Prices

January 21, 2020

CRU: U.S. Iron Ore Producers Under Pressure

Written by Erik Hedborg

By CRU Senior Analyst Erik Hedborg, Principal Economist Lisa Morrison, Principal Analyst Josh Spoores and Senior Analyst Ryan McKinley, from CRU’s Iron Ore Market Outlook

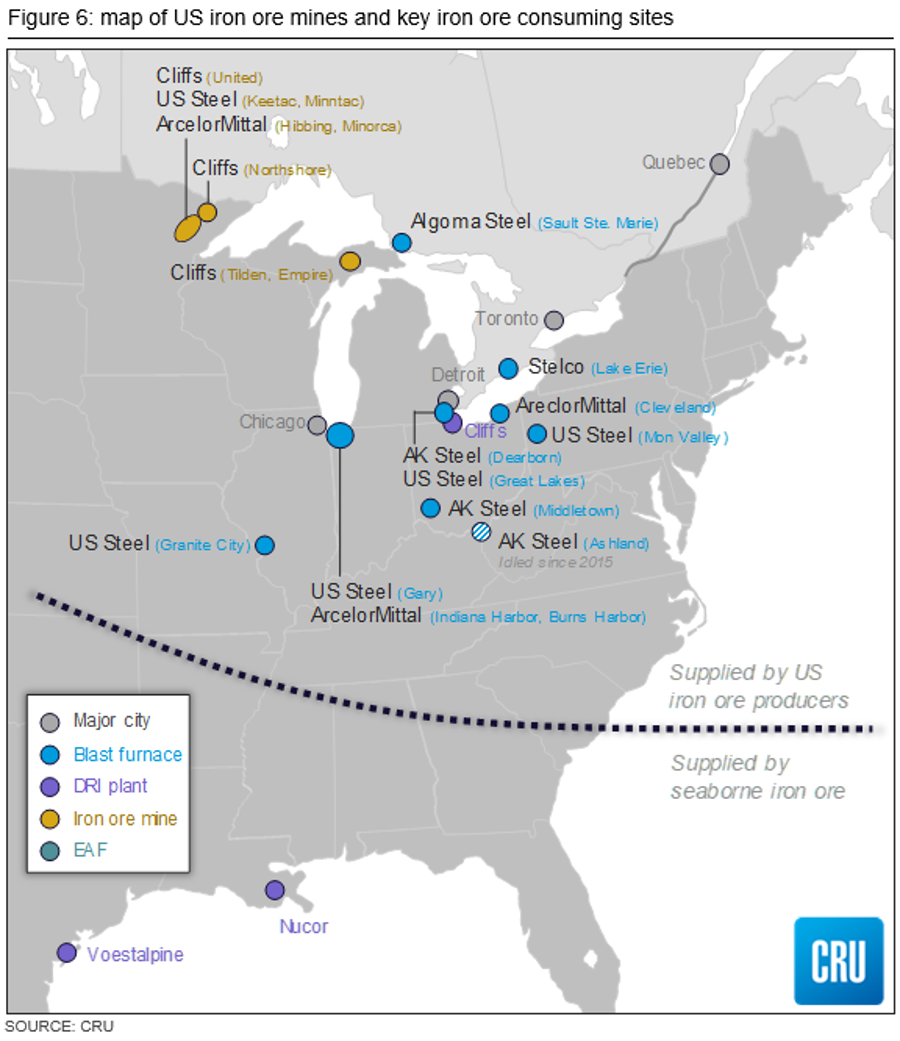

In a recent insight series, CRU highlighted some of the challenges facing the three U.S. iron ore producers, Cleveland-Cliffs, U.S. Steel and ArcelorMittal. The location of the mines and pellet plants means that they are unlikely to ever become a significant participant on the seaborne iron ore market. Therefore, the companies are in the hands of the BF producers around the Great Lakes, as even delivering iron ore to the domestic DRI plants in the Mexican Gulf is challenging as overland transportation is costly. Most of the country’s BFs produce hot metal used to produce sheet products, particularly for the U.S. automotive sector.

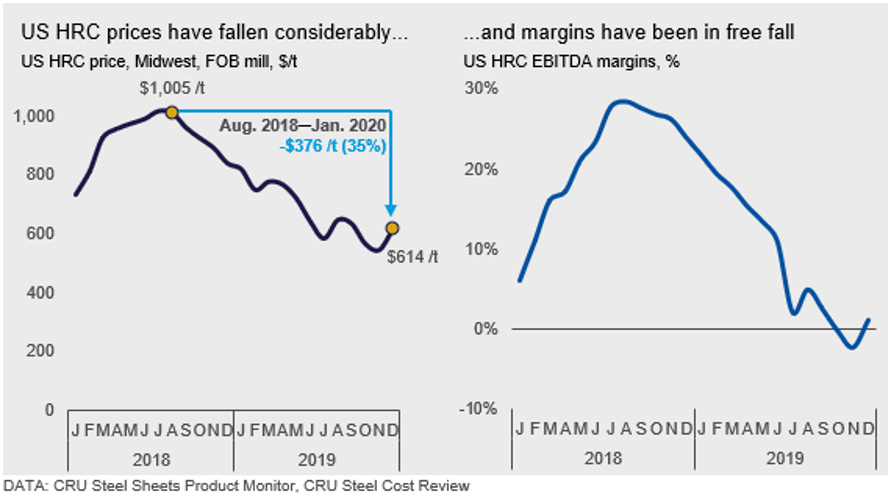

In 2019, the trio suffered from a collapsing U.S. sheet market as tariffs were unable to keep prices and margins in the U.S. steel industry elevated. That forced steelmakers to take action by reducing BF output and implementing cost cutting measures.

Besides reflecting the health of the iron ore producers’ customers, the HRC price is also an important component in the pricing of pellets sold around the Great Lakes. In addition, the seaborne 62% Fe fines prices and BF pellet premia in the European market also have an influence—earlier in 2019, Cleveland-Cliffs’ CFO Tim Flanagan indicated that Cliffs received price moves by $3 /t when the HRC price moves by $50 /t or the seaborne 62% Fe fines price moves by $5 /t. The price also shifts by $3 /t when the Atlantic Basin pellet premium moves by $2.5 /t. Contract changes in 2019 mean that Cliffs’ pricing methodology is now more dependent on the European pellet market and the overall supply and demand fundamentals in the 62% Fe fines market.

On the cost side, the strength of the U.S. dollar has a large impact on the competitiveness of U.S. iron ore producers. When the U.S. dollar is strong, global iron ore production costs fall as costs are largely denominated in local currencies and U.S. producers lose competitiveness. U.S. iron ore producers have in the past exported up to 5 Mt/y to the seaborne market. Exports peaked between 2011-2014, a time when the U.S. dollar was weak and pellet prices elevated. In the current market environment, the U.S. dollar is keeping their costs elevated and it is difficult for them to compete on the seaborne iron ore market.

2019, a Particularly Tough Year for U.S. Producers

As discussed earlier in the report, iron ore producers worldwide have enjoyed exceptionally high margins in 2019. However, this is not the case for U.S. iron ore producers and, for Cliffs and others, most of the key metrics pointed in the wrong direction in 2019. Cliffs, for example, reported a net income of $230 million for the first nine months of 2019, compared with $518 million for the same period in 2018.

• The U.S. dollar has remained strong for most of 2019, thus keeping costs of iron ore production in the U.S. higher than elsewhere in the world.

• The Atlantic Basin pellet premium, which typically reflects the pellet sold to Europe, has fallen sharply in 2019 H2 as European steelmakers have reduced hot metal production while also lowering pellet rates.

• U.S. HRC prices fell steadily in 2019 and U.S. iron ore producers’ customers are currently struggling to make profits.

U.S. HRC Prices to Remain Under Pressure

In recent weeks, U.S. HRC prices have recovered somewhat, and it is likely that prices will climb further in Q1. However, CRU sees this as only a temporary rebound as we maintain our bearish view on steel demand. The price rebound is caused by higher scrap prices and supply fears as ArcelorMittal’s BF at Indiana Harbor has reached the end of its campaign life and U.S. Steel decided to close its Great Lakes works. In addition, at end-December, there was an explosion at Indiana Harbor and CRU expects production to be affected in the coming months. The mills have announced that they will compensate for these losses by increasing production elsewhere, however, this will be a challenge as Gary is the only site with spare capacity at the moment. In addition, the steelmakers will be in no rush to increase production due to the weak margin environment.

Some Upside for U.S. Iron Ore Demand

In December, Cleveland-Cliffs announced the acquisition of AK Steel, which has three BFs in Dearborn, Middletown and Ashland (idled since 2015) with a combined capacity of nearly 6 Mt/y, but there is still plenty of uncertainty regarding Cliffs’ plans for these sites. Our view is that the objective of this acquisition is to control the iron making facilitates and it is likely that the downstream assets will be put up for sale again. Restarting the Ashland BF to produce pig iron for the merchant market is a possibility, which would increase iron ore demand by up to 2 Mt/y.

U.S. Steel has announced that it will shut down its Great Lakes works, which has three BFs. One of the BFs had already been idled for years and another one was taken offline in the summer of 2019. The last BF will be taken offline in April this year. Crude steel production at Great Lakes has averaged ~2.4 Mt/y and some of that production will now be shifting over to its Gary works that has four BFs and a combined capacity of 7.5 Mt/y. In the past five years, the site has averaged 5.5 Mt/y of production, which means there is capacity to offset some of the losses from the Great Lakes closure.

Furthermore, Stelco in Canada is aiming to produce pig iron from its BF. Stelco has a capacity of 2.6 Mt/y of hot metal production, and production could lift to nearly that level if the company goes ahead with its pig iron production plans.

Although margins are currently poor for both steelmakers and iron ore producers in the U.S., we see flat iron ore demand in 2020 as some of U.S. Steel’s output losses are likely to be offset by production increases by companies such as Cliffs, through its Ashland works, and Stelco.

Where is the U.S. Dollar Heading?

On a broad, trade-weighted basis, the U.S. dollar remained quite strong in 2019. However, in recent weeks it has weakened somewhat, but more against “major” currencies than those of emerging economies. Given so much strength bias, the most likely course for the U.S. dollar is to weaken going forward, rather than strengthen further. However, for this to occur, something has to shift. CRU has identified three factors that will drive the U.S. dollar in 2020:

• Interest rates: Although the Fed cut interest rates in July, September and October, the ECB and other central banks have also reduced rates. The ECB has also implemented another round of Quantitative Easing (QE), indicating an extremely accommodative monetary stance. We expect little change in U.S. or Eurozone monetary policy in 2020, so this factor will continue to support the dollar.

• Safe haven status: The trade tensions between the U.S. and China continue, with uncertainty lingering despite the Phase I deal being signed. Not imposing tariffs on autos and parts imports is good news, but the U.S. trade relationship with the EU remains very tense. The closer the U.S. and China come to a settlement of their trade conflict, the more likely this factor is to fade, allowing the dollar to weaken.

• Growth prospects: The U.S. economy did better than expected in 2019 and slightly outpaced its potential. Activity in Europe, particularly in manufacturing, remains weak and concerns over the ability of China to continue to meet its growth targets have risen. The U.S. economy is expected to grow more slowly in 2020, particularly in H1, and it is likely we will need to wait until 2020 H2 to see some change in this factor.

We expect that the most likely pillar of U.S. dollar strength to be knocked away is its safe haven status. If trade tensions with China ease, growth prospects for China, and its trading partners, will brighten, thereby providing a reason for the U.S. dollar to ease.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com