Market Data

February 4, 2020

CRU: Steel Prices in Sharp Decline as China Returns from Holiday

Written by Erik Hedborg

By CRU’s China Steel Team, with Senior Analysts Richard Lu and Erik Hedborg.

On Monday, Feb. 3, financial markets and commodity trade resumed after the extended Chinese New Year (CNY) holiday caused by the outbreak of the novel coronavirus (2019-nCoV). Equity markets fell sharply as fears of economic slowdown prompted investors to push the sell button. Both steel and iron ore prices also fell sharply at the start of the week on expectations of weak steel demand for the rest of February.

Number of Confirmed Cases Keeps Rising

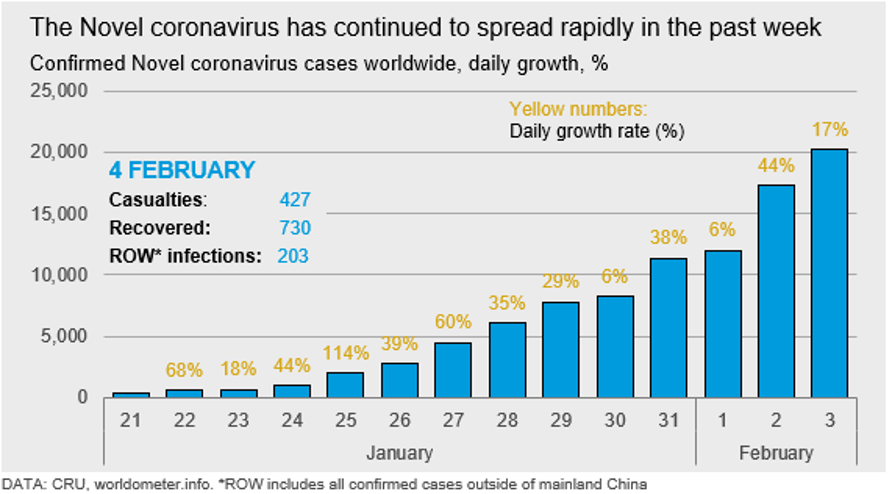

The novel coronavirus (2019-nCoV) continues to spread at a high rate both in China and abroad. On Monday, Feb. 3, the number of confirmed cases exceeded 20,000 and 427 people have been reported dead. Around 13 percent of the people infected are reported to be in a critical condition and the fatality rate is estimated at ~2 percent. The 9-month SARS outbreak during 2002-2003 resulted in ~8,000 infections and nearly 800 deaths, giving a fatality rate of close to 10 percent. Another difference between the two outbreaks is that ~50 percent of the deaths from SARS occurred in mainland China, whereas all but two of the deaths from the 2019-nCoV has, so far, occurred in China.

Many provinces in China have taken the initiative to extend the CNY holidays to Feb. 9 for “non-essential” industries, particularly in eastern China and provinces such as Shanghai, Anhui, Shandong and Jiangsu. In Beijing, many businesses have also been recommended to remain closed until Feb. 9, while all businesses in Hubei will remain closed to Feb. 13.

Steel Trading Resumes, But with Low Liquidity

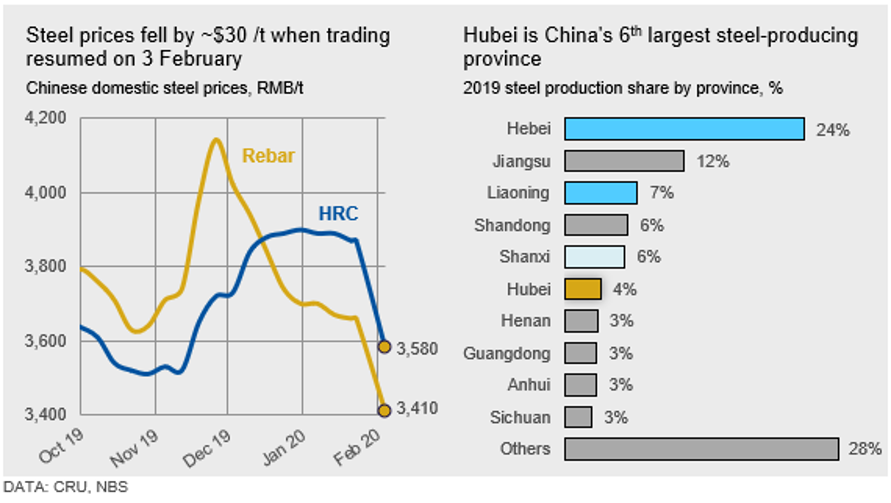

On Monday, Feb. 3, trading activities covering most commodities resumed in China. Steel prices were in steep decline on Monday, with prices of HRC and rebar falling by over RMB200 /t (~$30 /t) in one day. CRU’s contacts have reported that there are widespread fears of weak steel demand in the short term as several steel-consuming industries will pause operations as most of their workforce is not allowed to return to work. Transportation restrictions will also reduce the ability to deliver goods to businesses, and CRU has heard of large inventory build-ups in the past week.

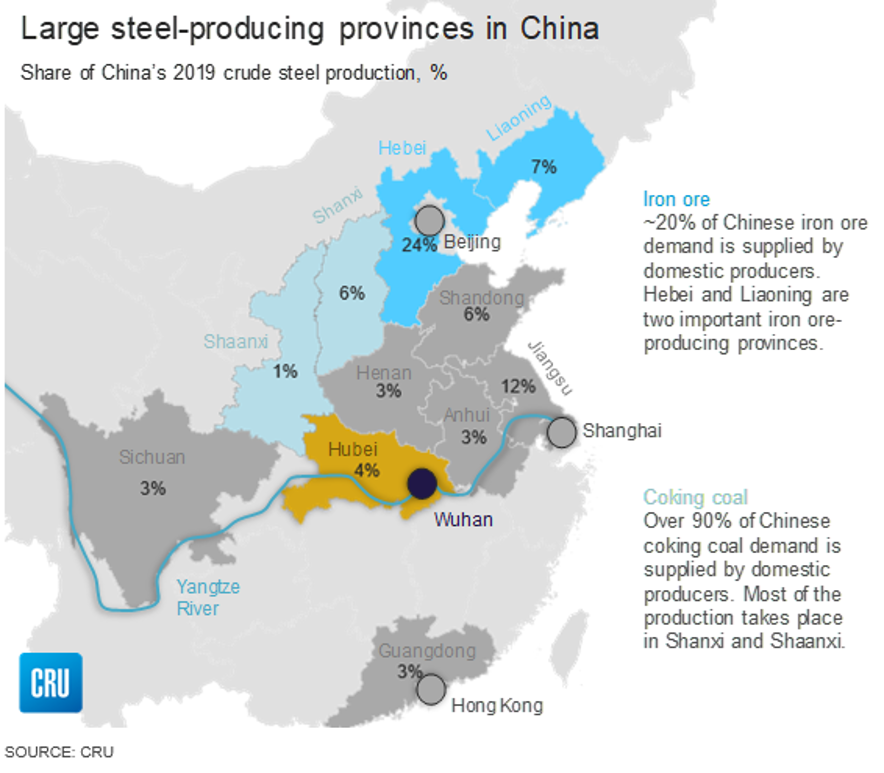

Our contacts have mentioned that transportation of goods in Hebei province has been somewhat impacted by restrictions, but the overall situation is not too different from right after the 2019 CNY. The situation is slightly worse at the port of Tianjin, close to Beijing, where operations have resumed but there are reports of disruptions due to a shortage of workers. In eastern China, port restrictions are much more severe than in the north. We have heard of several steel mills reporting difficulties in transporting both raw materials and finished steel products. In addition, transportation on the Yangtze River, which passes through Wuhan, has been heavily affected and this has had an impact on steelmakers in the river delta.

Steelmakers Reliant on Stocks of Raw Materials

Every year, the steel value chain goes through cycles of inventory build as there are two key processes that are unaffected by the long CNY holiday.

• Blast furnaces (BFs) cannot be stopped easily, meaning that they will still be producing even during the CNY. However, they can reduce productivity by adjusting the operations. This means steelmakers typically build up inventories of coking coal and iron ore prior to CNY in order to keep these facilities operating even as logistics and transportation pause in most parts of the country.

• Raw material imports are still taking place, but the transportation from ports to mills will be restricted. This means that inventories at ports are usually built up during the holidays. This is especially true for iron ore as China imports ~80 percent of its iron ore needs.

Blast Furnaces Remain Operational…

BFs in China have still been operating despite the extended holiday and muted demand, although we have heard of several steelmakers doing everything they can to reduce the BF productivity by adjusting their operations. Approximately 90 percent of China’s crude steel output is produced via the integrated process (BF/BOF), meaning that steel production has not been severely impacted by the extended holiday. Our contacts in the market all mention that they are relying on raw materials inventories to support their production and the reduced operating rate means that these inventory levels are expected to last longer. Although there is a high degree of uncertainty regarding future transportation restrictions, our sources have mentioned that, for now, they see no immediate risk to BF operations due to a raw materials shortage. Some mills have mentioned future BF maintenance being brought forward to the second half of February.

…But Coal and Iron Ore Producers Have Taken a Hit

We have also heard that production of coking coal and iron ore in China has taken a hit. The shortage of workers is expected to affect production of both commodities, but difficulties operating wash plants with a large share of the workforce unable to return to work will have a large impact on China’s coking coal supply. Most iron ore production takes place in the northern parts of the country, which are less affected by transportation restrictions. However, there are still concerns about a labor shortage, especially since most iron ore mines are located in remote areas with less developed healthcare infrastructure.

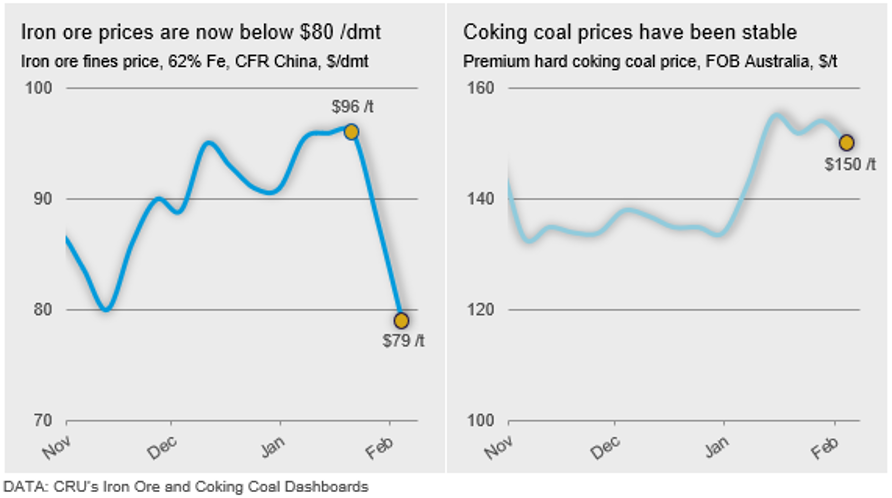

Both iron ore and coking coal have experienced very different price moves in the past weeks. Iron ore has fallen by 18 percent on expectations of falling steel production in the coming month. Coking coal, however, has been broadly stable due to the expected weakness of domestic supply and recent supply issues, particularly in Australia.

Steel Inventories Rising Fast

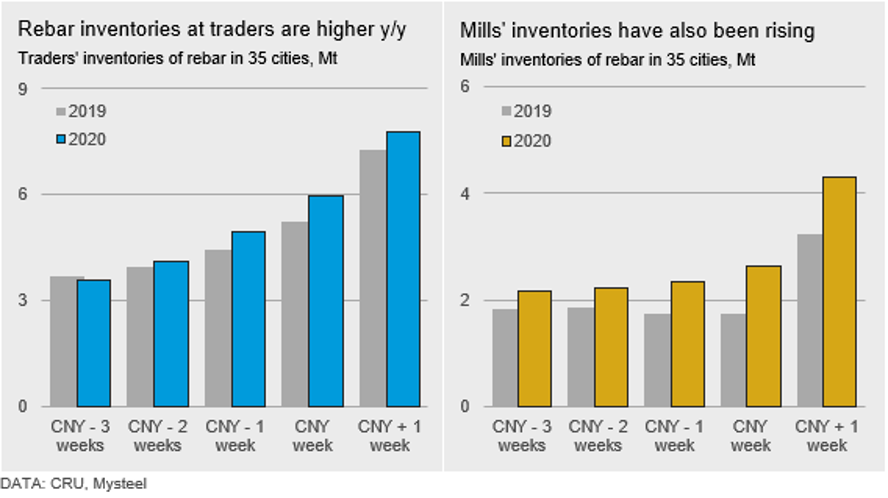

In line with our view of crude steel production not being severely affected, we have heard from multiple sources that inventories of finished and semi-finished products have been built up in the supply chain. Independent rolling mills have, in many cases, been idled, which is resulting in semi stocks being built up at mills. Rebar inventories at mills are at a higher level now than after the 2019 CNY. Our sources have also hinted that mills closer to Hubei province are having more difficulties moving products, and the high inventory levels have become a concern for many in central China and those near the Yangtze River.

EAFs, which make up ~10 percent of China’s crude steel production, can be operated with a high degree of flexibility and production typically shuts down during CNY. These facilities have remained shut during the extended holiday and steelmakers that rely on EAF production are not building up inventories at the moment.

As we continue to see steel inventories being built up in the supply chain, there is little upside to steel production in the coming weeks. Even as demand improves, steelmakers and traders are expected to be sitting on high inventory levels, which will limit the upside to steel prices once demand returns.

Steel Demand to Remain Weak for the Rest of February

China’s construction sector makes up a significant proportion of the country’s steel demand. It typically takes longer for the sector to return to normal levels after the CNY holidays as a large proportion of the workforce is made up of migrant workers that live far away from construction sites. Therefore, we expect a prolonged process of bringing back the workforce as soon as conditions improve, meaning that we are likely to see steel demand from the construction sector remain weak for the rest of February. We also expect the manufacturing sector to be severely impacted by weak demand following a period of weak consumer confidence.

Where Are Chinese Domestic Steel Prices Heading?

Tough in the short term: The on-going tough situation is not likely to turn around in the near term. The labor-intensive construction activity is expected to remain restricted, which suggests the real estate sector will take a big hit. In particular, the y/y drop of floor space starts in Q1 is expected to be large. The same goes for infrastructure projects.

Virus containment prioritized over steel demand: Financial resources will be focused to tackle the 2019-nCoV outbreak. We are doubtful the government will stimulate any infrastructure progress, except for essential medical support in each province. Although the central bank has provided financial support by injecting ~RMB1.7 trillion early this week, it is unlikely that it will provide much support to steel prices as the measure is more aimed at the financial sector.

High steel stocks could temper a panic restock of raw materials: Even once the situation stabilizes, prices will remain under pressure. Steel inventories have accumulated, and there will be no shortage of steel once demand recovers. Steelmaking raw materials are currently being drawn down, which means restocking demand is inevitable. However, high steel inventories are likely to reduce the urge for steelmakers to quickly build up stocks.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com