Market Data

December 20, 2019

Currency Update for Steel Trading Nations

Written by Peter Wright

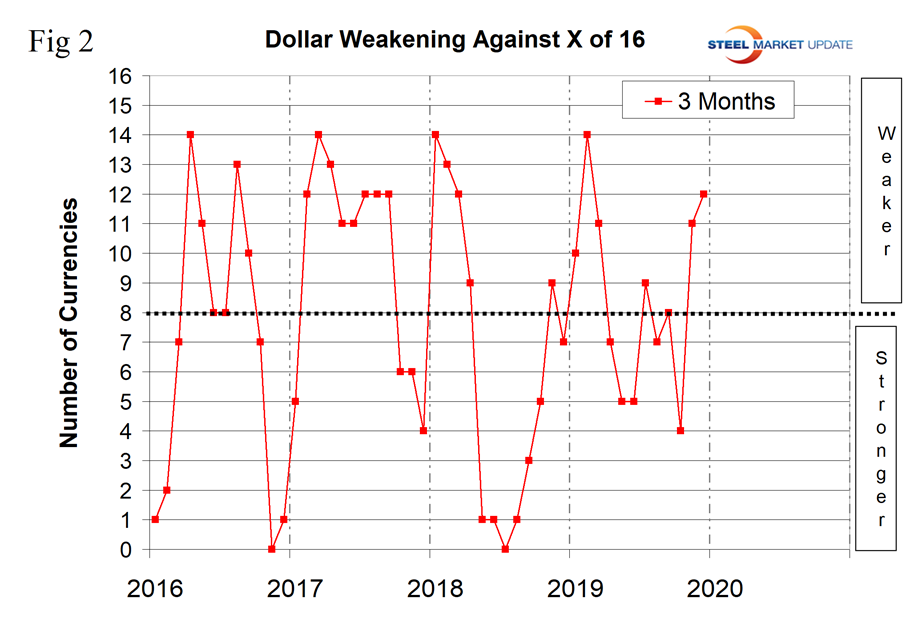

The U.S. dollar has weakened against 12 of the 16 steel trading nation currencies in the last three months.

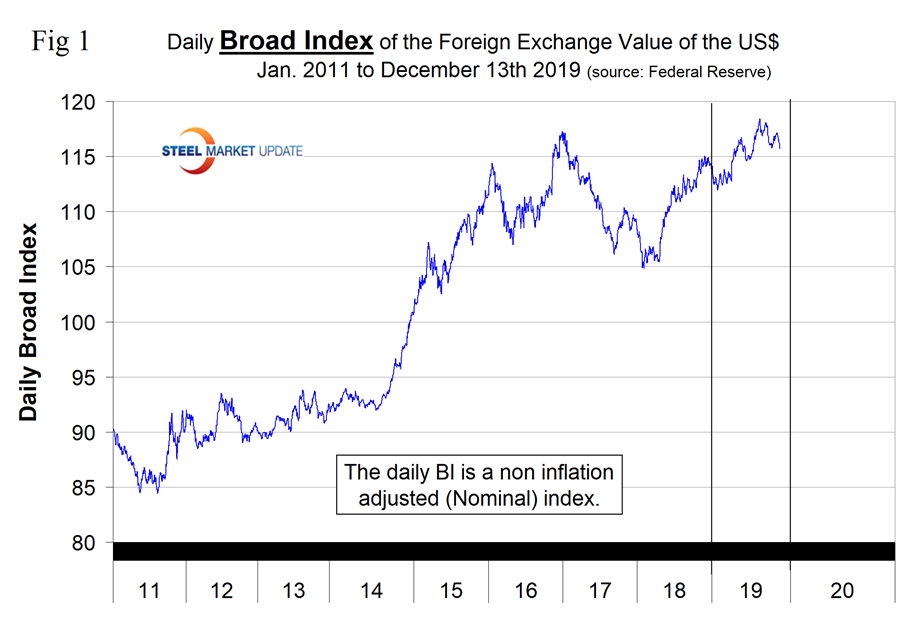

In this report we examine the change in currency values of the 16 pre-eminent global steel and iron ore trading nations. The currencies of these 16 don’t necessarily follow the Broad Index value of the U.S. dollar. In fact, at any given time, some are always moving in the opposite direction. The latest value of the Broad Index as published by the Federal Reserve was Dec. 13. In three months prior to that date, the dollar had weakened by 2.0 percent; therefore, in this instance, the currencies of the steel trading nations are moving in parallel with the broad index.

![]()

Figure 1 plots the daily Broad Index (BI) value of the U.S. dollar since 2011. The dollar has appreciated erratically in 2019 and on Dec.13 was up by 1.8 percent YTD.

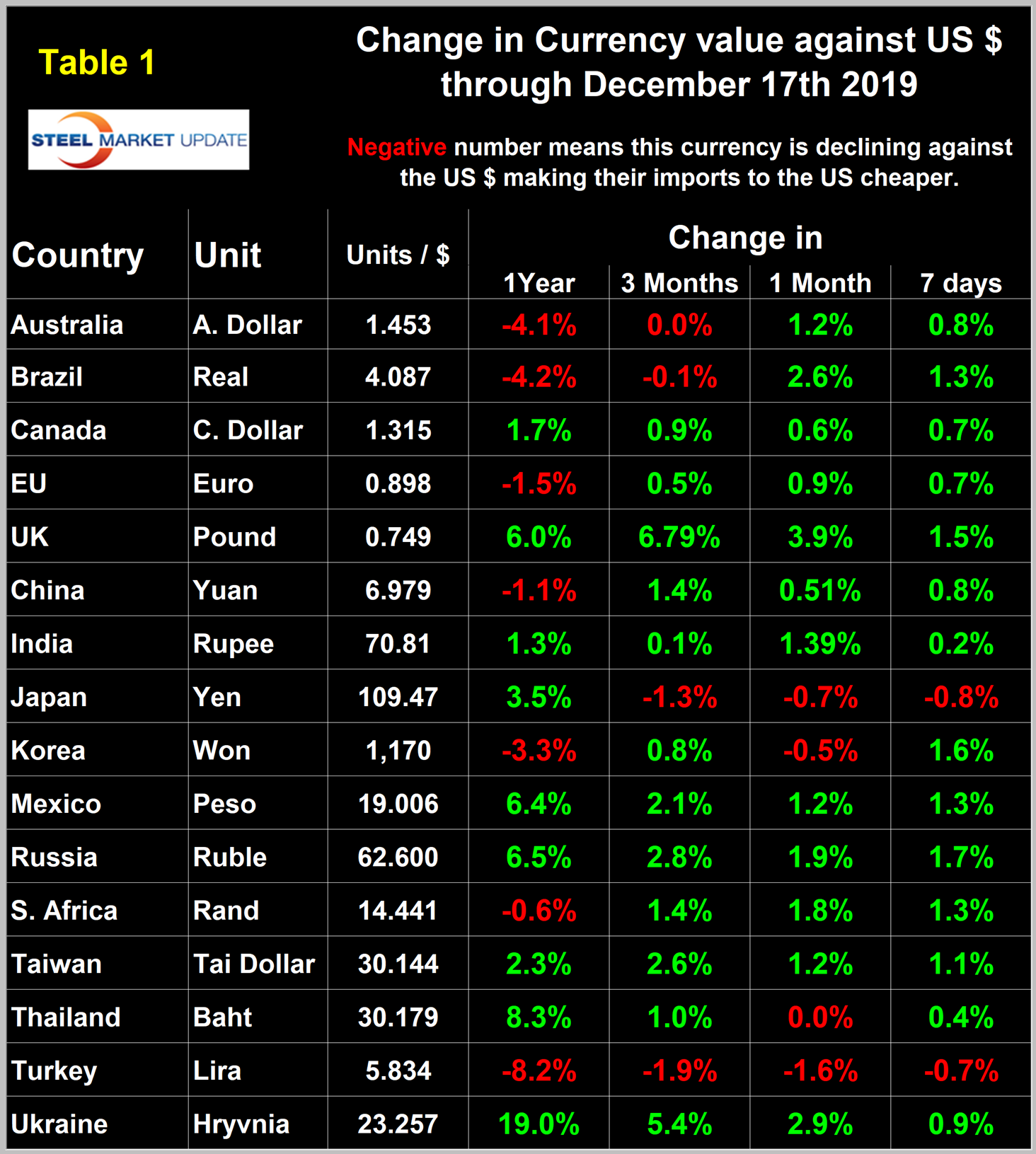

At Steel Market Update, we track the currencies of 16 steel trading nations. Table 1 shows the number of currency units that it takes to buy one U.S. dollar and the percentage change in the last year, three months, one month and seven days. The overall picture for the steel trading nations is that in the last year the U.S. dollar has weakened against 9 of the 16. In the last three months and one month, the dollar has weakened against 12. Table 1 is color coded to indicate weakening of the dollar in green and strengthening in red. We regard strengthening of the U.S. dollar as negative and weakening as positive because of the effect on net imports. Figure 2 shows the extreme gyrations that have occurred at the three-month level in the last four years.

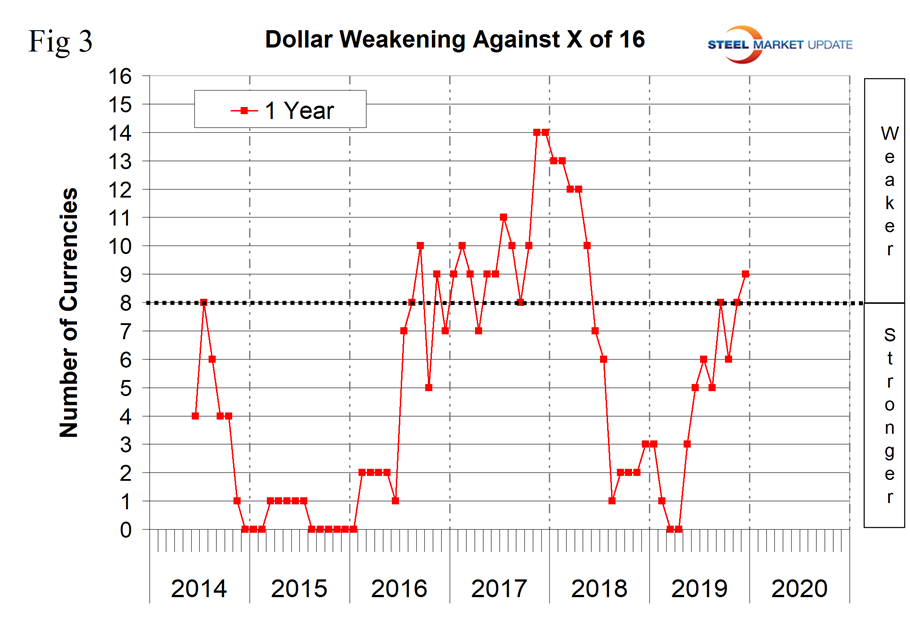

To try to get a less volatile look at the changes in value of the 16 currencies under examination here, we have developed Figure 3. This shows the number of currencies against which the dollar was weakening on a year-over-year basis. In March and April, the dollar was strengthening against all 16; by mid-December it was only strengthening against 7.

Big movers in the last three months have been the British pound, up 6.79 percent, the Turkish Lira down by 1.9 percent, and the Russian Ruble, up by 2.8 percent. We present long-term charts of the value of these three currencies against the dollar below together with an IMF update on the state of the Australian economy (see the end of this report for details of data sources).

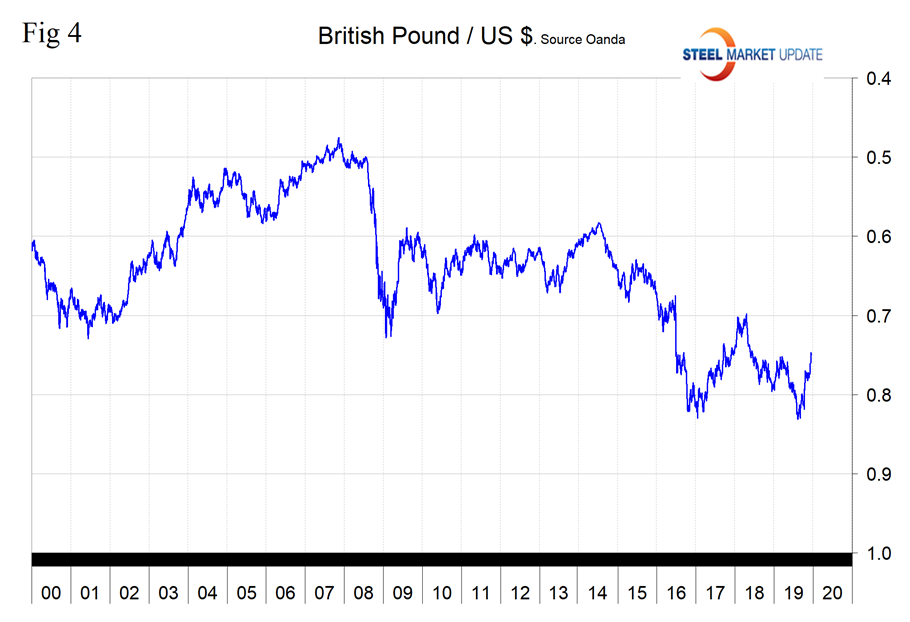

The British Pound

On June 2016, the British shocked the world when the nation narrowly voted to leave the European Union. After three years and six months of internal wrangling with the Parliament and external negotiations with the leadership of the Union, the Dec. 12 election stood as a second referendum. The citizens of the UK told the world they are ready to “get on with it” and leave the EU as soon as possible based on the results of last week’s election. The British pound moved to the upside against both the dollar and the euro currency in the wake of the election. In the last three months, the pound has appreciated by 6.79 percent against the dollar and was up by 3.9 percent in the last month (Figure 4). This is the last month that we will report on the British pound. In January, we will replace the pound with the Vietnamese dong. Vietnam has become a much bigger factor in the global steel scene and through November 2019 shipped over twice as much steel to the U.S. than did Britain.

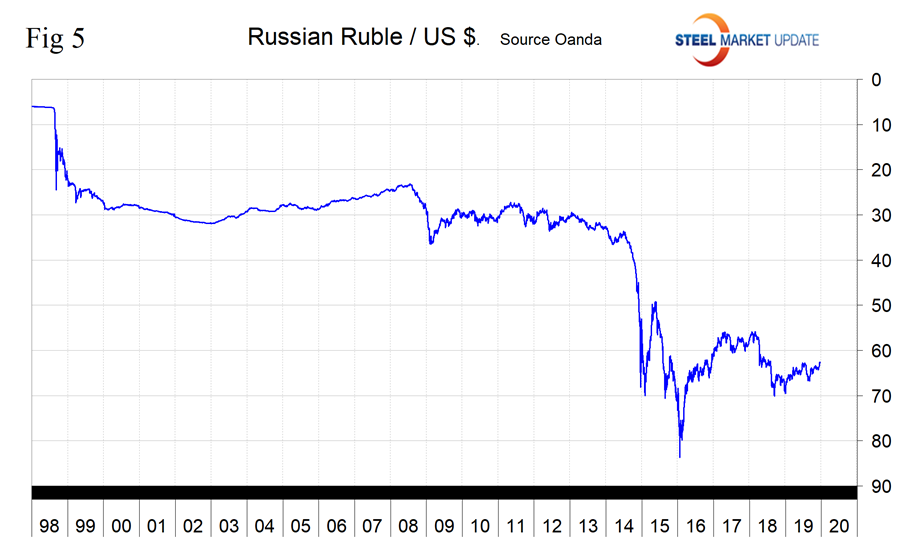

The Russian Ruble

The ruble has appreciated by 6.3 percent since its recent low of Sept. 3, 2019. The ruble has appreciated by 2.8 percent in the last three months and by 1.9 percent in the last 30 days (Figure 5).

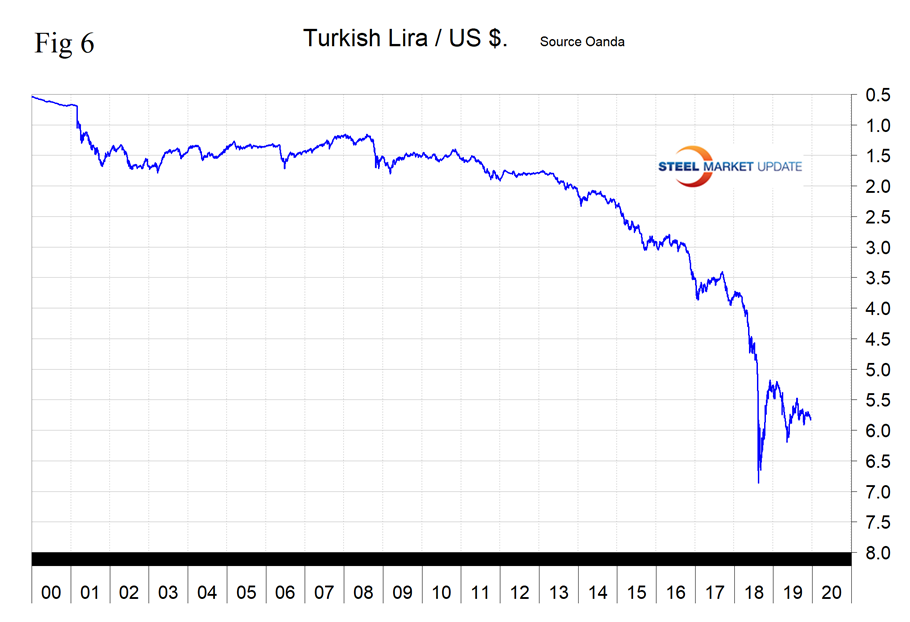

The Turkish Lira

In the last three months, the lira has depreciated by 1.9 percent against the dollar and on Dec. 17 was down by 8.2 percent year over year (Figure 6).

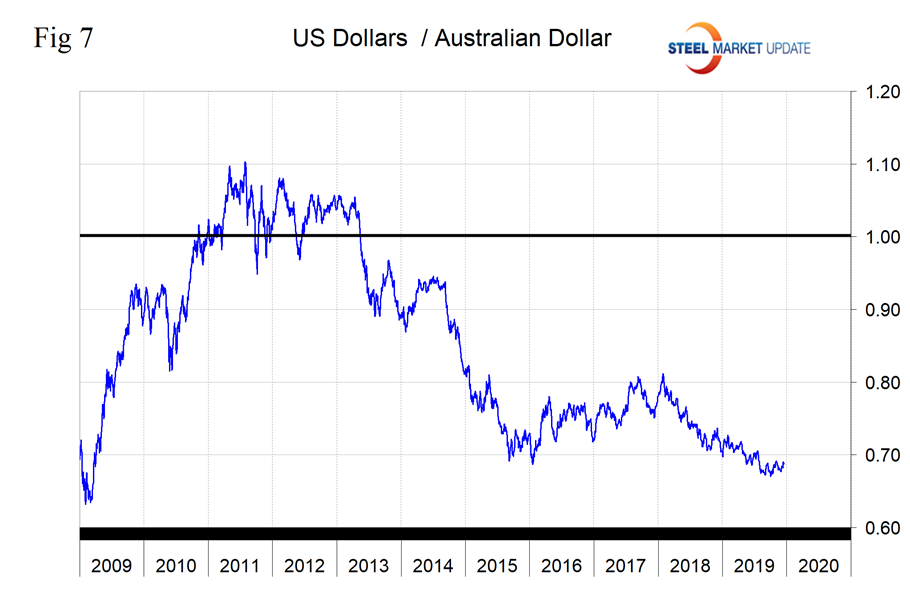

The Australian Dollar

On Dec. 12 the IMF published its Staff Concluding Statement of the 2019 Article IV Consultation Mission. An extract is as follows: Growth should continue to recover at a gradual pace. Following growth of about 1.8 percent in 2019, the economy is expected to expand by 2.2 percent in 2020. Private domestic demand is expected to recover slowly, supported by monetary policy easing and the personal income tax cuts. An incipient recovery in mining investment is also expected to contribute to growth. Non-mining business investment is expected to take longer to recover. Over the medium term, growth is expected to reach the mission’s estimate of potential growth of about 2.5 percent, supported by infrastructure spending and structural reforms. With continued labor market slack, underlying inflation will likely stay below the target range until 2021.”

The Australian dollar has depreciated by 4.1 percent in the last year and on Dec.17 was down by 17.9 percent since its recent peak on Jan. 27 last year (Figure 7).

In this monthly analysis we show the trends we think have the most immediate significance, but all 16 steel trading nation graphs are available on request.

Explanation of Data Sources: The Broad Index is published by the Federal Reserve on both a daily and monthly basis. It is a weighted average of the foreign exchange values of the U.S. dollar against the currencies of a large group of major U.S. trading partners. The index weights, which change over time, are derived from U.S. export shares and from U.S. and foreign import shares. The data are noon buying rates in New York for cable transfers payable in the listed currencies. At SMU, we use the historical exchange rates published in the Oanda Forex trading platform to track the currency value of the U.S. dollar against that of 16 steel trading nations. Oanda operates within the guidelines of six major regulatory authorities around the world and provides access to over 70 currency pairs. Approximately $4 trillion U.S. dollars are traded every day on foreign exchange markets.