Prices

December 5, 2019

Hot Rolled Futures: Will HR Market Form a Longer-Term Technical Bottom?

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

The U.S. Midwest HR futures curve in Cal’20 has had a strong move higher from the beginning of November with an average increase close to $40/ST. The market originally pushed higher on a series of mill price increase announcements timed to coincide with new year restocking. The futures market prices continued to run up further on the back of flood news at USS Gary steel works. This was followed this past week by POTUS tweets regarding new tariffs on aluminum and steel aimed at Brazil and Argentina, which helped push Q1’20 prices over $600/ST due to worries of a supply shortage of slabs. On Tuesday, prices peaked near term as Cal’20 settled close to $602/ST. Following a $30 rise in the HR index on Wednesday, markets had guidance on the December futures, which were actively trading in the $555 to $565/ST range.

Today the market is trading the latter half of 2019 about $10/ST lower as numerous selling interests appeared at the $600ish/ST level. The curve, which was basically flat earlier this week on the back of the news, is now a bit backwardated in the latter half of 2019. The Q3’20 HR futures traded down to $592/ST.

The forward curve has shifted from a $30 contango in early November to slight backwardation today. While market players anticipate some Q1’20 and Q2’20 price strength due to restocking for 2020, the jury is still out for the balance of Cal’20 given the difficulty of forecasting in the current unstable global trade situation and the upcoming presidential elections. Participants are trying to determine whether the recent technical price bottom due to mill price increases can be maintained for the medium term. Mill lead times remain relatively uneven and the lagging index suggests prices traded are lower than those advertised. Expect choppy HR futures prices for the curve due to the difficulty of forecasting in this uncertain global trade environment.

Scrap

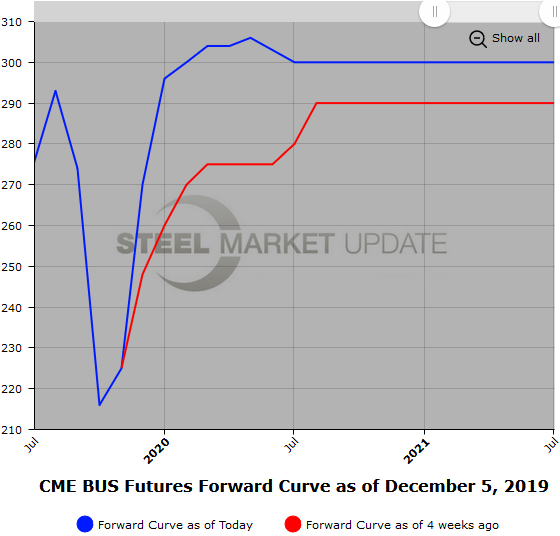

Generally, the market is anticipating that physical scrap prices will be up at least $30/GT. Lately the Dec’19 futures have been hovering between $265/$270/GT. The forward curve in BUS has shifted from early November for Jan’20 to Dec’20 BUS futures from +$45/GT to +10/GT this week as the front of the curve moved up faster than the latter half. The latter half of Cal’20 has risen $10/GT from $290/GT to $300/GT with the near dates up roughly $40/GT (from $250/GT to $290/GT). This week’s tariff tweets likely gave the BUS markets a bit better bid tone as lack of slab imports will likely lead to higher domestic sourcing and scrap prices. The bulk of trading of late has been in the nearer futures months.

Below is a graph showing the history of the CME Group hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact us at info@SteelMarketUpdate.com.

Below is another graph showing the history of the CME Group busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here.