Prices

August 22, 2019

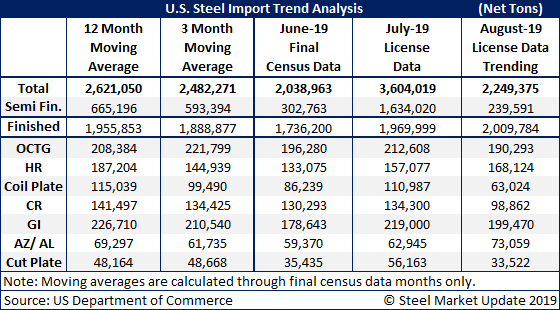

Import Licenses Trending Below Average in August

Written by Brett Linton

With about 10 days left in the month, steel imports are trending below average at just over 2.2 million tons, based on Commerce Department license data.

Imports of semifinished steel, at around 240,000 tons, are tracking at less than half of normal levels following a surge in July. Domestic mills scrambled last month to secure imported slabs, as July was the first month of the third quarter. Semifinished imports from certain countries, notably Brazil, are subject to quarterly quota limits.

Finished steel imports are looking to top 2 million tons this month, slightly higher than the three-month and 12-month averages. Hot rolled and Galvalume are the only finished steel products showing an increase in licenses from July to August.