Prices

February 27, 2020

Census Releases Preliminary January Import Data

Written by Brett Linton

Preliminary Census data for January steel imports was released this week, totaling just over 3.1 million net tons for the month, according to the U.S. Department of Commerce. While the January license data is still preliminary, the last time the final Census data was this high was in April 2019 at 3.3 million tons.

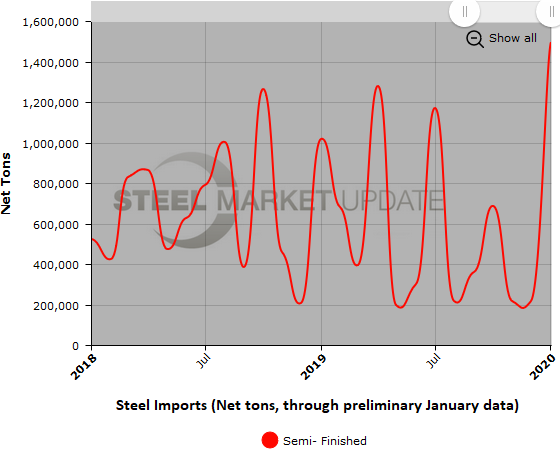

The total January import figure is unusually high as a result of buyers seeking to max out quarterly quota limits on semi-finished products. For the remainder of the first quarter, semi-finished imports should be significantly lower (likely ~200,000 ton levels in February and March). Finished imports in January totaled 1.6 million tons, compared to 1.5 million tons of semi-finished products.

License data through Feb. 26 shows total imports of 1.6 million tons, composed of 1.2 million tons of finished products and 400,000 tons for finished products.

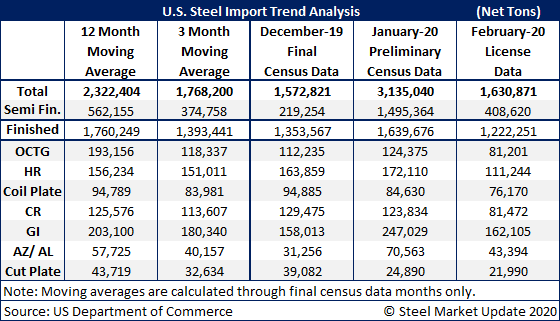

Due to Trump administration tariffs and quotas that skew the data, Steel Market Update has not projected any of the February figures in the table below.

The table below shows total steel imports through preliminary January data. For comparison, in January 2019, 3.5 million tons of steel were imported. The 2019 monthly average was 2.3 million tons per month, while 2018 averaged 2.8 million tons per month.

Semi-finished imports jumped dramatically to 1.5 million tons in January, whereas 1.0 million tons were brought into the country in January 2019. To smooth out the quarterly quota swings, the 2019 monthly average for semi-finished steels was 560,000 tons per month, down from 650,000 tons per month in 2018.

The graphic below shows the seven other steel products tracked by SMU; for an expansive view, you can use the interactive imports graphing tool on our website.