Product

April 2, 2020

HRC Futures Trade $450 and Busheling Futures Trade $220

Written by David Feldstein

SMU Contributor David Feldstein is president of Rock Trading Advisors (davidfeldstein@rocktradingadvisors.com). In addition to market analysis, RTA provides price risk management not only for ferrous products, but also base metals, energy and interest rates. RTA also trains sales staff and creates the infrastructure necessary for firms to offer their customers fixed pricing on physical sales.

It’s incredible how much change has occurred since my last article only three short weeks ago. We are all adapting to this rapidly changing world where survival is everyone’s focus. Whether it be survival from the virus, economic survival or surviving isolation, these are outrageously tough times.

I spend a lot of time looking for patterns. One pattern I saw was this common process of dealing with COVID-19. I experienced it myself and watched friends, family and neighbors go through it as well. It started with denial, then some concern, then looking around and taking some actions like stocking up on groceries, then mental preparation of being forced to “stay home,” and then actually living through isolation while watching with shock the numbers of infected climb to astronomical levels.

In our industry, I saw a similar pattern. First, denying the virus was an issue and expecting to run business as usual somehow. Then the initial fear was that buyers would run out of steel, which was somewhat baffling and contrary to what was happening in other commodities. Then the realization and actions taken to mitigate the threat by having many employees work from home. With some plants and offices still open with only essential workers showing up, then a worker would be diagnosed with the virus and the office or plant would have to be shut down temporarily to be cleaned. As the virus spread, plants started being shut down initially for a week, but then the return date was moved weeks out. The economy and supply chain are in disarray and while the futures were quick to reflect it, the steel indexes surprisingly held up. Finally, the indexes started to adjust sharply lower this week and the futures did as well.

CME Midwest HRC Futures

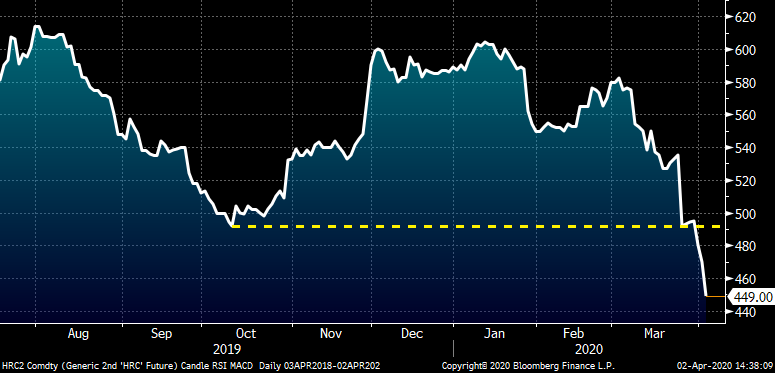

This chart of the rolling 2nd month CME HRC future looked to be forming a double bottom pattern finding support at the $485 level. However, that pattern was broken forcefully as futures came under intense pressure today, trading as low as $449 in March and $447 in June.

Rolling 2nd Month CME Hot Rolled Coil Future $/st

Busheling futures were also under pressure today.

CME Busheling Futures

This chart shows CME busheling and LME Turkish scrap. Turkish scrap rebounded today after trading down to $212.50 yesterday, while May busheling traded as low as $220 today.

Rolling 2nd Month CME Busheling Future (white) & LME Turkish Scrap Future (red)

Until today, the busheling curve has held up relatively well throughout much of this. The curve has shifted into a steep contango, which is interesting considering the complications that are about to occur with the Army Corps of Engineers set to start work on the Mississippi River in July. Barges will be next to impossible to come by in June as their owners will want them back below where the river will be shut down. That likely means significant difficulties acquiring scrap for some mills and a lot of scrap stuck in the Midwest this summer. Expectations were the mills would need to load up come May, but with the rapid changing market, fall-off in demand and uncertainty, how will mills address this issue? It looks like the project is happening either way, so what will this mean for those scrap prices over the summer, and why isn’t the curve reflecting that?

CME Busheling Futures Curve

The analysis of economic reports has become futile in this rapidly changing Mach 10 with your hair on fire environment. Instead I have spent much of my time tracking and analyzing the virus. The virus is extremely contagious and as a result, the exponential growth of the outbreak is like something none of us have seen in our lifetimes. They say the cure for high commodity prices is high commodity prices. Similarly, the cure for coronavirus is coronavirus. It’s not the government that is forcing us into isolation, it’s the virus. There is a pattern here as well. Weeks after the lockdown begins, there is a lagged slowdown in new daily infections. The news cycle is so intense that it’s easy to forget that it was only 10 days ago that Italy was the epicenter of the pandemic.

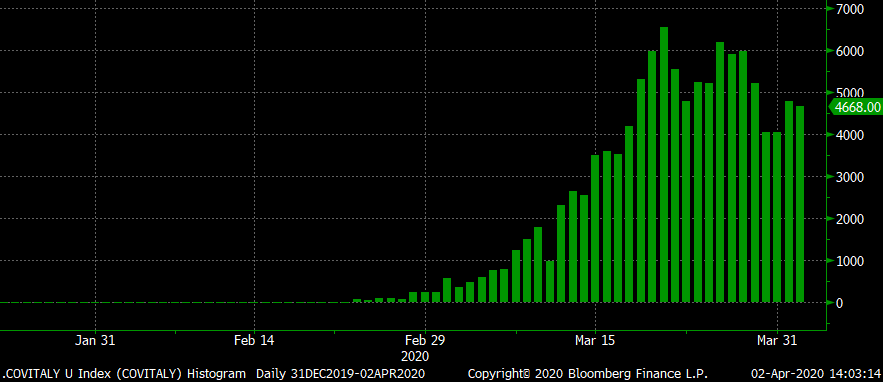

I have been watching Italy closely with the expectation that once the number of Italy’s new daily infections flattens and starts to trend lower, it will be a major turning point. The reassurance to the public that if Italy can accomplish getting the spread of the virus and their outbreak under control, then so can the U.S. and the rest of the world. This chart below shows Italy’s daily new infections and it looks to be headed in the right direction.

Daily New Infections Italy

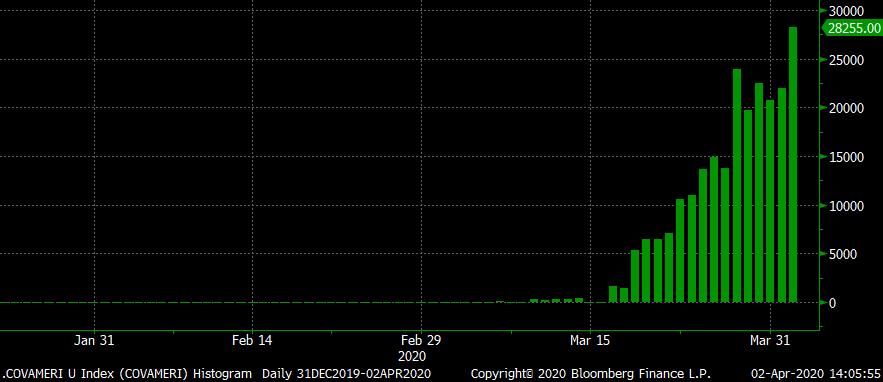

This chart shows the number of daily new diagnosed infections in the United States, which does not look good. The exponential growth is continuing with today’s new infections of 28k the highest so far. The measures taken across the U.S. were spread out over time and regions, but they started the week of March 9, so there has been three weeks of history now. If you compare the chart of Italy with the chart of the U.S., you can see the Italian outbreak started roughly two weeks before it did here. Hopefully, the U.S. will start to see the number of new daily cases slow soon thus “flattening the curve” and providing some hope and optimism that the end is near.

Daily New Infections United States

Weeks ago, I wrote about how hard it was going to be for markets to rally as the news cycle was going to get horrible. That it would be hard for people to find optimism as the number grew day after day. While it was clear the exponential growth in infections was coming, the actual numbers have been shocking. In my own personal adaptation to trading the financial markets through this pandemic, I decided I had to completely suspend whatever idea I had of what was a reasonable amount for a barrel of oil, rate of interest or ton of steel. The volatility in these markets is astronomical, but volatility moves both up and down.

For example, today at 9:29 a.m. WTI crude oil futures went from $22.04/bbl to $27.39/bbl in eight minutes.

Rolling Front Month WTI Crude Oil Future $/bbl

For many, liquidity and uncertainty are the focus, but don’t forget to look ahead and think about the opportunity this moment presents. If oil can turn on a dime, so can steel and scrap.

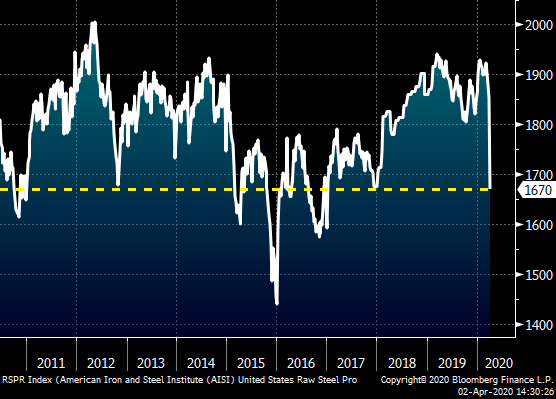

Mill production has moved abruptly lower with numerous mills shutting down blast furnaces and this week’s AISI utilization rate falling to 71.6 percent. Once the spread of the virus slows and the economy starts again, what will availability look like? Will demand come back faster than supply and will that cause a shortage that will rocket flat rolled prices higher?

A.I.S.I. Raw Crude Steel Production

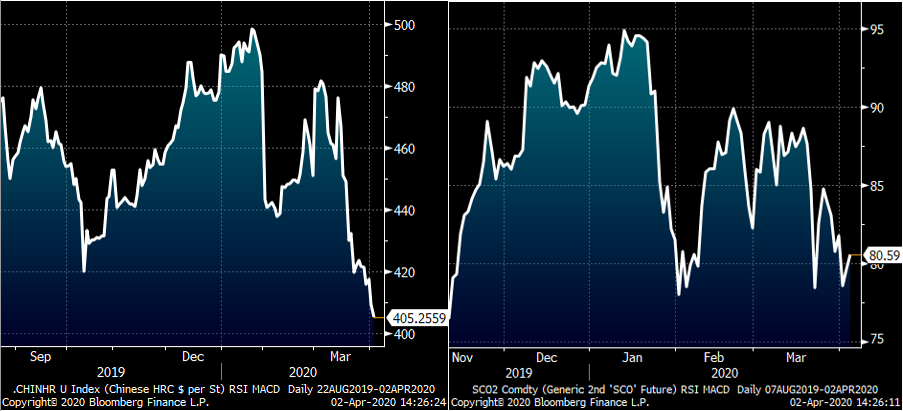

Take a break from worries of liquidity and uncertainty to think about opportunity. Chinese hot rolled prices have been falling sharply in the last few days. The 2nd month SHFE HRC future settled at $405/st. Is there an opportunity to speculate on imported steel out of Asia? This could be dangerous with tariffs and President Trump’s track record of fending off steel imports, but look at that carry trade with fourth quarter CME futures trading at $515.

Rolling 2nd Month SHFE Chinese HRC Future $/st & SGX Iron Ore Future $/t (rt)

Today’s sell off in HRC futures is opening all kinds of opportunities to lock in prices for later this year, especially considering there is serious upside risk if demand returns with so much supply taken out of the system. Perhaps these prices aren’t attractive enough for you, but then what price is? Perhaps $400 tons for Q3 is the right price. Regardless, you might get the opportunity to lock in steel in the futures market at deeply discounted prices. It might trade there for a day or two and then just like $20/bbl oil, poof! You missed the boat. Think optimistically, think opportunistically, think big and, most importantly, stay safe!

CME Midwest HRC Futures Curve