Market Data

June 21, 2019

Currency Update for Steel Trading Nations

Written by Peter Wright

The U.S. dollar has strengthened against 13 of the 16 steel trading nation currencies in the last month.

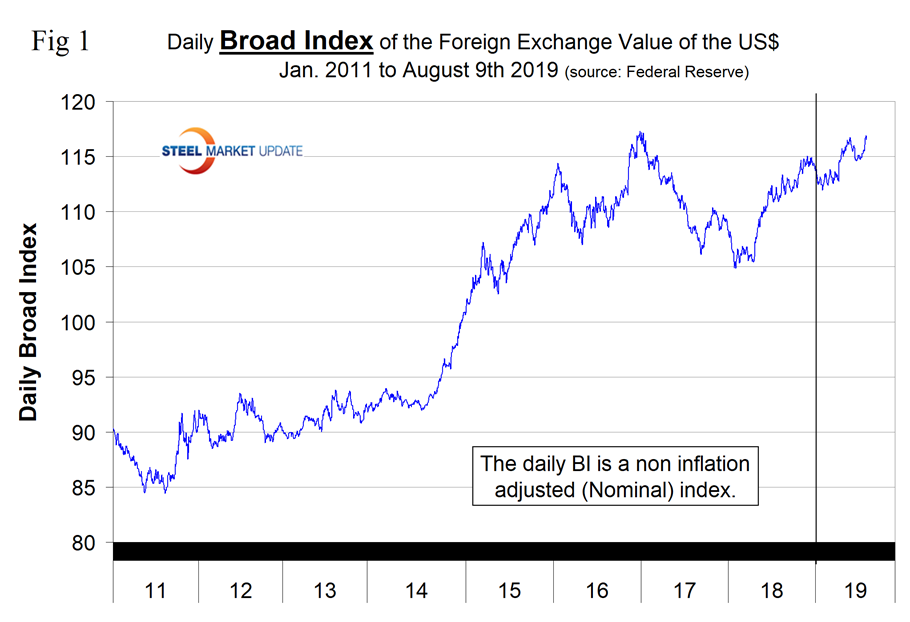

In this report we examine the change in currency values of the 16 preeminent global steel and iron ore trading nations. The currencies of these 16 don’t necessarily follow the Broad Index value of the U.S, dollar. In fact, at any given time, some are always moving in the opposite direction. The latest value of the Broad Index as published by the Federal Reserve was Aug. 9. In three months prior to that date, the dollar had strengthened by 0.2 percent and by 1.4 percent in the previous 30 days.

![]()

Figure 1 plots the daily Broad Index (BI) value of the U.S. dollar since 2011. The dollar has been on an erratic upward trend this year. The dollar index has appreciated by 2.0 percent since Jan. 1. The BI is still below its recent peak of Dec. 28, 2016.

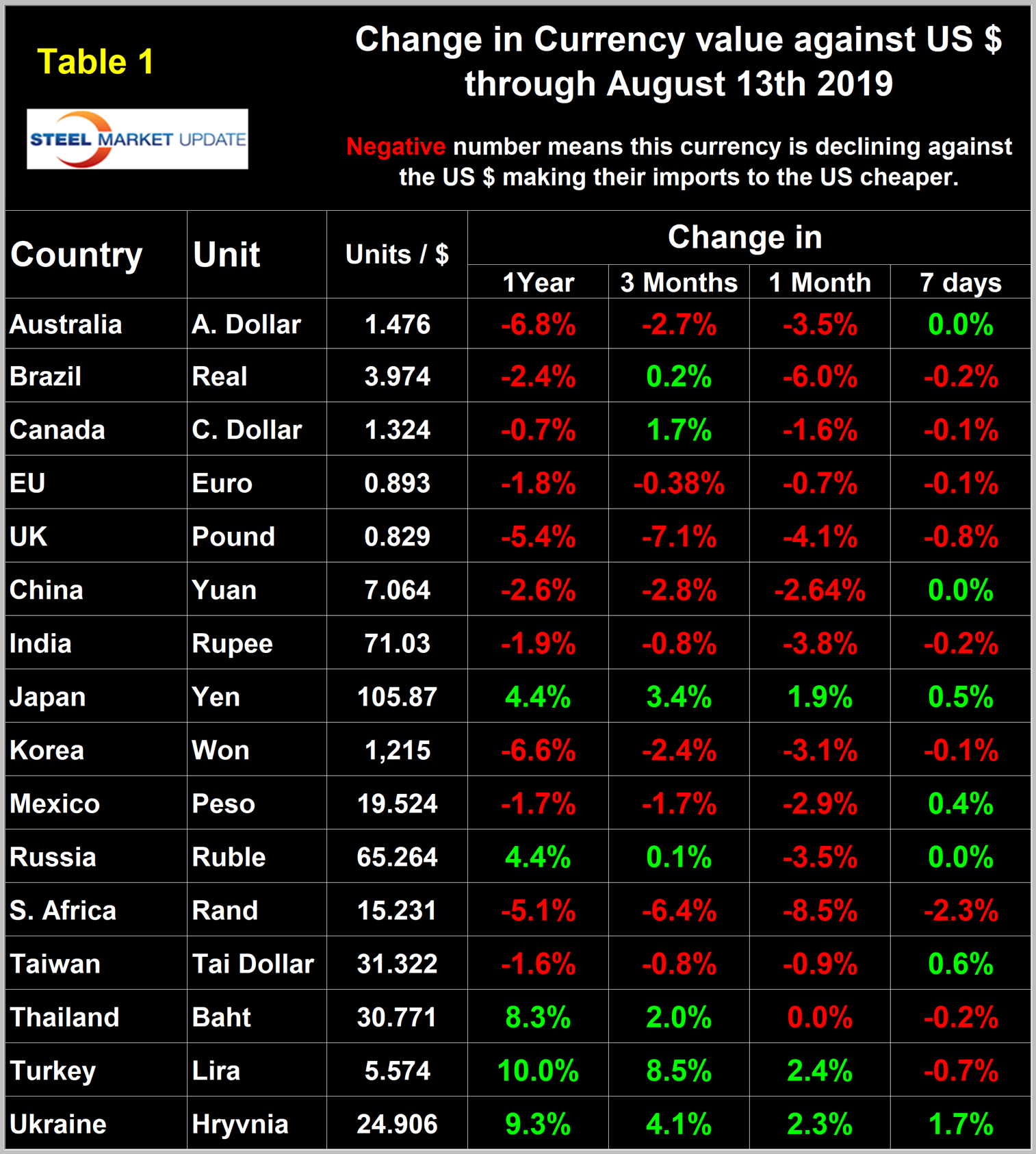

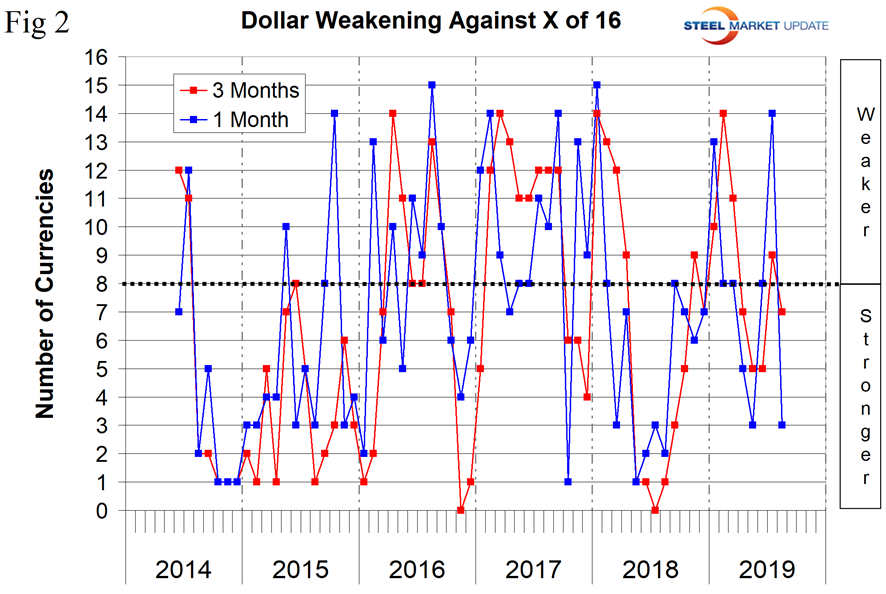

At Steel Market Update, we track the currencies of 16 steel trading nations. Table 1 shows the number of currency units that it takes to buy one U.S. dollar and the percentage change in the last year, three months, one month and seven days. The overall picture for the steel trading nations is that in the last year the U.S. dollar has strengthened against 11 of the 16 and weakened against five. In the last three months, the dollar has strengthened against nine and weakened against seven. In the last month, the dollar has strengthened against 13 of the 16 and weakened against the other three. Table 1 is color coded to indicate weakening of the dollar in green and strengthening in red. We regard strengthening of the U.S. dollar as negative and weakening as positive because of the effect on net imports. Figure 2 shows the extreme gyrations that have occurred at the three-month and one-month levels since the beginning of last year.

Big movers in the last three months have been the UK down by 7.1 percent, South Africa down by 6.4 percent and Turkey up by 8.5 percent. We will examine these three in more detail. In addition, the IMF reported on its consultations with Russia in the last month. (See the end of this report for details of data sources.)

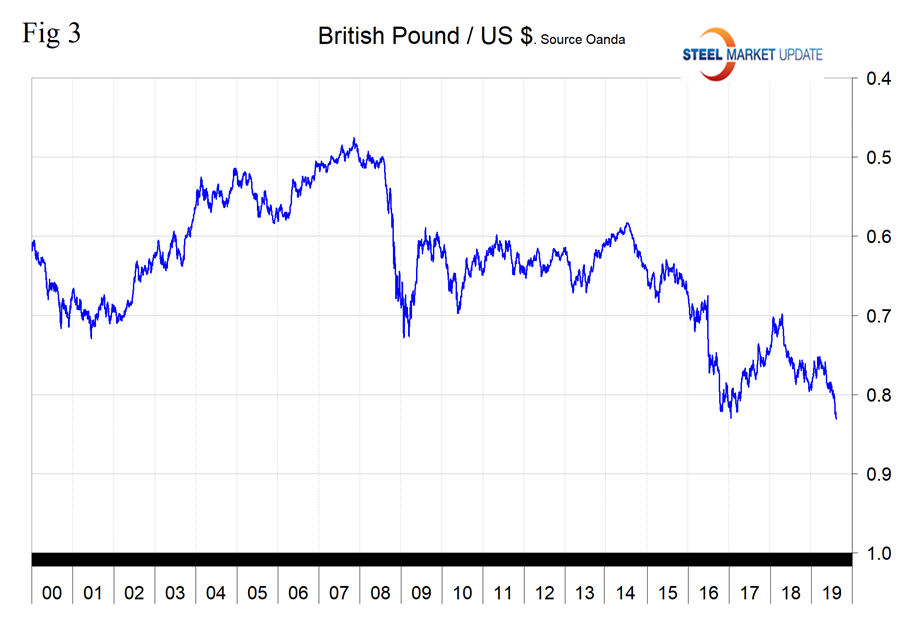

UK Pound

The UK pound has declined by 4.1 percent in the last month, by 7.1 percent in the last three months and is now worth 1.2068 U.S. dollars. On Aug. 13, currency specialist Andrew Hecht wrote: “Markets are focused on the impact of a hard Brexit on the British pound as the Oct. 31 deadline approaches. The pound was below the $1.21 level against the U.S. dollar on Aug. 13 and below $1.08 against the euro at the end of last week. The British currency is trading at the lows because the new Prime Minister Boris Johnson has told the world that he is prepared to exit the European Union with or without an agreement with the leadership in Brussels and Frankfurt. While the pound is on the lows versus both the dollar and euro, the euro is not far off its lowest level versus the dollar since May 2017.”

A hard Brexit on Oct. 31 would not only weigh heavily on the UK economy, but Europe would also experience a period of uncertainty and economic weakness at a time they can hardly afford more bad news.

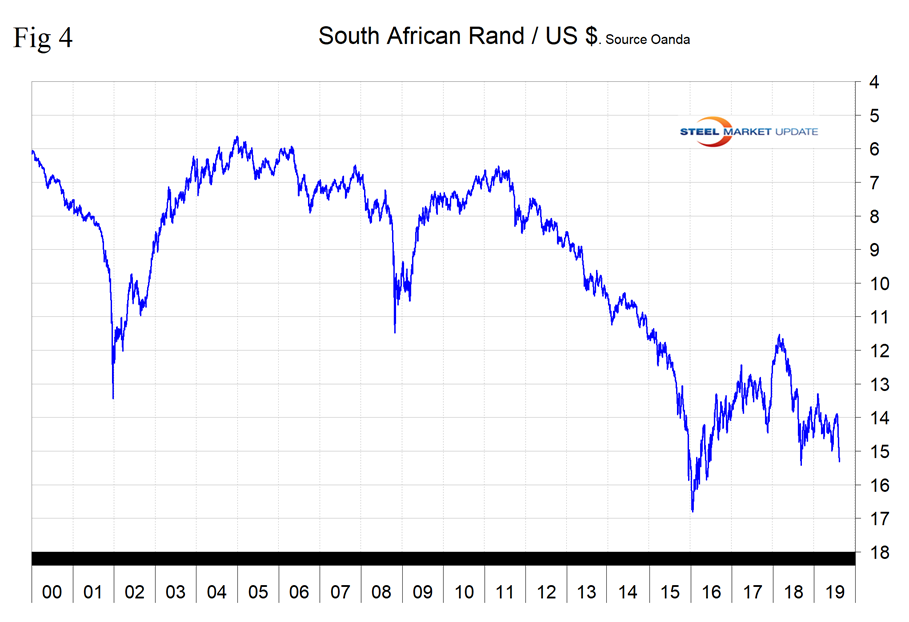

South African Rand

South Africa’s rand has declined by 6.4 percent in three months and by 8.5 percent in one month. The U.S. dollar is now worth 15.23 rand.

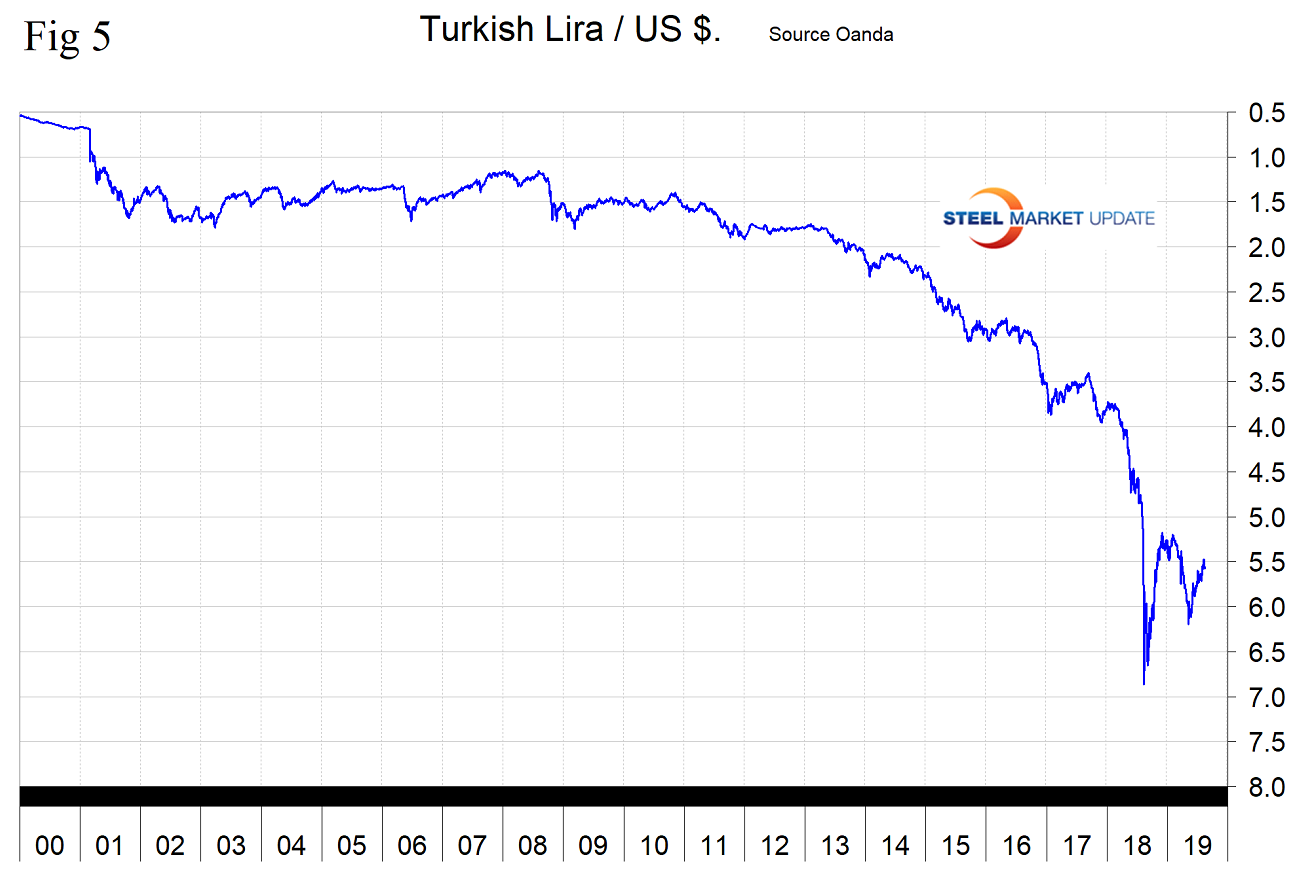

Turkish Lira

Turkey’s lira has appreciated by 8.5 percent in the last three months and by 2.4 percent in the last month. There has been a sustained strengthening since May 8. The U.S. dollar is now worth 5.57 lira.

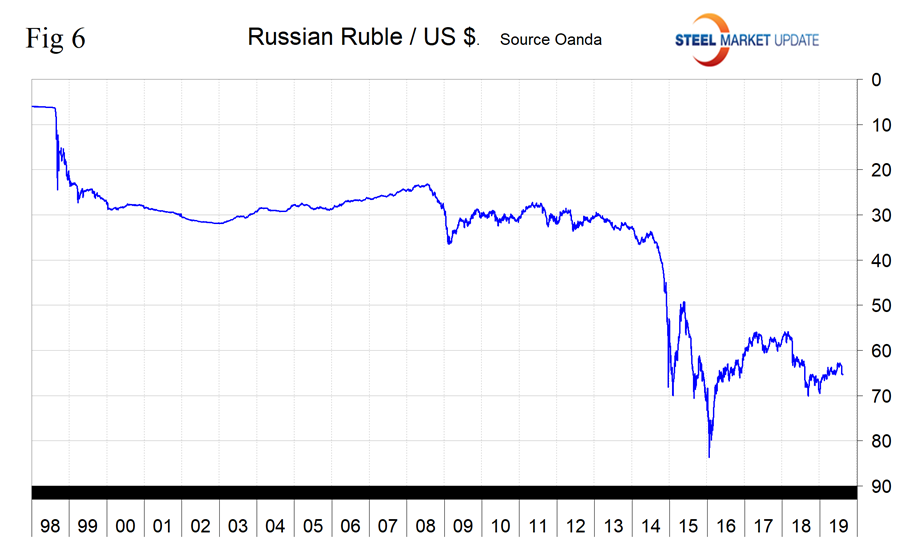

Russian Ruble

Russia’s ruble has declined by 3.5 percent to the U.S. dollar in the last month. One dollar is now worth 65.26 rubles. In spite of the recent decline, the ruble has appreciated steadily in 2019.

Following is the IMF summary of Article 4 Consultation, Aug. 2, 2019: “In recent years, the authorities have put in place a sound macroeconomic policy framework that has reduced uncertainty and helped weather external shocks. The current macroeconomic policy mix combines moderately tight monetary policy with a broadly neutral fiscal stance. The medium-term growth outlook remains modest due to structural constraints and sanctions. The authorities have implemented some politically difficult measures in the past year (pension reform and a VAT increase) and have announced plans aimed at raising productivity growth, including higher public spending on infrastructure, health and education. To significantly increase Russia’s long-term growth prospects and reduce stagnation risks, deeper efforts are needed to address the large footprint of the state, overbearing regulation, and governance and institutional weaknesses.”

In this monthly analysis, we show the trends we think have the most immediate significance, but all 16 steel trading nation graphs are available on request.

Explanation of data sources: The Broad Index is published by the Federal Reserve on both a daily and monthly basis. It is a weighted average of the foreign exchange values of the U.S. dollar against the currencies of a large group of major U.S. trading partners. The index weights, which change over time, are derived from U.S. export shares and from U.S. and foreign import shares. The data are noon buying rates in New York for cable transfers payable in the listed currencies. At SMU, we use the historical exchange rates published in the Oanda Forex trading platform to track the currency value of the U.S. dollar against that of 16 steel trading nations. Oanda operates within the guidelines of six major regulatory authorities around the world and provides access to over 70 currency pairs. Approximately $4 trillion U.S. dollars are traded every day on foreign exchange markets.