Prices

April 11, 2019

HRC Futures: If You Liked 'Em at $685, You Gotta Love ‘Em at $635

Written by David Feldstein

The following article discussing the global ferrous derivatives markets was written by David Feldstein. As an independent steel market analyst, advisor and trader, we believe he provides insightful commentary and trading ideas to our readers. Note that Steel Market Update does not take any positions on HRC or scrap trading, and any recommendations made by David Feldstein are his opinions and not those of SMU. We recommend that anyone interested in trading steel futures enlist the help of a licensed broker or bank.

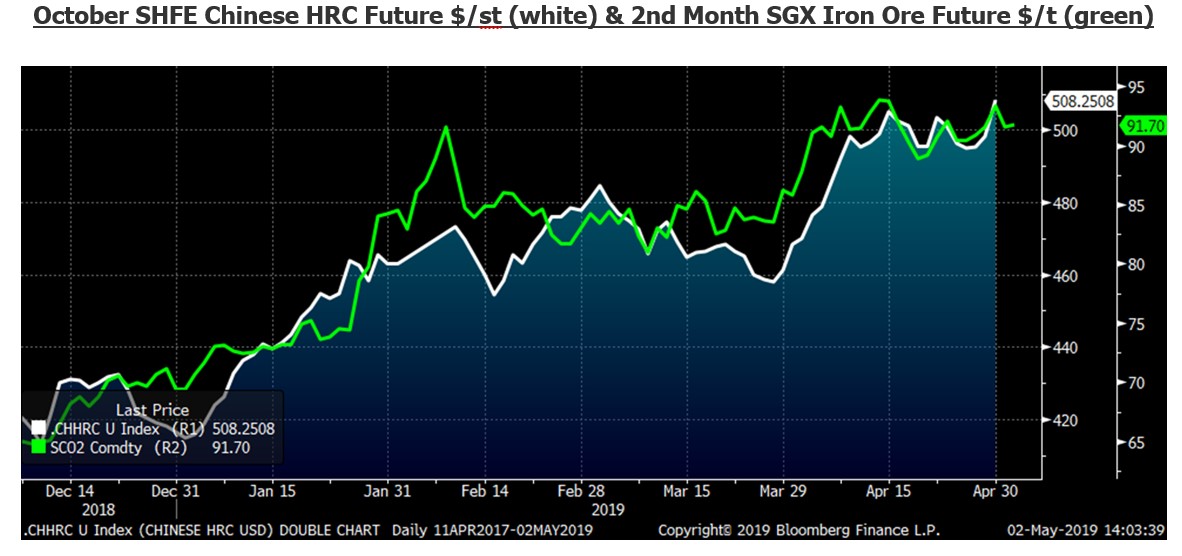

Paradoxically, iron ore and Chinese HRC prices have sustained a solid rally since Q2 began. The active SHFE October Chinese HRC future settled Tuesday night at $508/st and the June SGX iron ore future settled today at $91.70.

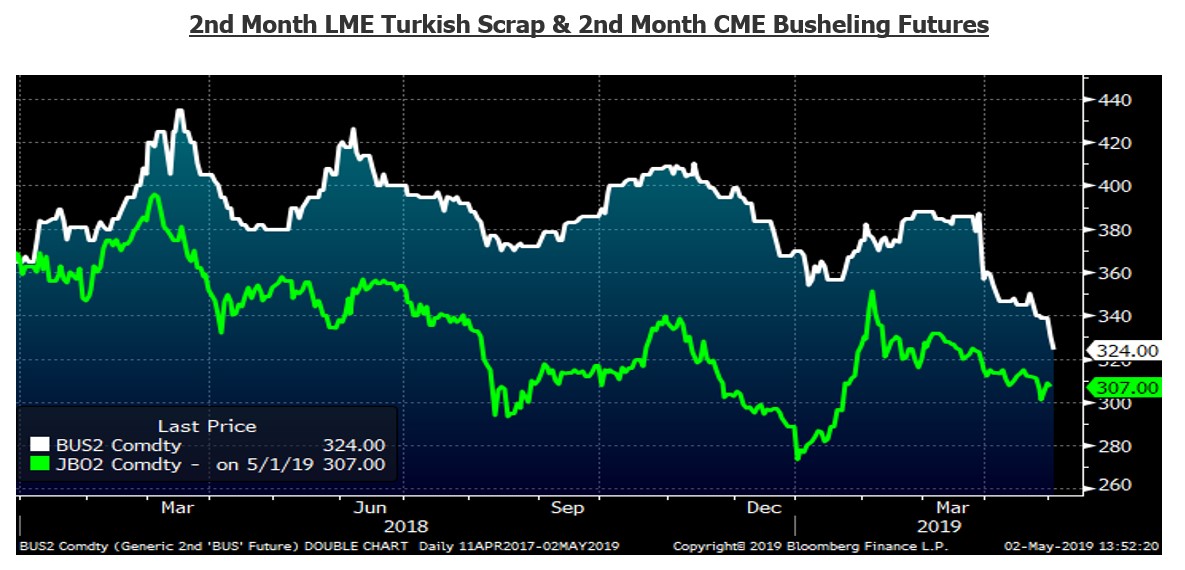

Yet the sell-off in scrap continued lower despite the rally in ore with June CME busheling at $324 and June LME Turkish scrap at $307.

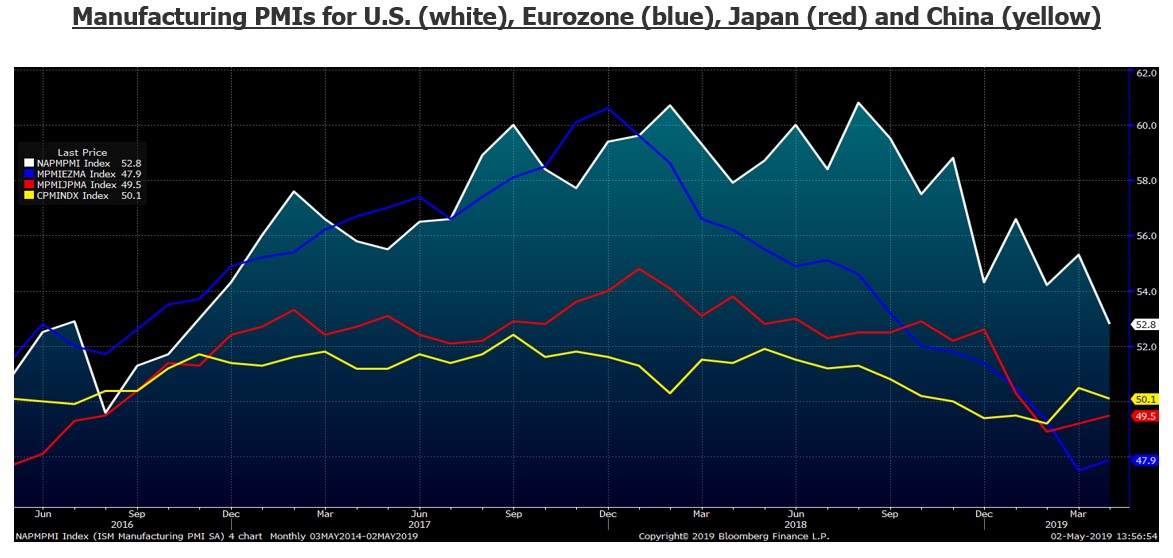

Yesterday, we learned April global manufacturing PMIs continued to disappoint and trend lower. The ISM Manufacturing PMI fell to 52.8, the lowest level since the fall of 2016 and missed expectations of 55. Both of China’s manufacturing PMIs fell with the official PMI just above 50 at 50.1. The manufacturing PMIs of Japan and the Eurozone remained in contraction territory.

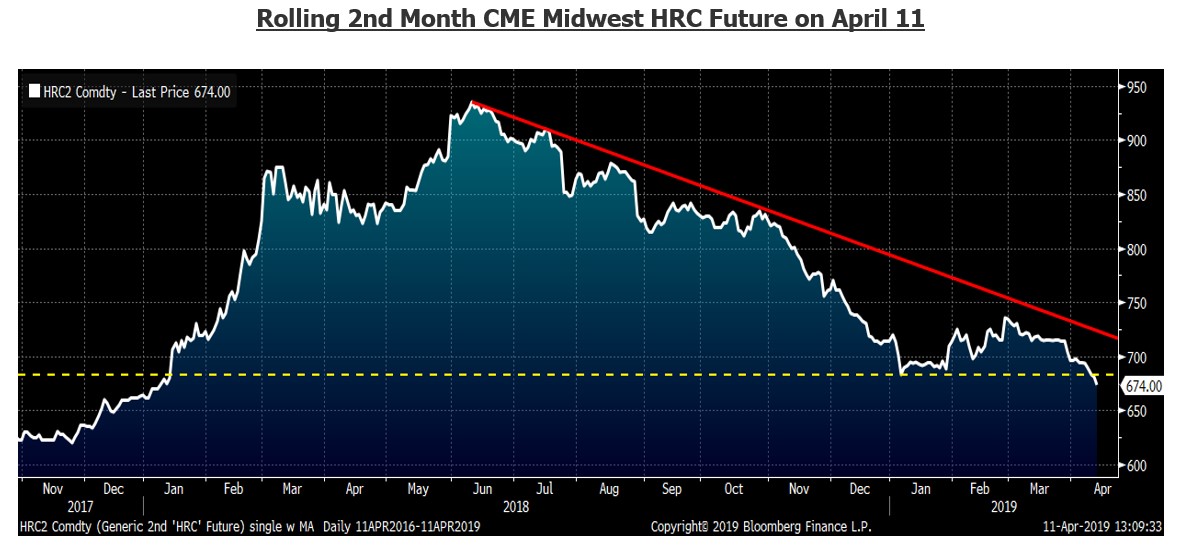

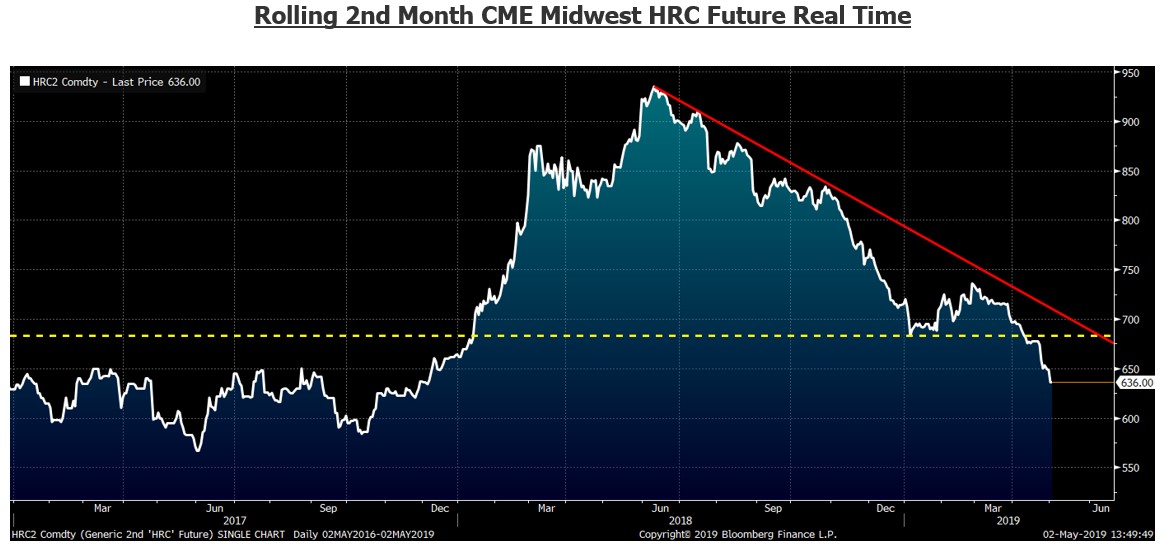

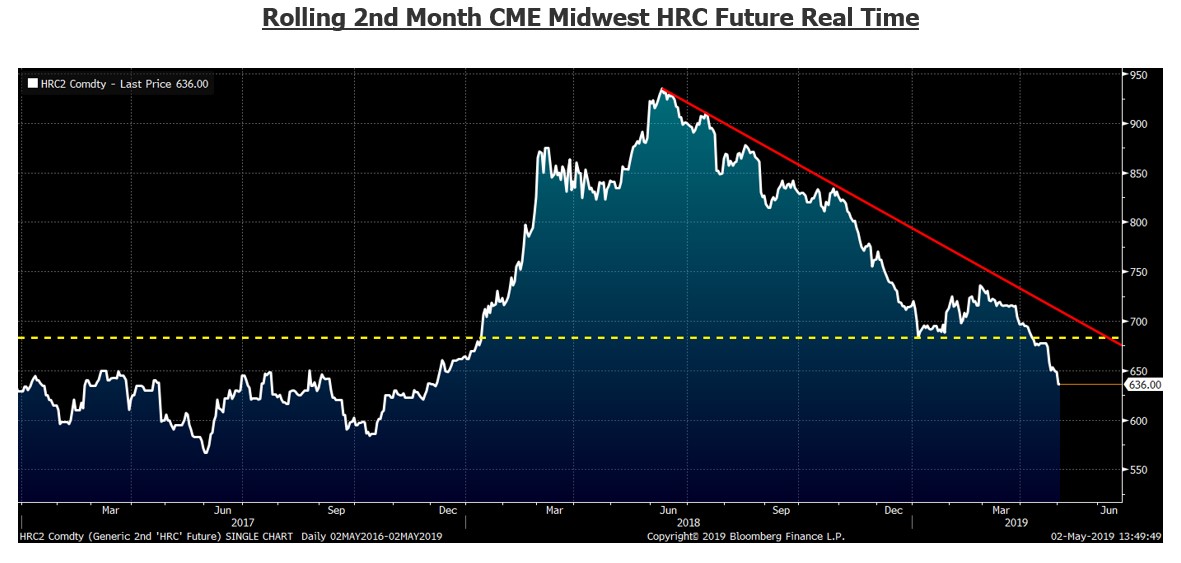

In my last article on April 11, I pointed out the downtrending 2nd month CME HRC future breaking below the previous low and that the support level of $680 was signaling an imminent and abrupt move lower.

CME HRC futures languished for about a week before falling sharply lower over the last two weeks.

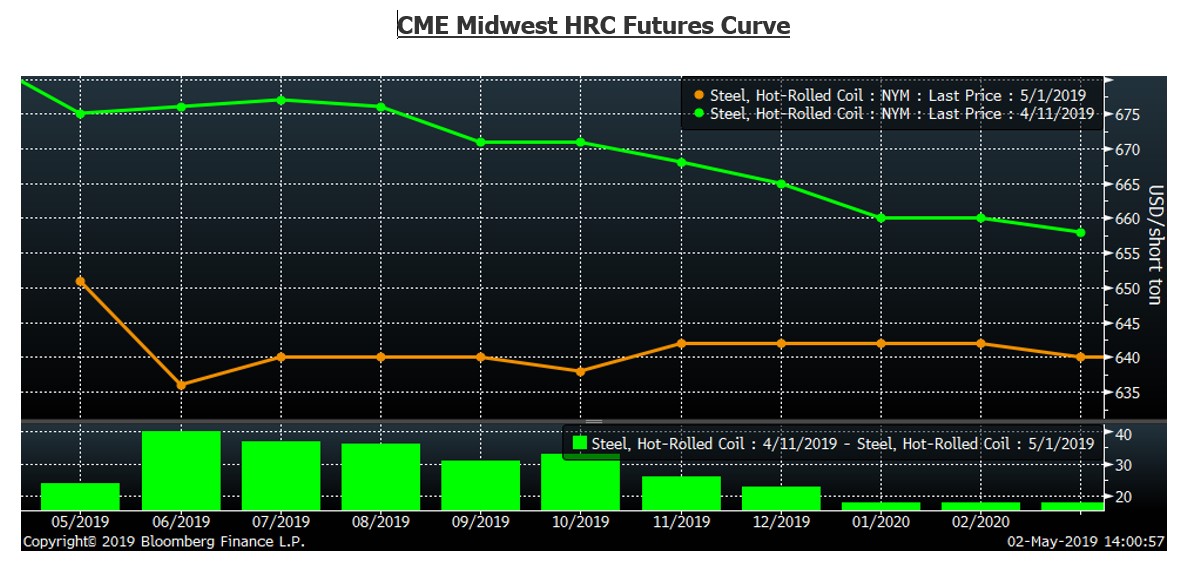

The chart below shows the CME HRC futures curve settlements as of April 11 and May 1. Since April 11, the June future has fallen $40 while Q3 has fallen $30-35/st. The curve has flattened and moved into a slight contango.

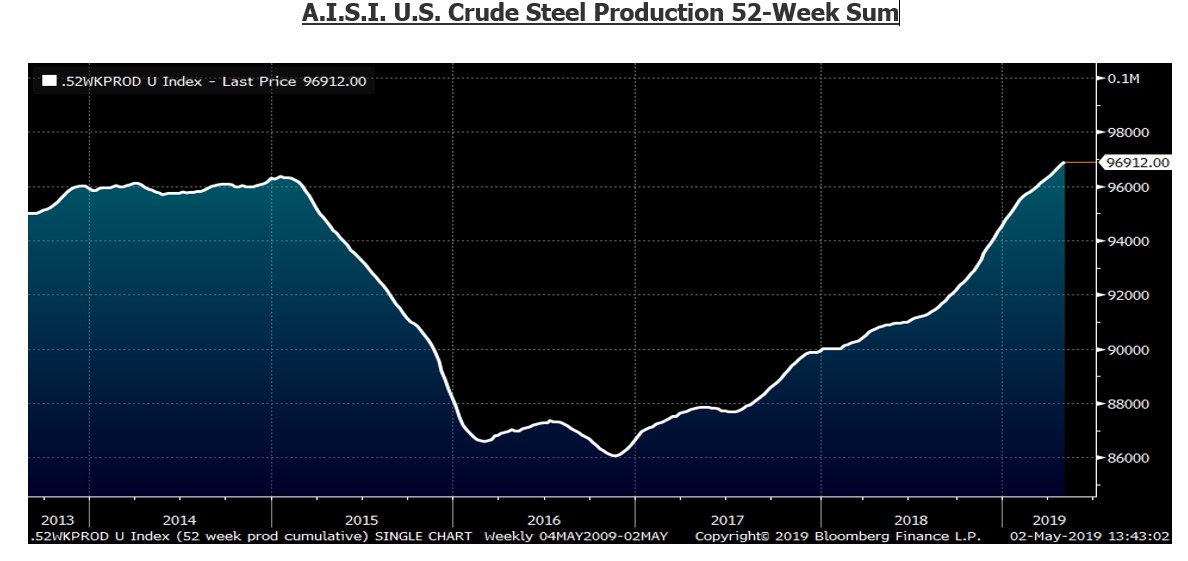

Unattractive import differentials and a sustained rally in iron ore have had little influence on Midwest HRC prices. Instead, it looks like domestic supply and demand have taken control. Clearly demand is slowing as evidenced by the ISM Manufacturing PMI as well as data from the U.S. construction, automotive and energy sectors. This chart shows a 52-week moving sum of the weekly AISI U.S. Crude Steel Production statistic indicating excess supply.

Increased supply + decreased demand leads to a drop in prices…every time.

This begs the question of why the mills are “over-producing” and why haven’t any of them cut their production? The answer may lie in part with weakening demand, but it is most likely due to the addition of JSW and Granite City. The domestic mills look to be in a turf war.

The bear market in Midwest HRC rolls on (see the April 11 SMU issue for more about bear markets). Those individuals with short futures positions established during the first quarter or before are sitting on very nice profits. The low hanging fruit has been picked. If futures start to rally for some reason, it’s gonna be hard for those individuals to watch their profits start to evaporate. This could lead to an “emotional” short squeeze like the one we saw in late January and February.

I’ve been thinking about catalysts that could spark a move higher. The most likely one would be a planned or unplanned cut to domestic production. However, as the year unfolds, increased galvanized capacity is set to come online at multiple mills. Another catalyst for a move higher could be the further compressed import differentials finally exerting their influence. And don’t forget about the cure for low prices being low prices.

The two trillion dollar infrastructure plan announced yesterday would be yet another catalyst as it could spur a sharp restocking, especially in the service center community, but those projects are too far in the future to have much of an effect in the short-term.

However, the downside catalyst of a reversal of tariffs imposed on Canada and Mexico remains and was in fact magnified earlier this week in a Wall Street Journal op-ed written by the Republican Senator and Chair of the Senate Finance Committee declaring:

“If these tariffs aren’t lifted, USMCA is dead. There is no appetite in Congress to debate USMCA with these tariffs in place.”

Additionally, it has been more than three months since the introduction of the Bicameral Congressional Trade Authority Act of 2019, which if passed gives congress the authority to reverse tariffs on steel and aluminum across the board. However, today a staff member from Representative Mike Gallagher’s (R-WI) office told me the bill is “stalled due to the larger debate” regarding the USMCA. That once the USMCA is agreed upon, then “Congress can move forward with a bill reclaiming congressional Section 232 tariff authority” through this bi-partisan bill.

Perhaps prices move back into the $560-$650 range seen throughout 2017. Perhaps the $680 floor that was breached three weeks ago becomes the new ceiling in a range with a low that remains to be seen.

There are many questions to be answered as we head into the summer months. Don’t spend too much time trying to explain why, take action instead! Keep watching that red down trendline as we remain in a bear market until it is breached. Buckle your chinstrap!!