Prices

July 16, 2019

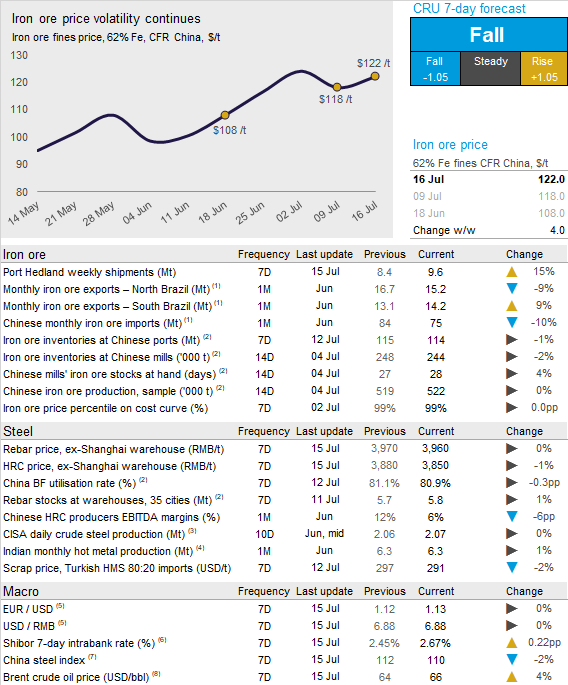

CRU: Iron Ore Bounces Back on Steady Chinese Demand

Written by Tim Triplett

By CRU Senior Analyst Erik Hedborg

Iron ore prices jumped back in the past week as Chinese iron ore demand remained steady while weak seaborne supply from Australia has kept port inventories at a low level. On Tuesday, July 16, CRU has assessed the 62% Fe fines price at $122.00 /t, a $4.00 /t increase w/w.

In the past week, iron ore prices recovered as investigations of trading behavior at the Dalian Commodity Exchange only resulted in a short-term drop in iron ore prices. The underlying fundamentals show continued strong demand while mill and port inventories have remained low. In addition, the Australian maintenance period has resulted in weaker shipments, although there has been a slight recovery w/w. BHP’s shipments have remained flat while the uptick is caused by stronger supply from FMG.

The Chinese iron ore imports in June came in at a low level with only 75 Mt, a sharp m/m drop and the lowest level since February 2016. Our sources suggest that there are three reasons for this low figure – lower vessel speeds that have delayed the arrivals of Brazilian shipments, higher deliveries to other Asian countries and longer customs clearance times at Chinese ports.

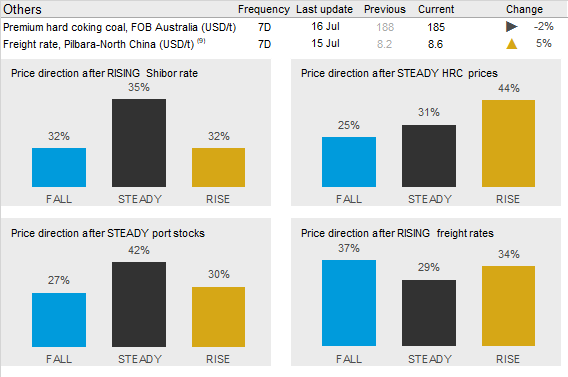

We continue to expect prices to fall in the coming week. Although inventories are low, there are indications of further arrivals of vessels to China. In addition, there is an increasing risk of steelmakers reducing output due to high raw materials costs.