Prices

January 14, 2020

CRU: Iron Ore Prices Hold High on Australian Supply Fears

Written by Erik Hedborg

By CRU Senior Analyst Erik Hedborg, from the CRU Steelmaking Raw Materials Monitor

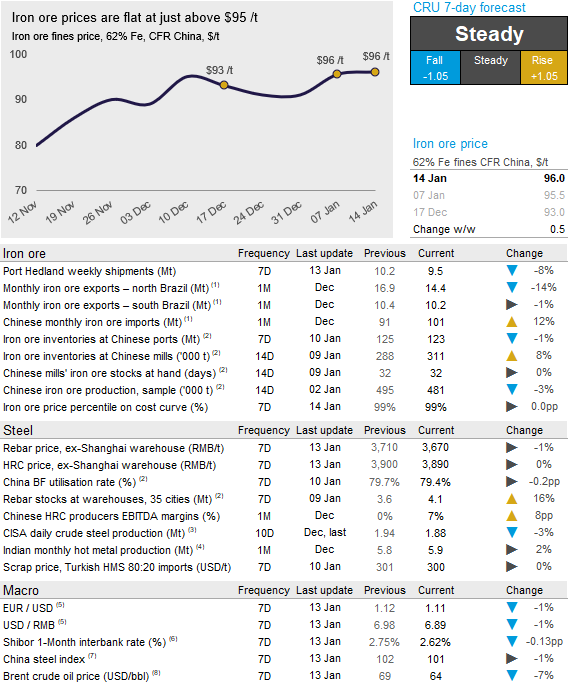

In the past week, iron ore prices have remained at a high level as restocking in China has continued and there are increasing fears of Australian supply disruptions caused by Cyclone Claudia that passed north of the major iron ore ports in Western Australia.

For the first half of January, iron ore supply has followed the same trends as in end-2019 with strong supply from Port Hedland and weak Brazilian supply. Port Hedland shipments have been around 10 Mt in each of the past two weeks. One year ago, the shipments fell to 9 Mt/w in the first half of January. In Brazil, the heavy rain over Minas Gerais continues as the latest forecast suggests over 400mm of rain in the state’s capital for the month of January. This is well above the historical average of 100mm, but below the December level of 560mm.

There is more bad news on the supply front. Rio Tinto has announced that their shipments will be affected by Cyclone Claudia that passed around 500km north of the Pilbara coast. This forced a temporary evacuation of Rio Tinto’s ports in order to prevent any danger that might arise from the swells. Production should be back fairly quickly as the cyclone has now moved further west. Port Hedland is not affected as it is a more sheltered port than Rio Tinto’s Cape Lambert and Dampier ports.

In China, steel inventories are being built up, even slightly more than last year. Steel prices have been flat and we estimate the iron ore inventory build-up by mills to pause. The drawdown of port stocks typically occurs at this time of the year as the transportation from ports to mills will be restricted during the Chinese New Year.

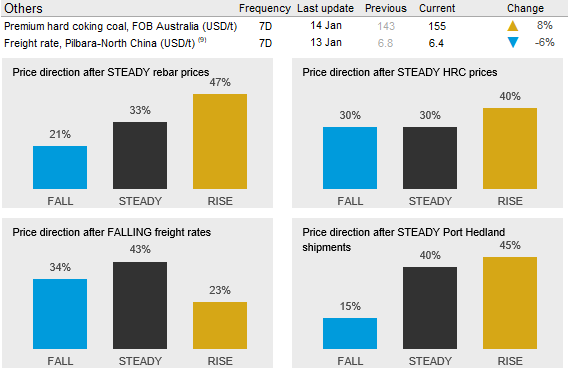

In the coming week, we expect prices to remain steady again. Our indicators below suggest there is an upside risk, which is confirmed by an increase of open derivatives contracts in Dalian, at a time when prices are increasing. However, there is little upside to demand from this point, as the mill inventories have improved while steel prices are in a slightly downward trend.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com