Prices

May 9, 2019

Hot Rolled Futures: Paper Markets Under Pressure

Written by Gaurav Chhibbar

SMU contributor Gaurav Chhibbar is a partner at Metal Edge Partners, a firm engaged in Risk Management and Strategic Advisory. In this role, he and his firm design and execute risk management strategies for clients along with providing process and analytical support. In Gaurav’s previous role, he was a trader at Cargill spending time in Metal and Freight markets in Singapore before moving to the U.S. You can learn more about Metal Edge a www.metaledgepartners.com. Gaurav can be reached at gaurav@metaledgepartners.com for queries/comments/questions.

The paper markets in the past couple of weeks have been under enormous pressure. As the benchmark index values have come off, several of those who were long in the May/June timeframe have looked at rolling their positions further out or cutting losses.

Just this morning the Q3 to Q4 spread was heavily traded. When trading a calendar spread, the buyer of a spread goes long the nearby and sells the further out period. For example – a buyer of Q3 to Q4 would buy Q3 and sell Q4. The value at which this was trading this morning was -$5, implying a buyer of Q3 would sell Q4 at $5 higher. Conversely, a seller of this spread would sell Q3 and buy Q4 at a price $5 higher.

Spread-based strategies are helpful in markets where a clear trend may not be visible. They come with their own risks, though, as a spread is no less likely to lose money. Speculators, however, look at spreads as ways of taking directional bets on one period outperforming/underperforming the other.

So that brings us to the question, what has led to this market moving from a strong backwardation to a small but not insignificant carry? The answer is the pressure on the spot prices despite the lack of import hedge pressure. Typically, U.S. sellers for forward months would hedge their purchases of imports. In the current market conditions where the import options are not very many, the hedge pressure has eased off to some extent.

As spot prices in the U.S. have taken a beating as a result of increased domestic supply, weaker raw materials and muted demand, international markets have been playing on different fundamentals. Iron ore has remained supported nearby as Vale’s operational challenges are still not resolved. Combined with the supportive steel price outlook in China, it has resulted into ore demand remaining steady. Chinese ore port stocks have declined to multi-month lows. This divergence of price action between the U.S. and the international markets may be another factor contributing to lack of aggression from sellers in the Q4 period.

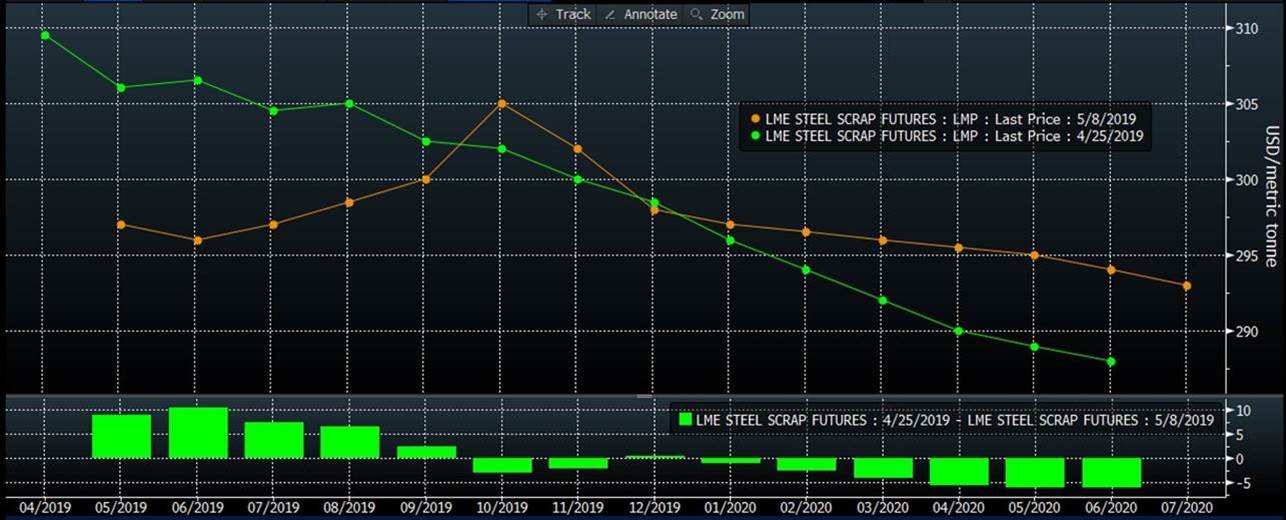

The support to ore has not transitioned to scrap. As the Turkish socio-political situation goes through another round of challenges, their appetite for scrap has taken a beating. The Turkish Scrap LME curve has transitioned from a fully backwardated cure to a flatter curve with a carry in front months (thanks to the spot weakness).

Disclaimer: The information in this write-up does not constitute “investment service,” “investment advice,” or “financial product advice” as defined by laws and/or regulations in any jurisdiction. Neither does it constitute nor should be considered as any form of financial opinion or recommendation. The views expressed in the above article by Metal Edge Partners are subject to change based on market and other conditions. The information given above must be independently verified and Metal Edge Partners does not assume responsibility for the accuracy of the information