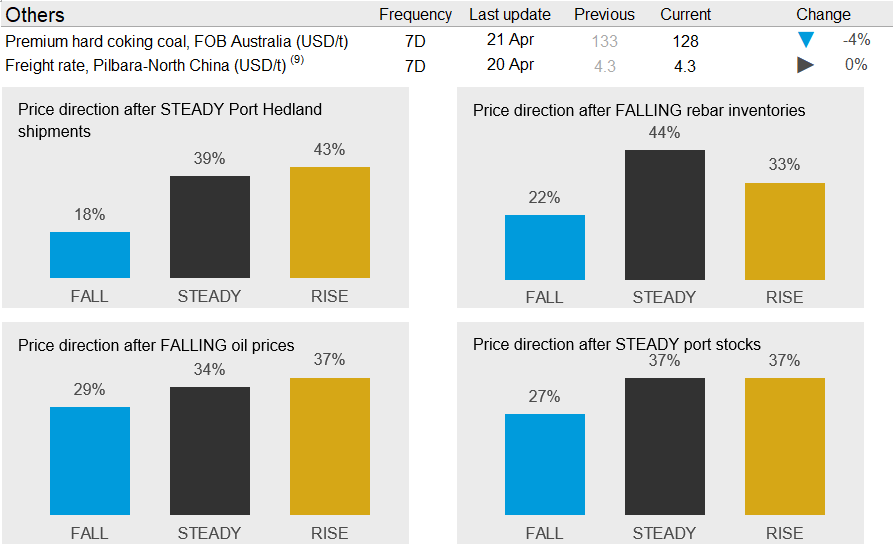

At the same time, Chinese domestic iron ore production and seaborne supply continue to increase. Last week, seaborne shipments reached their higher level so far this year as Brazilian shipments rose on the back of improving weather conditions and Australian producers continued to perform extremely well. Port Hedland shipments totaled 10.4 Mt, relatively stable w/w, while Rio Tinto shipped at a very high rate in the past week.

On Monday, Rio Tinto, BHP and Vale released their quarterly reports. While the Australian producers reported a strong quarter, Vale’s production was lower than expected due to heavy rains and dam issues impacting production in its Brucutu mine. These problems have also curtailed the company’s pellet feed availability, impacting its pellet production in Brazil and the Middle East. As a result, Vale lowered its fines and pellet production guidance for 2020, supporting views of a tighter market this year. However, Covid-19-related uncertainties and plummeting oil prices have been clouding the market with a rather bearish sentiment.

Looking ahead, steel production in China is expected to remain healthy despite rising competition from low-priced imports as overseas producers struggle to sell in their domestic markets, which are hit by the Covid-19 outbreak. However, iron ore supply will also remain robust as Australian producers continue to perform well and, as expected, Vale’s shipments rise as the company faces improving weather conditions in Brazil. As a result, we expect the 62% Fe fines price to fall in the coming week.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com