Prices

April 7, 2019

Sheet Imports Decline While Slabs Remain Elevated

Written by Brett Linton

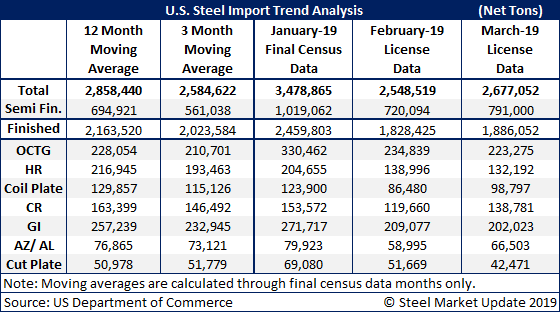

The U.S. Department of Commerce released license data for foreign steel coming into the United States. Based on the data received and reported through April 2, March imports are expected to come in slightly higher than February at 2.6-2.7 million net tons. When removing the semi-finished (mostly slabs) licenses from the data, the finished steel imports drop to just under 1.9 million net tons.

Hot rolled imports were well below both the 12-month and 3-month moving averages both in February and March at just over 130,000 net tons.

Other products followed by SMU that were below both the 12-month and 3-month averages were coiled plate, cold rolled, galvanized, other metallic (AZ/AL) and cut plate. Only oil country tubular goods (OCTG) was slightly above the 3-month moving average, but was slightly below the 12-month moving average.

As mentioned above, foreign slab receipts continue to be high with the past three months averaging 843,000 net tons per month. Most of the semi-finished steels are going to mills such as California Steel, JSW Baytown, NLMK USA and AMNS in Calvert, Ala. One of our readers made an interesting comment that we want to leave you to think about:

“I continue to be surprised that most of the industry coverage around imports discusses lower sheet receipts. However, slabs continue at higher rates and are nullifying the impact of lower sheet receipts. And perhaps to make it slightly worse, there’s a lag effect, where those extra slabs will get rolled in the months ahead, acting somewhat as delayed inventory reporting by buyers. Assuming we continue to see slab imports arriving at recent levels, then the only way this doesn’t impact supply is if there’s a pullback in melt output (assuming all else is equal). Given current margin spreads for the mills, I think they’d all be loath to cut back production,” said one service center executive.

SMU will continue to monitor imports and will review slab data in more detail in future issues.