Prices

November 2, 2019

CRU: U.S. Longs Prices Near Floor as Buyers Return and Scrap Firms

Written by Ryan McKinley

By CRU Senior Analyst Ryan McKinley

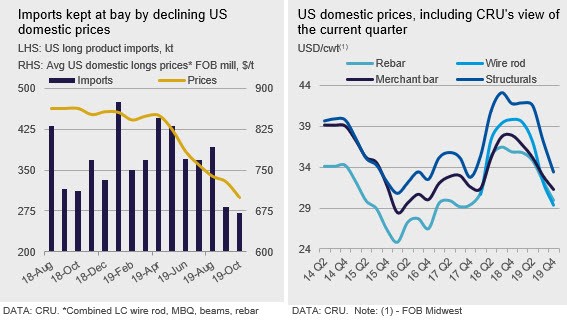

The rate of decline for U.S. domestic longs product prices is decelerating as steel buyers slowly return to the market and scrap market sentiment firms. Although not low, inventory levels have worked through enough for buyers to re-enter the market and conduct seasonal restocking. Still, domestic prices and demand remain subdued enough to push import levels lower (see chart).

For wire rod, buyers in some instances are returning to the market all at once, extending mill lead times. In some cases, lead times expanded from two to six weeks amid the sudden uptick in demand. Yet there is still hesitancy from buyers to replace too much of their inventories given the precipitous decline in wire rod prices during 2019. Should prices firm in early 2020, buyers expect to increase orders to secure more material ahead of possible price increases in the first two quarters of next year.

Total wire rod import levels increased slightly m/m in October, according to preliminary license data from the U.S. Census Bureau. The m/m increase to 62,000t, driven mostly by higher imports from Japan, Brazil and Morocco, is still lower than the year-to-date average of 64,000t. With little upside for domestic prices for the remainder of the year, it is unlikely import activity will increase meaningfully in the short term.

The trend of domestic prices preventing increases in import levels is much more pronounced in the rebar market. Domestic prices are generally outcompeting current import offers. In the Northeast, for example, market participants put offers at $29-30/cwt FOB loaded truck. The ongoing price imbalance may soon manifest in October with one of the lowest import levels this decade. Imports are set for a 55 percent m/m decline in October to 31,500t and, should this become the final import statistic, would put import levels at their lowest since November 2011.

As import levels slide lower, some seasonal restocking has taken place and helped ease pressure on domestic prices. However, buyers are cautious about stocking up on too much material for the remainder of the year in hope of starting off 2020 in a better inventory and pricing position than the prior year.

Outlook: Prices to Temporarily Find a Floor

While seasonal restocking and low imports levels for longs products have allowed the rate of price falls to slow, an upswing in the U.S. scrap prices may allow the longs market to find a bottom. Mills are returning from planned outages as scrap supply dries up seasonally. As a result, scrap prices are likely to rise by $10-40/ t over the next 60-day timeframe and provide support to long products prices.

For the first half of 2020, price direction will likely be dictated by macro-economic trends. Should construction activity and industrial production increase, as predicted by some market participants, longs prices may slowly recover from this year’s downturn.