Prices

March 19, 2020

Mid-March Update on Foreign Steel Imports

Written by Brett Linton

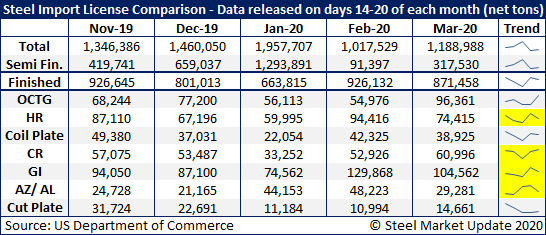

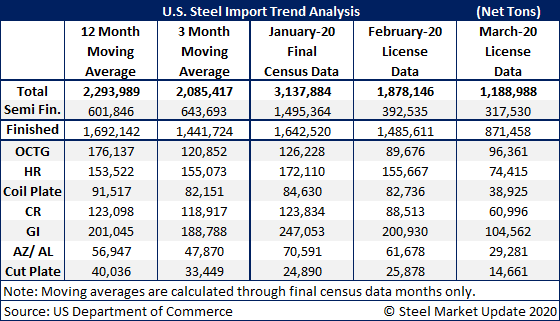

Updated February steel import license data was released this week, remaining in the 1.9 million net ton range for total steel imports, according to the U.S. Department of Commerce.

Finished steel imports in February were at 1.5 million tons, down over January’s 1.6 million ton level and below the 2019 finished import average of 1.7 million tons. The latest February license data showed roughly 400,000 tons of semifinished product imports (mostly slabs).

March licenses collected through the 17th day of the month are just shy of 1.2 million tons, with nearly 900,000 tons being finished products and 300,000 tons being semifinished.

As previously mentioned, the total January import figure is unusually high as a result of buyers seeking to max out quarterly quota limits on semifinished products. For the remainder of the first quarter, semifinished imports should be significantly lower. January semifinished imports were 1.5 million tons, the highest level seen in SMU’s 10-year history. Due to these month-to-month swings, SMU has ceased monthly import “trending” projections and now only show unadjusted figures as reported by the Commerce Department.

The table below compares import license data collected between the 14th and 20th days of each respective month; i.e. the March column represents the March import licenses collected through March 17, February data shows license data collected in February through Feb. 18, January data through Jan. 14, etc. This is an attempt to compare monthly import licenses against similar time periods to see how imports for the latest month are progressing. This is a new look at licenses by SMU and is subject to revisions. We welcome any reader input on this topic.