Prices

January 9, 2020

CRU: Scrap Demand Remains Strong During Mild Winter

Written by Ryan McKinley

By CRU Senior Analyst Ryan McKinley, from CRU’s Steel Metallics Monitor

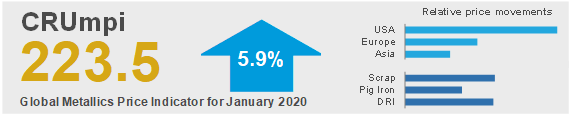

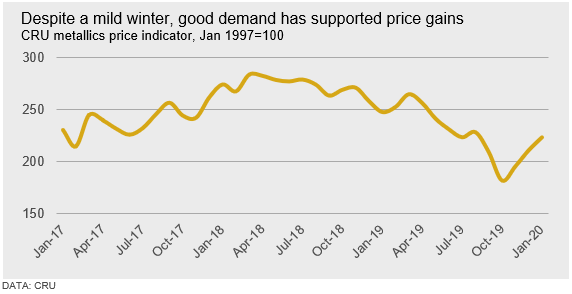

The CRU metallics price indicator (CRUmpi) rose by 5.9 percent m/m to 223.5 (see chart) following price increases in nearly every market, the highest level since August 2019. Solid scrap demand has offset better than seasonally typical supply due to mild winter weather in the Northern Hemisphere. Pig iron demand from China is still robust, which supported prices despite an increase in availability from Ukraine.

Winter in the Northern Hemisphere typically slows obsolete scrap collection as snowfall, rain and cold weather inhibit collection. This then supports stronger scrap prices in January. However, more mild winter weather conditions this year were offset by strengthening demand. Mills in the U.S. and Europe have sustained demand for scrap, albeit cautiously, to support steel production amid the ongoing steel restocking cycle.

Outside of Brazil and China, scrap prices have risen in all markets that we assess. The Brazilian domestic steel market remains weak, and mills have pushed for lower scrap prices—the lowest in a few years—that dealers accepted to clear inventories. In China, price declines were minimal, with reduced supply broadly balancing lower demand as the country heads toward the Lunar Holiday period.

In the U.S., stronger steel prices and steel output were the primary drivers of steel price gains amid mild winter weather and increased inflows due to rising prices over recent months. This resulted in prices rising by $25-30 /l.ton m/m; though, had winter conditions been more severe, price gains may have been higher. The European market had barely begun trading as we publish the Steel Metallics Monitor this month. While demand there remains strong, mills are cautious and are not in a rush to secure large volumes of scrap. Ongoing weakness in the manufacturing sector continues to limit prime scrap generation and steel demand.

Vietnamese steel demand from both construction and manufacturing sectors has been strong, supporting robust steel output. This has resulted in good scrap demand and supported higher steel prices. Meanwhile, despite the Indonesian authorities lifting some restrictions on scrap imports following the ban a month ago, trade remains thin. Good demand from Vietnam and elsewhere in Asia has boosted sentiment from Japanese scrap exporters and this has enabled price gains in the Japanese domestic market also.

Turkish scrap import prices rose to around $300 /t CFR for HMS 80:20 in late December and have hovered around this level since. The U.S. East Coast market has become tighter recently, prompting exporters there to lift dock prices to limit the flow of material toward inland markets. Concurrently, we have heard that U.S. exporters have increased offers to Turkish mills to around $310 /t CFR, though no deals have been heard at this level.

Merchant pig iron prices have increased further by $10 /t m/m in Brazil and the CIS. Demand from Europe remained subdued while buying interest from the U.S. resumed amid limited availability as Chinese demand kept merchant pig iron sellers busy. Even though availability was greater from Ukraine, this was not sufficient to rebalance the market.

Outlook: Slightly Softer Scrap Prices as Pig Iron Continues to Rise

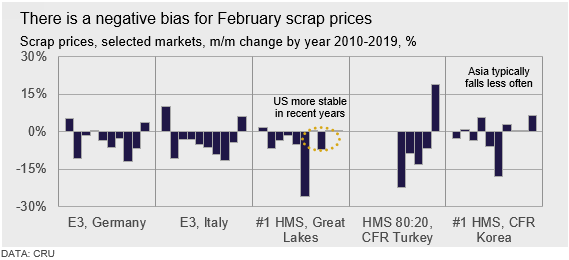

Last year was the first time that scrap prices rose in February since 2010, an anomaly that followed an atypical fall in scrap prices in January 2019. Prices have followed the more typical seasonal trend of rising in January this year, though conditions are slightly uncharacteristic of the period. Winter weather is very mild, enabling greater supply while good demand has still supported price gains. Ongoing mild weather and improved inflows following recent scrap price gains could lead to an oversupplied market and turn prices lower in February. Equally, though, with steel prices expected to rise further in February, steelmakers may be less willing to undermine scrap prices.

For pig iron, we do not expect the supply tightness to ease in the coming weeks because of low availability and solid demand, at least from China. While there are idles and outages at integrated works in the U.S., production is expected to be shifted to other integrated facilities within the same companies. So, unless U.S. EAF-based steel sheet producing mills are able to capitalize on the outages and gain volumes, there is unlikely to be a boost to pig iron demand from these idles/outages. The end of the steel restocking cycle also presents a risk to ongoing price support for pig iron as real demand has not strengthened significantly.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com