Prices

September 19, 2019

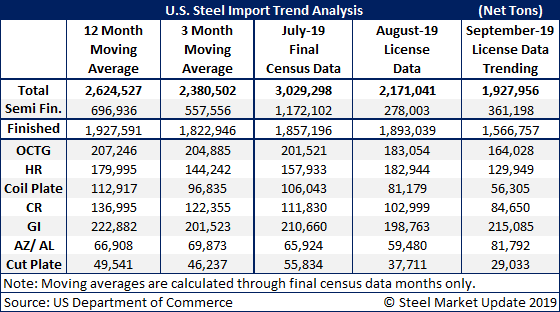

Import Licenses Trending Below Average in September

Written by Brett Linton

U.S. steel imports were trending considerably below average though mid-September at less than 2 million tons, based on Commerce Department license data.

Imports of semi-finished steel, tracking at just over 360,000 tons, are a bit more than half the normal level, as the mills are still working off the nearly 1.2 million tons of slabs they acquired in July. Slab imports from certain countries, notably Brazil, are subject to quarterly quota limits, so domestic mills were quick to secure raw material in the first month of the third quarter. Semi-finished imports can be expected to jump again in October as the fourth quarter begins.

Finished steel imports are also on track to finish the month below average at less than 1.6 million tons. Imports of coated steels, both galvanized and Galvalume, are the only products to see an increase so far in September, based on SMU’s projection of import licenses through the end of the month.