Prices

December 10, 2019

Steel Imports Trending Up in December?

Written by Brett Linton

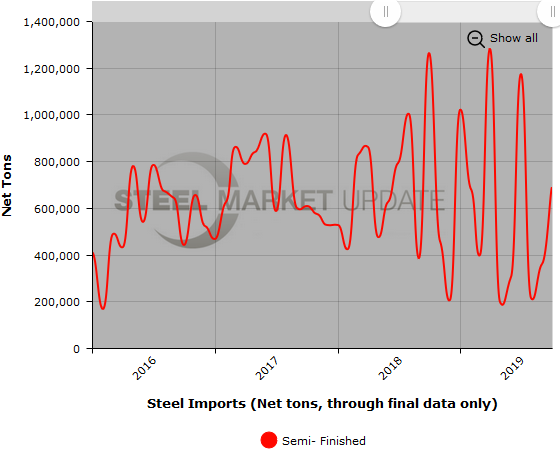

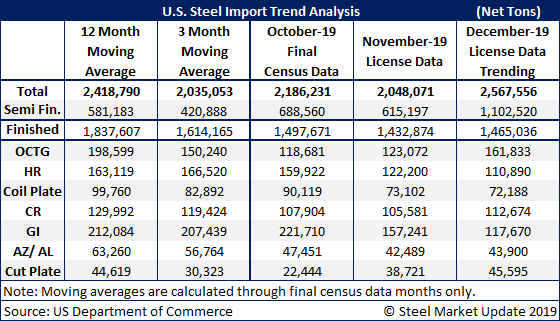

Total steel imports into the United States are trending toward 2.5 million tons in December, which would be up dramatically over November and higher than the 12-month average. However, imports of semifinished steels, some of which are subject to quota restrictions, are likely to come in well under the current trend of 1.1 million tons.

Steel Market Update takes the average daily rate of Commerce Department import licenses for the month to date and then extrapolates it for the entire month to get an early estimate of likely import volumes. With just one-third of the month of December in the books, and the holiday slowdown upcoming, these estimates are very preliminary. The final totals are likely to be well below the current trend.

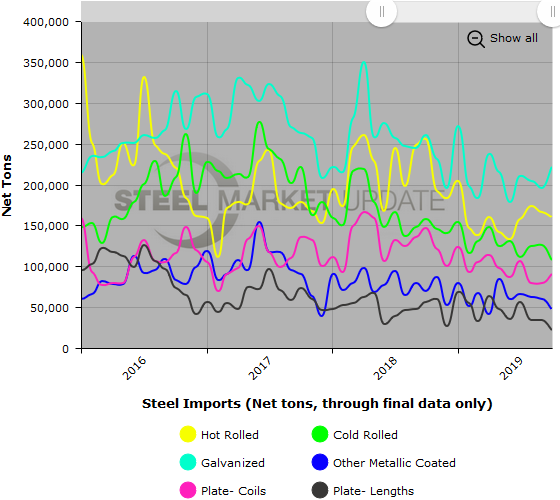

While the estimate for semifinished imports is expected to adjust downward in the company weeks, the total projection for finished steel imports is in line with the other months in the fourth quarter.

The market is watching anxiously to see if President Trump follows through with his threat to place a 25 percent Section 232 tariff on steel from Brazil, which is currently tariff-free but limited by a quota. Brazil is a major source of steel slabs required by some mills in the United States.

Below are three graphs showing the history of U.S. steel imports through final October figures. To use their interactive features, view the graphs on our website by clicking here. If you need assistance logging into or navigating the website, contact us at info@SteelMarketUpdate.com.