Market Segment

April 30, 2019

AK Steel: Counting on UHSS Advantage as Steel Capacity Increases

Written by Sandy Williams

AK Steel is not too worried about new steel capacity stealing market share. New carbon steel capacity coming on line is still several years away, said President and COO Kirk Reich. Much of it is not “new” but rather older restarted facilities that AK Steel competed with in the past, and some of that capacity will produce bar, rod, long products, tubular and plate products that do not impact AK’s markets. There are no new or restarted capacity additions in the areas of stainless or high-end electrical steels, said Reich during the company’s quarterly conference call.

Facilities that are planning to produce flat-rolled carbon products are primarily aimed at the construction and spot markets. Those planning to expand into automotive OEMs will need to compete with AK Steel’s high-end steels.

“The product mix is moving in our direction, as [OEMs] still need exposed product and they also need ultra-high-strength product to be able to get their light weight,” said CEO Roger Newport. “And that’s going to either come in ULTRALUME, which is the hot-stamped side of that piece, or NEXMET, which is the cold-stamped side. So, whichever way they are going to get their light weight, we’re in the right space for that.”

Newport said the company, overall, is pleased with the USMCA changes such as new rules of origin, although there is still work to be done on the trade agreement with Canada and Mexico. AK Steel is in favor of replacing the Section 232 tariffs on Canada and Mexico with quotas to ensure that imports of steel, especially electrical steel, stay at appropriate levels. AK Steel is seeing electrical steel coming in through Mexico and being changed slightly in order to bring it into the U.S. in what Newport calls “legal circumvention.”

“So, while I think the government administration has tried to address things, people keep finding loopholes to bring steel into our country. And we’re hoping some of those get closed up,” he added.

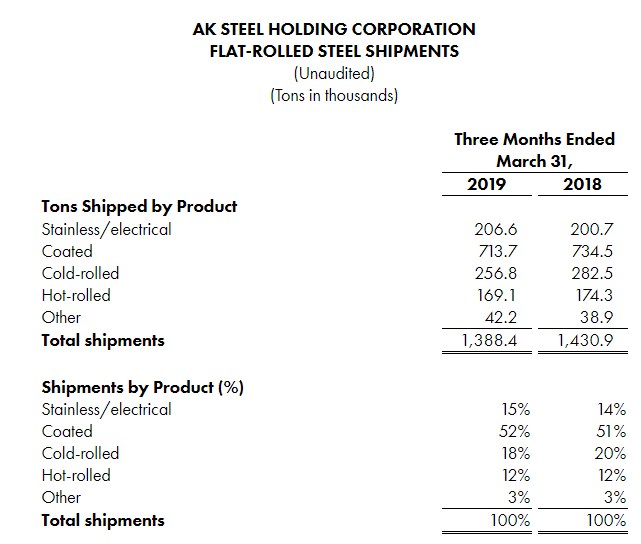

AK Steel’s first-quarter performance was a strong one with sales of $1.7 billion, a 2 percent increase from a year ago. Due to a $77.4 million charge for the Ashland Works closure, a net income loss of $4.5 million was recorded. Adjusted net income, excluding the charge, was $72.9 million, up from net income of $8.7 million in Q1 2018.

“Our solid first-quarter operating performance benefitted from our annual customer contract renewals. A higher proportion of contractual sales helps to reduce the volatility in our business and this was reflected in our first-quarter results,” said Newport. “We also continued to strengthen our position with automotive manufacturers by commercializing new steel solutions, including through our downstream tubing and stamping operations.”

AK Steel announced the closing of Ashland Works in January 2019. The blast furnace and steelmaking operations have been idled since December 2015 with only the hot-dip galvanizing coating line remaining in operation.

“This decision stems from our overarching strategy to enhance our competitive cost position while simultaneously reducing our exposure to certain commoditized products that do not generate sufficient financial returns through the cycle,” said Newport. Once production for the coating line is transferred to AK Steel’s other facilities, the company expects to realize a $40 million annual run rate savings.

A capital expansion at Precision Partners will allow production of a body-side outer subassembly consisting of a single-piece, hot-stamped door ring for two major SUV programs, representing $50 million of annual stamping and assembly revenue. AK Steel has been successful in producing >980 megapascal ultra-high strength steels for the automotive market. Demand for UHSS products is expected to grow significantly at a 29 percent compound annual growth rate from 2019 through 2025.

AK Steel is also growing its market share in the foundry coke market and has identified a new way to access additional mining reserves at AK Coal’s existing mine. Instead of opening a new mine entrance, the coal will be mined from another seam lower in the mine. About 15 percent of the coal from AK Coal is used internally by AK Steel.

Outlook

AK Steel updated its annual guidance due to the decline in steel prices in the the hot-rolled carbon spot market. Spot prices moved from approximately $720 per ton in January to about $690 per ton currently. The company’s annual guidance had indicated that for every $10 change in the carbon hot-rolled coil spot market price, annual earnings would be impacted by $5 million to $7 million. Accordingly, the company now expects net income to be in the range of $76 million to $96 million.