Prices

June 18, 2019

Import Licenses Trending Up in June

Written by Brett Linton

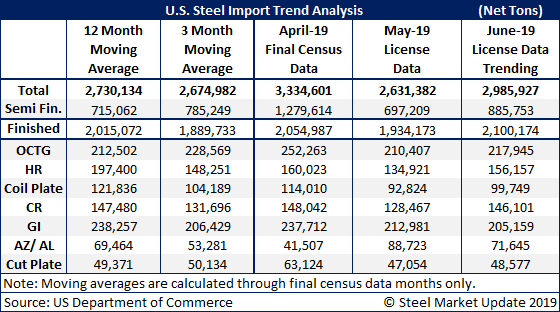

Halfway through the month, imports of foreign steel into the United States are trending considerably higher in June, based on license data from the Commerce Department. If import licenses continue at the current rate, June steel imports could approach 3 million tons—up from an estimated 2.6 million tons in May and the 12-month average of around 2.7 million tons.

Much of the increase from May is attributable to imports of semi-finished steel, mostly slabs purchased by domestic mills, forecast at a higher-than-average 886,000 tons at the current license rate. Finished steel imports are trending toward 2.1 million tons—also higher than the three-month and 12-month averages.

It seems unlikely that the final totals for June imports will show as big an increase as in these early estimates. With domestic steel prices already low and getting lower, service centers and OEMs have little incentive to assume the risk of buying foreign steel, which currently offers little price advantage.