Prices

November 14, 2019

Hot Rolled Futures: Hot Rolled Rolling Higher

Written by David Feldstein

The following article discussing the global ferrous derivatives markets was written by David Feldstein. As an independent steel market analyst, advisor and trader, we believe he provides insightful commentary and trading ideas to our readers. Note that Steel Market Update does not take any positions on HRC or scrap trading, and any recommendations or comments made by David Feldstein are his opinions and not those of SMU or the CRU Group. We recommend that anyone interested in trading steel futures enlist the help of a licensed broker or bank.

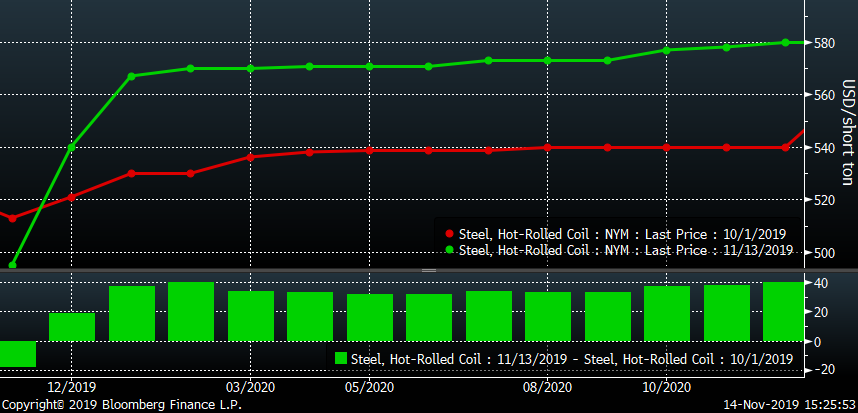

CME Midwest HRC futures have gained $30-$40/st across the curve since Oct. 1. Two domestic mill price increases, gains in raw material prices and ArcelorMittal’s announcement they are idling IHW #3 have helped the market continue to rally. Have fundamentals shifted for the better and has the bottom of this bear market been put in?

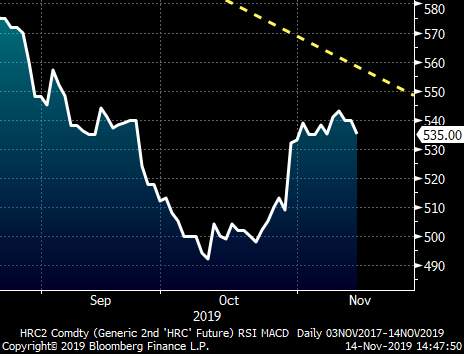

CME Rolling 2nd Month Midwest HRC Future

Busheling gained $20 in November to settle at $236/lt and expectations for a big move higher of $30-$50 in December have been priced in with December futures trading as high as $270 today, which would be up $34 MoM. The rolling 2nd month CME busheling future settled Wednesday night well above the downtrend that began in March. A positive development.

Rolling 2nd Month CME Busheling Future

Today, the SGX 2nd month iron ore future rallied $2.50 and then gained another $1.14 in the night session to close at $83/t, also closing above its multi-month downtrend.

SGX Rolling 2nd Month Iron Ore Future

The 10-year U.S. Treasury yield also broke above its year-long downtrend. There is a bullish pattern forming across these three markets. Are these canaries in a coal mine signaling the end of the deflationary pressures seen throughout 2019?

U.S. 10-Year Treasury Rate

The January 2020 Chinese HRC future is approaching its downtrend line.

January 2020 SHFE Chinese Hot Rolled Coil Future

So is our beloved CME rolling 2nd month Midwest HRC future.

CME Rolling 2nd Month Midwest HRC Future

The downtrend line sits around $555. Can December close above it? It would be a step in the right direction for transitioning out of the bear market and into a new bull market indeed.

CME Rolling 2nd Month Midwest HRC Future

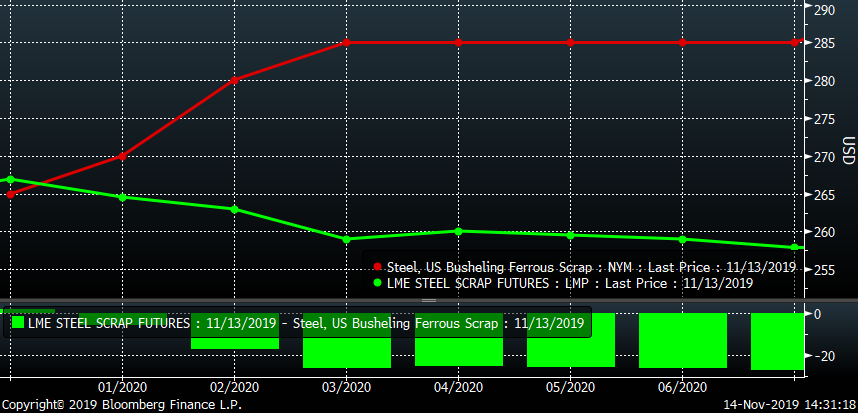

The CME busheling curve is upward sloping with expectations for further scrap increases in the first quarter with February, March and April trading this week as high as $280, $290 and $285, respectively. With December busheling trading as high as $270, that prices in a $54 increase since October’s low. With $80 in price increases and $54 in scrap increases, have the mills captured enough spread to satisfy their appetites or will further price increases follow in response to higher scrap?

CME Busheling & LME Turkish Scrap Futures Curve

December CME copper futures rallied just above the long-term down trend line peaking last week on news of a meeting between Trump and Xi.

December CME Copper Future

Then, the rally failed and has fallen day after day since.

December CME Copper

A similar pattern was seen in LME aluminum after its nascent rally failed.

LME 3 Month Aluminum

Will the rallies in ore, scrap and interest rates follow through or fail as well? Will CME Midwest HRC break higher or fail? Steel production ramped back up along with the price increases. Is there enough demand to satisfy production? Service center inventory looked to be run down to the bone in October. Will the service center collective step up and restock in the coming months? How about the OEMs? Will they look to restock or are their inventory levels bloated? Will the domestic mills continue to overproduce and continue to fight their turf war?

AISI Crude Steel Production

There are a lot more questions than answers right now as the story unfolds of whether this is the period in which the market transitions from an extended bear market to a nascent bull market OR if this is the calm before the perfect storm.