Prices

February 13, 2020

CRU: Mild Winter Creates Scrap Supply Surplus Amid Covid-19 Outbreak

Written by Ryan McKinley

Written by Senior Analyst Ryan McKinley. More in-depth regional analysis found in CRU’s Metallics Monitor.

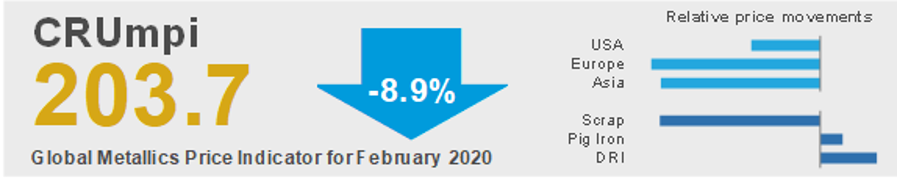

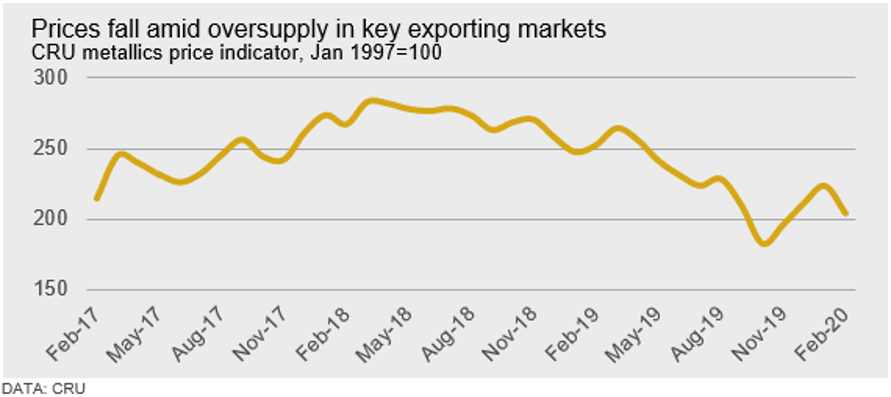

The CRU metallics price indicator (CRUmpi) fell by 8.9 percent m/m to 203.7 (see chart) following price falls in nearly every market. Supply outpaced demand due to mild winter conditions in much of the northern hemisphere. Key exceptions were Russian scrap and ore-based metallics prices, which rose m/m. The coronavirus Covid-19 is impacting steel markets, which threatens to weaken metallics markets over the coming month.

Winter continues to be mild in both Europe and the U.S., leading to excess supply in both markets and dragging domestic prices lower. Turkish scrap buyers were beneficiaries of these lower prices and were able expand their margins between import scrap and rebar export prices. In China, scrap trading has come almost to a complete halt due to restrictions on labor and travel caused by the novel coronavirus (Covid-19) outbreak. Concerns surrounding this situation spilled over to other markets in Asia, with scrap prices declining in all east Asian markets.

Two exceptions to the downward price trend in February were Russian scrap and global pig iron prices. More typical winter weather patterns have caused domestic mills to raise buying prices to keep material flowing in the former, while prices for the latter were lifted by reduced production in Brazil and stable interest from buyers internationally. Brazilian domestic scrap prices also rose on increased demand for steel long products.

In the U.S., scrap price decreases were markedly fragmented by region and grade, but overall in line with typical price movements for February over the last 10 years. Generally, prices towards the interior of the country were sheltered from larger increases in the South or closer to the East Coast. Scrap markets in southern Europe were also weaker than those in the interior and north amid ample supply and a lack of motivation from mills to restock. Conversely, in parts of Europe where winter weather patterns were more typical, like Russia, some prices rose by about 15 percent m/m as mills sought to maintain inbound material flows.

Mills in Turkey were able to take advantage of the supply glut in both Europe and the U.S. Our Turkish CFR import price assessment for HMS 1/2 80:20 fell to $258 /t on Feb. 7 from $300 /t on Jan. 10. Still, the market appears to have bottomed for now amid resistance from U.S. scrap exporters and successful rebar price hikes by Turkish mills.

Although disruptions caused by Covid-19 have yet to impact markets further west, scrap trading in China came to a standstill in February. Both supply and demand have faced disruptions, with EAFs shutting off production and BOFs reducing output as transport and labor restrictions prevent the collection and transport of material. As a result, domestic Chinese scrap prices fell by RMB100 /t m/m.

In other parts of Asia, the uncertainty around how this outbreak will impact supply chains and steel markets weakened demand as market participant sentiment turned bearish. In Japan, weak domestic steel production created a drag on both domestic and export scrap prices. In Vietnam, a slow restart to construction projects following the Tet holidays was caused in part by workers being on extended leave due to the Covid-19 situation. This, in addition to weaker markets across the globe, caused both billet and scrap prices to decline m/m.

Although scrap prices dropped in virtually every market across the globe, pig iron prices resisted the downward pull. Producers in Brazil are dealing with iron ore quality issues as the result of heavy rains that have also hampered charcoal deliveries. Meanwhile, buying interest was still relatively high even in China, where purchasers are asking for deliveries to resume after May.

Outlook: Price Stability Ahead, Although Virus Threat Looms

Turkish scrap import prices appear to have reached a temporary floor, and we expect this to signal some stability for both U.S. and European scrap markets. Domestic mills in both regions are running well overall, but scale prices will decline throughout February. Consequently, we expect that mills will be hesitant to push prices much lower to keep from interrupting flows. Still, we do not anticipate a major uptick in finished steel pricing provided that the Covid-19 situation does not worsen, and therefore do not expect much upward momentum for scrap prices. Should the situation worsen, we could see demand from key markets in Asia continue to fall, putting downward pressure on international scrap prices.

We also do not expect that there is a major upside risk to pig iron prices, although downside risks are also minimal. Buyers remain interested in securing material around current price levels, and Chinese buyers should return to the market in the coming months to provide additional price support.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com