Prices

May 16, 2019

Foreign Steel Imports Trend Up in April, May

Written by Brett Linton

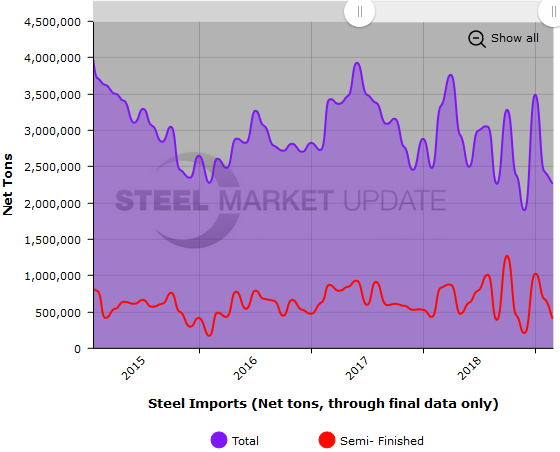

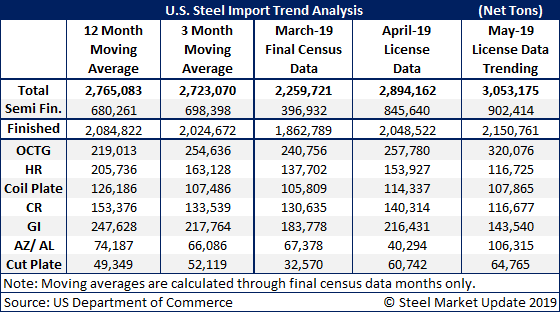

Final Census data shows that steel imports into the U.S. were well below average in March at 2.26 million tons, but have trended up sharply in April and May. Based on license data, April imports jumped by more than 28 percent to nearly 2.9 million tons, largely due to a 450,000-ton increase in semi-finished imports, mostly slabs purchased by domestic mills. Finished steel imports in April appear to be in line with the three-month and 12-month averages.

Halfway through the month, May license data is trending up by 5.5 percent over April and is at the highest level seen since January. Average daily licenses extrapolated through the end of the month suggest that steel imports could top 3 million tons. The final data may see some moderation in the semi-finished import estimate, however, as the slab rollers continue to work off all the semi-finished imported in April.

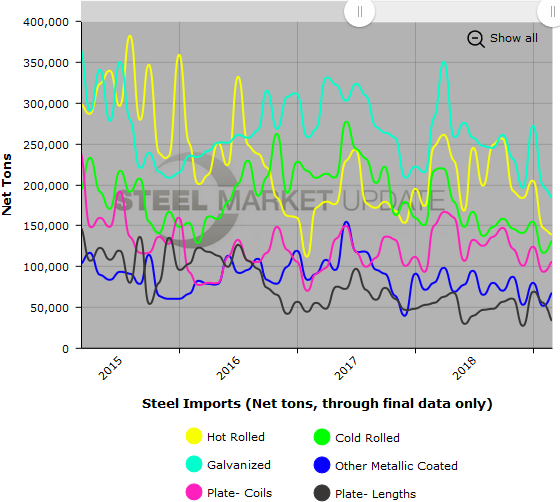

Finished goods that saw double-digit import increases in April include cut plate, up 46.5 percent; galvanized, up 15.1 percent; and hot rolled, up 10.5 percent.

Below are two graphs covering steel imports through final March 2019 figures. You will need to view the graphs on our website to use their interactive features; you can do so by clicking here. If you need assistance logging into or navigating the website, contact us at info@SteelMarketUpdate.com.