Prices

May 21, 2019

Foreign Steel Imports Trend Lower in May

Written by Brett Linton

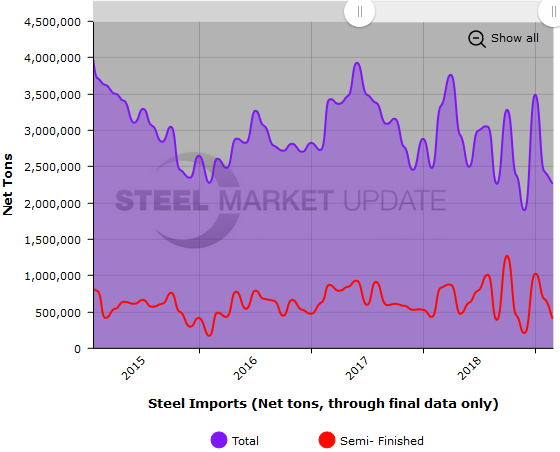

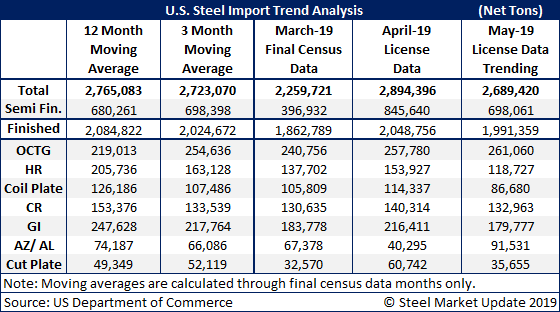

U.S. steel imports are trending a bit lower in May after a significant jump in April, according to Steel Market Update’s analysis of Commerce Department license data. With about 10 days left in the month, it appears May imports will approach 2.7 million tons, down from approximately 2.9 million tons in April. May imports are on track to fall in line with the quarterly and yearly averages.

Imports of semi-finished products by domestic mills, which saw a big jump in April, are returning to more typical levels of around 700,000 tons this month.

SMU’s projection of import license data does not take into consideration the Trump administration’s decision last week to remove the Section 232 tariffs on steel from Canada and Mexico, or the halving of the tariffs on steel from Turkey, which will affect import volumes to an unknown degree in the coming weeks and months.

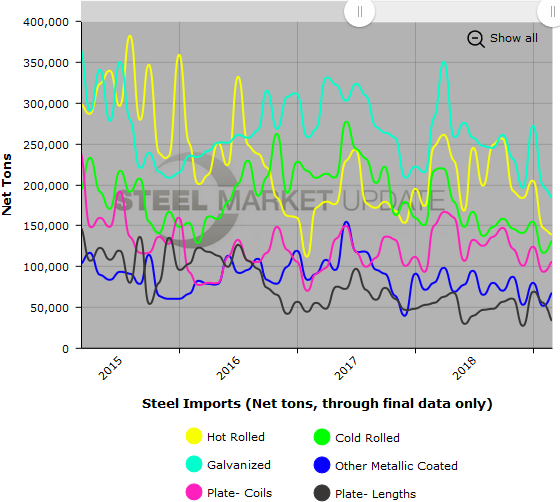

Below are two graphs covering steel imports through final March 2019 figures. You will need to view the graphs on our website to use their interactive features; you can do so by clicking here. If you need assistance logging into or navigating the website, contact us at info@SteelMarketUpdate.com.