Prices

August 20, 2019

CRU: Turkish Scrap Prices Fall

Written by Tim Triplett

By CRU Analyst Iris Speelmanns

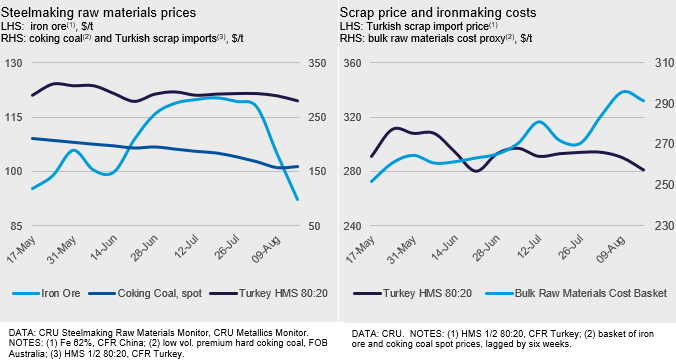

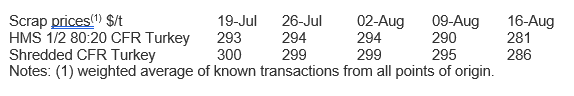

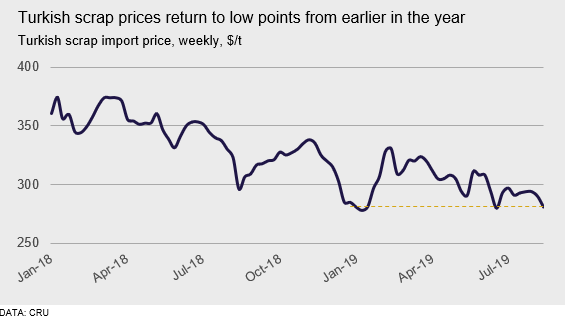

Last week, Turkish scrap prices slid further, dropping by $9 /t w/w to $281 /t CFR for HMS 80:20, based on one 40 kt deal from Europe. This new price level is the lowest level since the brief drop in mid-June and before that the distinct, though brief, weakness last winter. Weaker global steel prices amid iron ore price falls is a key contributor to the recent decline.

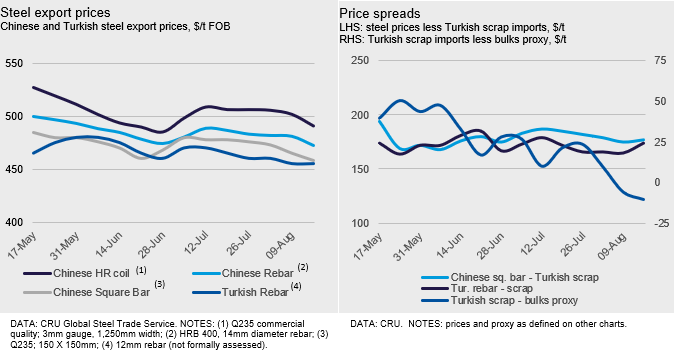

Turkish mills remain under pressure due to weak domestic steel demand amid a constrained trade environment. Chinese mills have cut export prices amid weak domestic conditions and subdued steel demand throughout Asia. Consequently, with higher freight rates, Turkish supply into Asia is becoming a tough sell. Although there is still an EU safeguard quota remaining, Turkish imports into Europe need to be managed carefully for scrap-intensive products such as rebar after the rapid initial drawdown of quota volume. Facing increased electricity costs, Turkish mills are not keen to accept sharp price increases and need lower scrap prices in order to contain costs and sustain already thin margins.

Turkish Scrap Prices on Hold to End of Summer

Although U.S. scrap prices further rose up by $20 /lt m/m, we see limited opportunity for U.S. exporters to pass higher prices on to Turkish scrap buyers. Conversely, the reawakening of European markets after the summer lull will play a key role for Turkey. For Europe, this may be the last point to rescue a so far lackluster year for steel markets there. If this does occur, there will be a pickup in scrap demand. However, there is already a sign of potential weakness for September, with some Italian mills planning summer outages that may well extend into the early weeks of the month. With weak conditions at home and in export markets, weakness in European steel and scrap markets may provide an opportunity for Turkish mills to pull scrap prices lower again in September.