Prices

March 7, 2019

Final December Steel Imports Fall 20 Percent to 8-Year Low

Written by Brett Linton

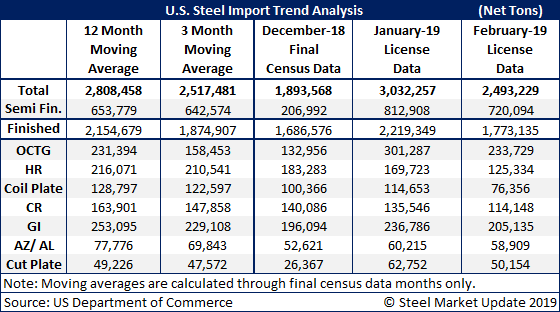

Foreign steel imports dropped to an eight-year low in December, coming in under 2 million net tons, according to final data released Wednesday by the U.S. Department of Commerce. Removing the 200,000 tons of semi-finished steels (mostly slabs used by domestic steel mills), finished steel imports were just under 1.7 million net tons.

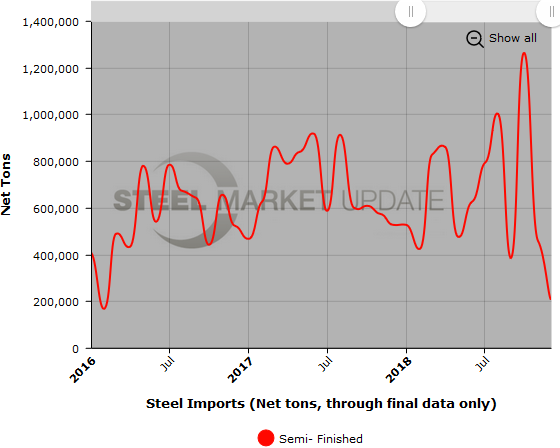

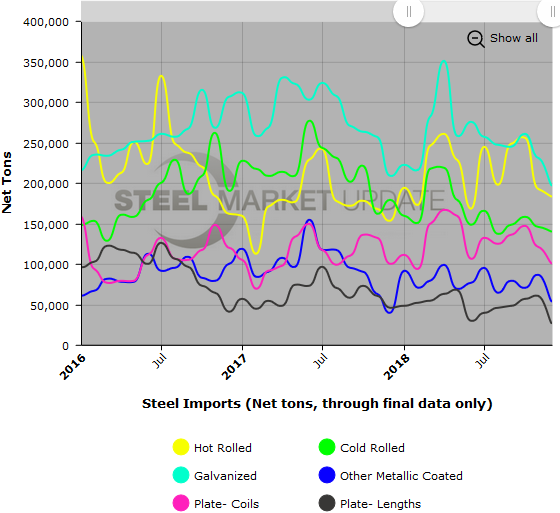

As shown in the table below, December saw low import numbers on semi-finished (due to quotas being filled, which is why the January and February numbers are so large), hot rolled, galvanized and cut-to-length plate.

Moving over and looking at the trends for January and February – January is coming in around 3 million net tons on the strength of 800,000+ tons of semi-finished steels (mostly slabs). We saw lower license requests on hot rolled and Galvalume.

The February trend is for imports to once again be less than 2 million net tons of finished steels. The license data (which can be off +/- 200,000 tons) is suggesting total tonnage of 2.5 million net tons and 1.773 million net tons of finished steels once the slabs/billets are removed from the calculation.

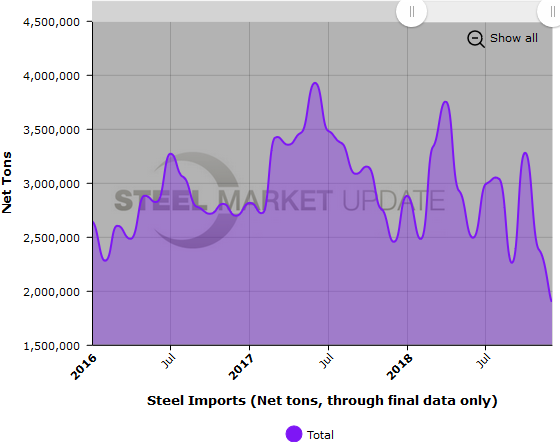

Below are three graphs showing the history of U.S. steel imports; total imports, semi-finished, and flat rolled products. You will need to view the graphs on our website to use their interactive features; you can do so by clicking here. If you need assistance logging in to or navigating the website, please contact us at info@SteelMarketUpdate.com.