Prices

August 18, 2019

CRU: $290 a New Upper Level for Turkish Scrap Prices?

Written by Tim Triplett

By CRU Analyst Alexander Ordosch

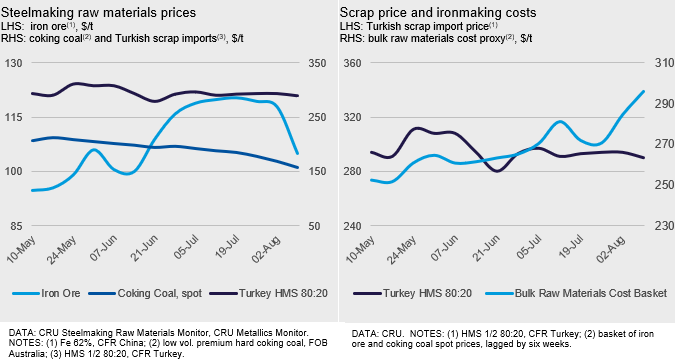

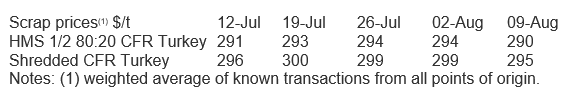

Last week, Turkish scrap prices declined slightly by $4 /t w/w to $290 /t CFR for HMS 80:20, based on one 40 kt deal from the U.S. The Turkish market remains quiet because of the Eid al-Adha (Festival of the Sacrifice) holidays this past week. We consider this new price level of around $285-290 /t to be the baseline for the coming weeks.

Political turbulence hit the industry last week. First, the Chinese currency depreciated below 7 RMB/USD. This has made Chinese exports more competitive, though mills are yet to take advantage of this. Second, the U.S. administration announced additional Section 301 tariffs (see our analysis here), further increasing downside risks for the global economy and the steel industry.

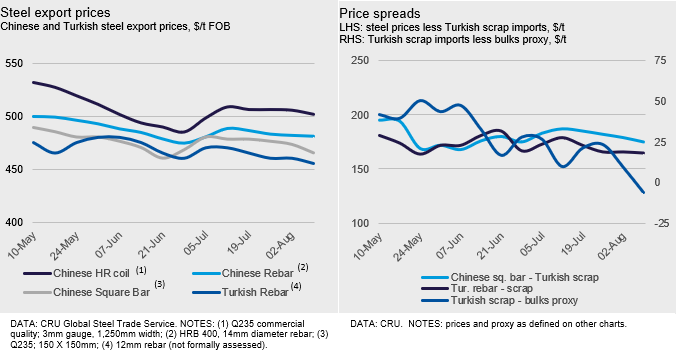

Iron ore prices fell sharply last week (-$13 /t w/w) despite strong steel output in China. With the view that steelmakers’ costs will now fall, steel end-users are already asking for lower steel prices. We have heard that Chinese exporters slashed rebar offers aggressively by $25 /t last week, leading to lossmaking margins. Chinese billet export prices also fell, by $8 /t w/w. Lower Chinese steel export prices have pushed Turkish mills out of the Asian market. Despite this, Turkish rebar export prices fell by just $5 /t w/w to $455 /t FOB, while wire rod and hot-rolled coil prices kept stable w/w. Turkish mills currently can’t afford much lower prices given the recent scrap prices, therefore they will try to drop them to become more competitive again.

Lower Turkish Scrap Prices in the Near-Term

Turkish scrap prices are expected to fall as mills attempt to maintain reasonable margins. Although U.S. scrap prices went up, we see limited opportunity for U.S. exporters to pass higher prices on to Turkish scrap buyers. Redirecting volumes to the Midwest or Southern markets is not really an option, because prices there are still discounted to international prices despite domestic price gains. However, Turkish scrap price falls will be limited because European domestic scrap prices have not fallen. Furthermore, European scrap demand should pick up in September as summer holiday outages at mills conclude.

Finished steel export sales are unlikely to improve for Turkish producers, particularly if Chinese steel exports continue to push into Asia and elsewhere. Given that EU safeguard quotas are largely full for Turkish rebar and, to a lesser extent, wire rod, there are limited options for volume outside Asia where they cannot compete. Consequently, we do not see an improvement for Turkish mills any time soon.