Market Segment

February 18, 2020

CRU: Coronavirus to Cause Protracted Disruption to Transport, Labor

Written by Jumana Saleheen

Writing with CRU’s Chief Economist Jumana Saleheen are Principal Consultant for Aluminum Wan Ling, Senior Analyst Richard Lu, Analyst Ruilin Wang and China office CEO John Johnson.

Last week, CRU’s China offices in Shanghai and Beijing returned to work following the Chinese New Year holiday, which was extended due to the outbreak of novel coronavirus (Covid-19). This virus has had a heavy human cost, and there has also been severe disruption to business and trade in China.

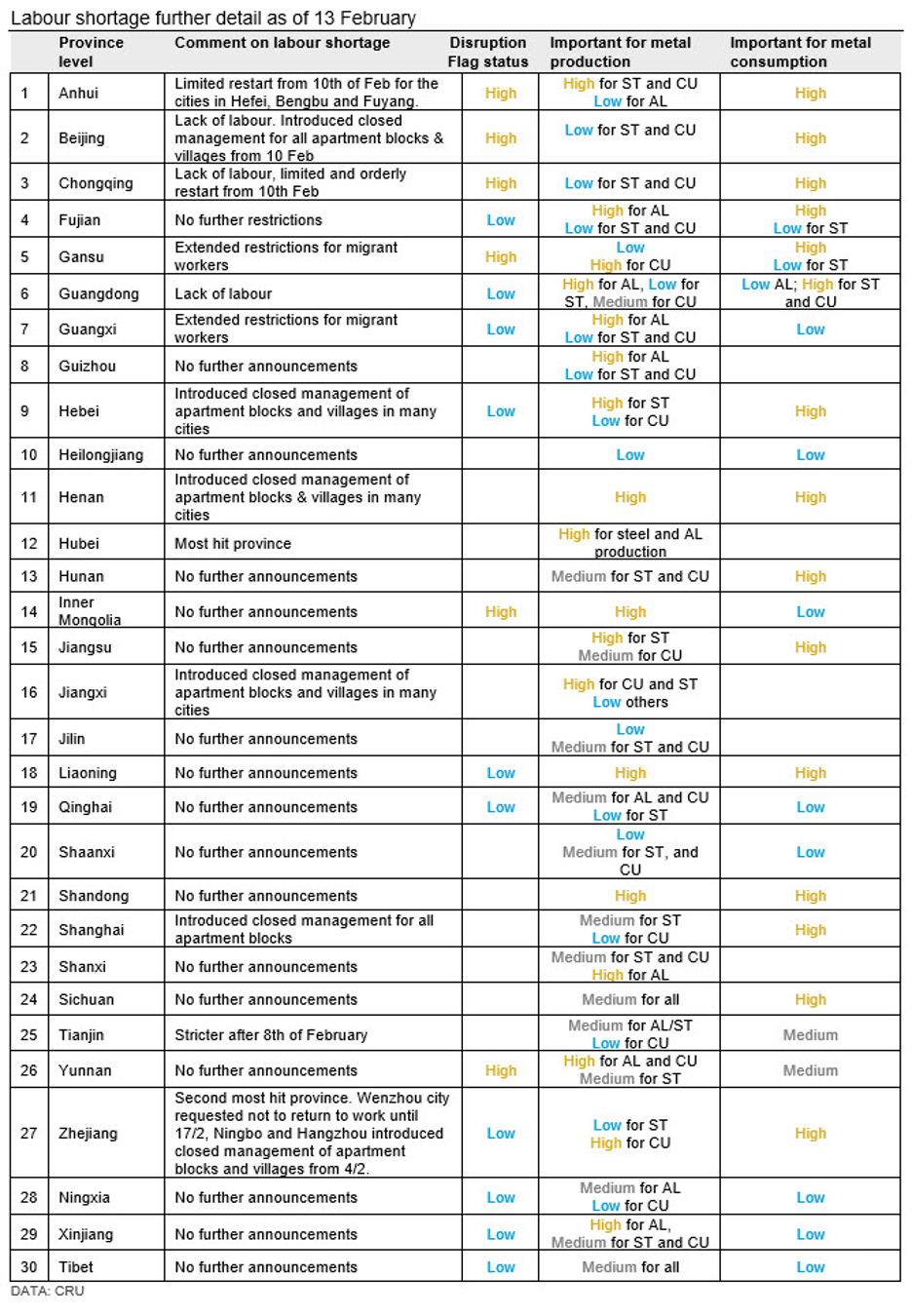

CRU’s analysts, on-the-ground in China, provide us with three key takeaways for commodities: first, labor shortages and transport disruptions have reduced both metals demand and supply; second, industries face bottlenecks at different parts along their value chain; third, it will take time for labor to return to work and for these bottlenecks to clear. As such, we do not see a return to business as usual until at least March.

Major Business Disruption to Transport

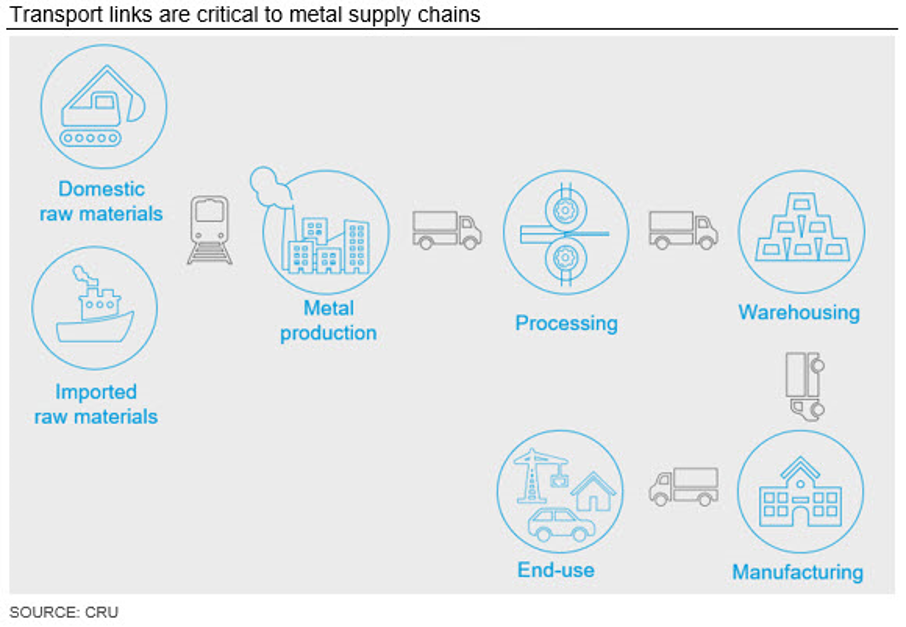

Road transport is a universal problem disrupting the commodity supply chains in China. Bottlenecks are forming through supply chains, especially those that are reliant on trucking. For steel, the blockage appears to be between steel mills and warehouses. For aluminum it is earlier, between smelter and fabrication plants.

Moving goods in and out of China has also been affected. Although ports appear to be operating well, enabling inflow of raw materials, some supply chain disruption has led to concerns about export and thus global supply chains.

The Implications for Commodity Prices are Nuanced

On the demand side, metals demand is lower than the usual seasonal level. End-use demand has fallen given reduced labor availability and medical equipment to ensure safety at work. For supply, blockages have built at different parts of the metals value chain. The implication of these changes for commodities markets depends on the speed of recovery of demand relative to supply in China, and China’s role in global markets either as a net exporter or importer of the commodity.

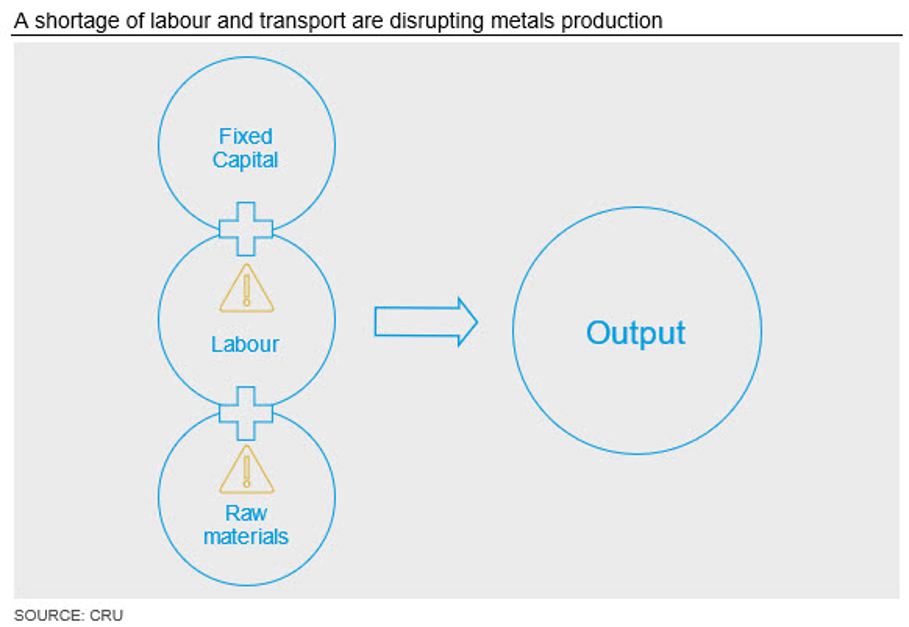

Labor and Transport are Critical to Output Production

Covid-19 has led to severe disruptions to the movement of people and road transport. This has affected both the demand for metals and metals production (supply). The output of any company is determined by its ability to draw on three factors: capital, labor and intermediate goods. For the metals industry, capital will typically take the form of buildings and machinery. For China, we divide labor into local labor and migrant workers who travel in from other provinces. The type of intermediate input depends on where the company sits along the metals supply chain. Outputs from one part of the supply chain will be intermediate inputs into another part of the supply chain.

The importance of transport and logistics can be seen in the context of a generic metals supply chain. At the early stage of the supply chain, raw materials are extracted and feed into primary metal production (e.g. steel mills). The primary metal is then moved on to be processed into a semi-finished form. Thereafter, it is converted into metal parts and components (screws) that in turn feed into the production of consumer goods—or end-use sectors such as property, cars, goods, and consumables. Transport is the key link from one part of the supply chain to another. Any disruption in transport and logistics can lead to blockages that compromise the entire production process.

Labor and Transport Disruption Will Continue into March

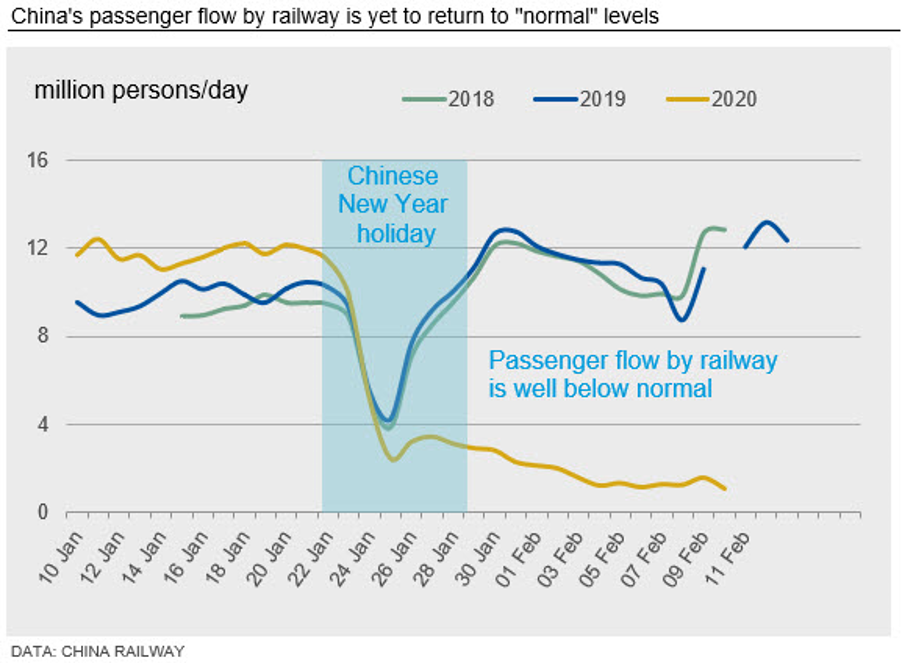

People are returning to work, but it will take time to return to business as usual. Analysis of passenger movement data on the Chinese railway network shows that passenger numbers post-Chinese New Year are down by as much as 80-90 percent y/y. Travel dropped a bit more than usual during the holiday period (reflecting lockdowns in Hubei) and has not recovered.

This week, people have started to return to work, encouraged by the government. But not everyone is back. There are several reasons: some have preferred to work from home, others face a mandatory quarantine period of up to 14 days (e.g. migrant workers who are returning to work); more labor-intensive work such as construction sites may not return until Feb. 20, as employers cannot offer a safe environment (masks, protective eyewear and hand sanitizers). Hubei remains under lockdown.

The Ministry of Transport announced on Feb. 11 that the road and water passenger occupancy rate should be less than 50 percent, as passengers are being advised to leave an empty seat between them for safety reasons. This will slow the return of labor and in turn the recovery of construction activity.

At the time of this writing, our assessment is that disruptions are likely to linger on into March. Business as usual will return thereafter, but getting to that point will depend on developments over the next week or two.

A full list of restrictions by province and the importance of metal production and consumption follows this article.

Logistics – Trucks Down

Our understanding is that the railway network is working relatively well, and that people and goods moved by rail are less hindered. As such, inland logistics for bulk raw materials, such as iron ore, appears not to be an issue. Problems are reported further down the supply chain. Trucking has been severely affected, leading to severe inbound and outbound shortages in some parts of the supply chain. Some companies have responded by re-deploying trucks to feed the rail network. The Ministry of Transport has announced that the road and water networks should be ready to return to normal operations by Feb. 20. But we expect it to take a bit longer for smooth transport to rebalance the blockages that are currently visible along the metals supply chain.

Commodity-Specific Impacts

The steel value chain is seeing falling demand and supply disruptions of raw materials. Labor and logistical constraints have hit the steel industry across the whole value chain from the supply of raw materials through to steel demand at end users. The restricted movement of people and trucks has severely curtailed activity in steel consuming sectors, lowering steel consumption, notably in construction. Evidence for the industrial slowdown comes from a 30 percent decrease in thermal coal consumption for power generation in coastal provinces.

Despite subdued demand, integrated steel mills have largely tried to continue operations because taking blast furnaces (BFs) offline is costly. Steel product inventories have consequently built up across the supply chain, particularly at steel mills, some of which have even run out of storage capacity. As a result, steel prices have plummeted by 8 percent compared to pre-Chinese New Year levels. The fall in profitability has forced some loss-making steel mills to cut production, either by forcing a shutdown of the BF or by charging lower-grade iron ore.

At the same time, bulk raw materials supplies have also been disrupted. Small scale iron ore and coking coal mines and many independent coal wash plants have remained closed due to a shortage of labor. Many steel mills were well stocked with raw materials before the CNY and have been less affected by these disruptions, but the demand for raw materials is currently lower due to steel production cuts. Since seaborne iron ore supply to China has been ongoing, muted demand pulled down iron ore prices by 14 percent compared to pre-CNY levels before prices rebounded following weather-related supply concerns.

Covid-19 Hitting Both Aluminum Supply and Demand

In the aluminum sector, transportation issues have had a growing impact on incoming raw materials and outgoing product from alumina refineries, aluminum smelters and downstream plants. At least eight alumina refineries have shut down 2.55 Mt/y capacity (~3 percent of China’s total production) in Henan, Shanxi and Guizhou due to lack of raw materials including bauxite, caustic soda and coke oven gas. Several smelters in Inner Mongolia, Xinjiang and Chongqing, located a long distance from alumina refineries, are also reported to have very low alumina stocks and there is a high risk that they will have to cut aluminum production.

Thermal coal supply has been very tight since coal mines cannot restart due to the concerns over the spread of coronavirus and a lack of labor. A few smelters are reported to have very low stocks of coal for their power plants, which may impact power supply for these smelters very soon.

Downstream aluminum semis plants that had intended to restart over the next week may be forced to delay any restart until raw materials deliveries are resumed. Foil plants in Jiangsu, Henan, and Shanghai have gradually reduced production or shut down. The lockdown to control the coronavirus has also lowered the demand from many aluminum end-users.

Copper Production Bottlenecks Lead to Rising Inventories

In the copper sector, the Covid-19 outbreak has recently triggered a disruption to copper concentrate and sulphuric acid transport, with the latter a more immediate threat to smelter operations. CRU’s primary research in China shows at least 12 smelters have begun to cut production over the past two weeks, and two have brought forward or extended their regular maintenance. This equates to a daily loss of around 2,600 t concentrate consumption in copper contained (or 13 percent of 2020 forecast blister supply on an annualized basis). It is understood that at least two smelters have contacted traders or miners to delay concentrate shipments and there are rumors that one operation in southern China has declared a force majeure. Market participants that we spoke to expect to see higher spot TC/RCs, but transactions have been few under such a chaotic market situation.

As most of these above-mentioned smelters have refining capacities, cathode production over the past fortnight has fallen. However, there remain large inventories of cathode at refineries and warehouses due to weak downstream demand and constrained logistics. Many semis fabricators did not resume production until Feb. 10 and will require further time for a full return to normal production due to labor and trucking shortages. Even if materials can be moved, shortages of trucks have led to a sharp increase in transport fees and many producers expect trucking fees to increase two-three times as the demand for transport grows and activity begins to normalize across China.

Disruption to Labor and Transport Will Linger into March

The view from CRU’s China offices is that the nature of the disruptions facing labor and transport following the Covid-19 outbreak will result in ongoing disruptions that will continue into March.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com