Prices

June 27, 2019

Will Ferrous Scrap Prices Find the Bottom in July?

Written by Tim Triplett

Declining ferrous scrap prices are expected to finally bottom in July, but only after backsliding by at least $10 per ton for one more month, predict Steel Market Update sources.

Flat rolled steelmakers announced a $40 per ton increase in finished steel prices this week, which brings increased scrutiny to the price of scrap. Scrap prices have been on the decline since the beginning of the year, adding to the downward pressure on finished steel prices.

“The recent increases in steel prices notwithstanding, the present lack of scrap demand and excessive supply will push July scrap prices down,” said one dealer in the Northeast. “That being said, July is looking more and more like a bottom as inbound flow should slow and scrap sellers should begin to hold back tons in anticipation of higher numbers in future months. Certainly, much attention will be paid to whether or not steel buyers come off the sidelines in July or continue to wait.”

CRU North America Analyst Ryan McKinley also believes scrap prices are likely to fall in July by $10-30/GT depending on the region and grade. “There is simply too much supply relative to demand at the moment, but this should be the bottom of the market. In theory, this will continue to pinch inbound flows into dealers’ yards and dry up supply. As such, it is likely this is the last price decrease for a while.”

Scrap demand should increase a bit as integrated mills follow through on plans to take their basic oxygen furnaces (BOFs) offline. Minimills, with their electric arc furnaces (EAFs), will likely ramp up production to try to fill the gap. EAFs consume much more scrap than BOFs. “Somewhat related, mills will want to use higher scrap prices to justify higher steel prices moving forward,” McKinley added.

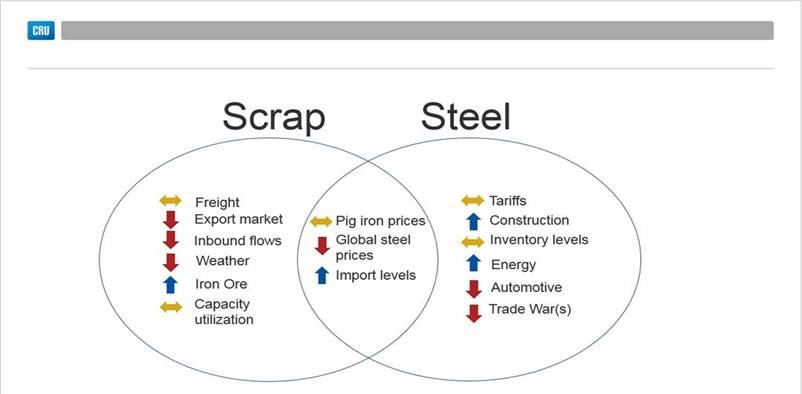

CRU: Price pressures at a glance as they stand for scrap and steel.

Agreed another source: “I don’t think the recent HRC price increase announcement is going to prevent the market from sliding at least a little. But it may be a sign that the price drop will be less severe than it’s been in the past few months, and that we are at a bottom for scrap prices.”

Export markets have stayed more stable—particularly dock buying prices—than domestic pricing over the last few months, he added. “Yard inflows have been really weak, and numerous dealers have told us they will not sell scrap in July at much lower prices than today. So, look for July domestic grades to trade lower by $10, give or take, from June sales, with slightly stronger markets closer to the coast.”

Consultant John Harris, CEO of Aaristic Services, Inc., said the market can expect scrap prices for all grades to fall by a further $10-30 per ton in the next two or three months for several reasons: outages in both BOF and EAF operations; insufficient volumes of export scrap leaving the East Coast of NAFTA for Turkey; mill utilization rates likely to fall below 80 percent in light of short HRC delivery times; weak economic factors in NAFTA and the EU; and China’s steel and scrap export position, which is holding Turkey’s export sales at bay.

Iron ore prices are driven by Chinese demand, as nearly all the mills in China use BOFs, Harris explained. Scrap markets are driven by Turkish demand, as Turkish steel mills rely on scrap imports of about 25 million metric tons per year. “China has been and will continue to be a scrap surplus environment. The scrap generated from China’s steelmaking and processing equals their total scrap requirements for both BOFs and EAFs. This doesn’t even consider the amount of obsolete scrap generated by their population of 1.4 billion on a yearly basis,” he added.

Scrap exports, mainly to Turkey, have bottomed, reported another SMU source. That market has increased $5-10/Mt on an offer basis. The rising iron ore cost is going to drive up alternatives like DRI/HBI and pig iron in the near future. Some Latin American integrated producers are already concerned about iron ore supplies. Pig iron suppliers to the U.S, are fighting further cuts in their prices, citing the rising cost of ore, he said.