Prices

February 28, 2019

HRC Futures: Lacking Clear Direction, Moving into a Range?

Written by David Feldstein

The following article on the hot rolled coil (HRC) futures market was written by David Feldstein. As the Flack Global Metals Chief Market Risk Officer, Dave is an active participant in the hot rolled futures market, and we believe he provides insightful commentary and trading ideas to our readers. Besides writing futures articles for Steel Market Update, Dave produces articles that our readers may find interesting under the heading “The Feldstein” on the Flack Global Metals website, www.FlackGlobalMetals.com. Note that Steel Market Update does not take any positions on HRC or scrap trading, and any recommendations made by David Feldstein are his opinions and not those of SMU. We recommend that anyone interested in trading steel futures enlist the help of a licensed broker or bank.

On Feb. 22, the April Midwest HRC Future traded as high as $752 in response to the second round of domestic mill price increase announcements. The April future settled at $740 that day and has traded in a range between $725 and $740 since. The rolling 2nd month CME HRC future remains in a downtrend, as you can see in the chart below.

Rolling 2nd Month CME Midwest HRC Future

The CME HRC futures were under pressure today on light volume (at 2:30 p.m. CST).

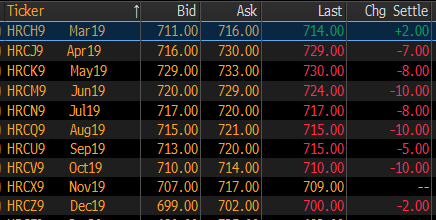

The CME Midwest HRC curve below remains backwardated or downward sloping with little change to the shape since the last article on Feb. 7.

CME Midwest HRC Futures Curve

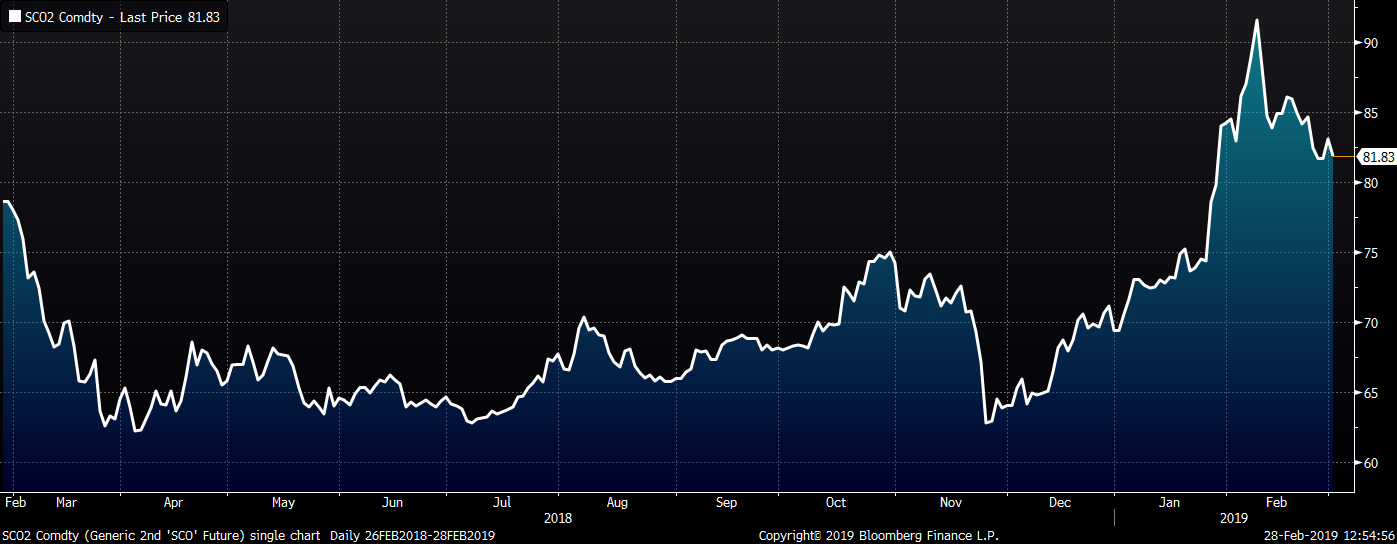

The first domestic mill price increase followed on the heels of the Vale dam breach in Brazil that sent iron ore prices soaring. Iron ore futures have calmed significantly, closing the day at $83.06 after trading as high as $94/t on Feb. 8.

2nd Month SGX Iron Ore Future

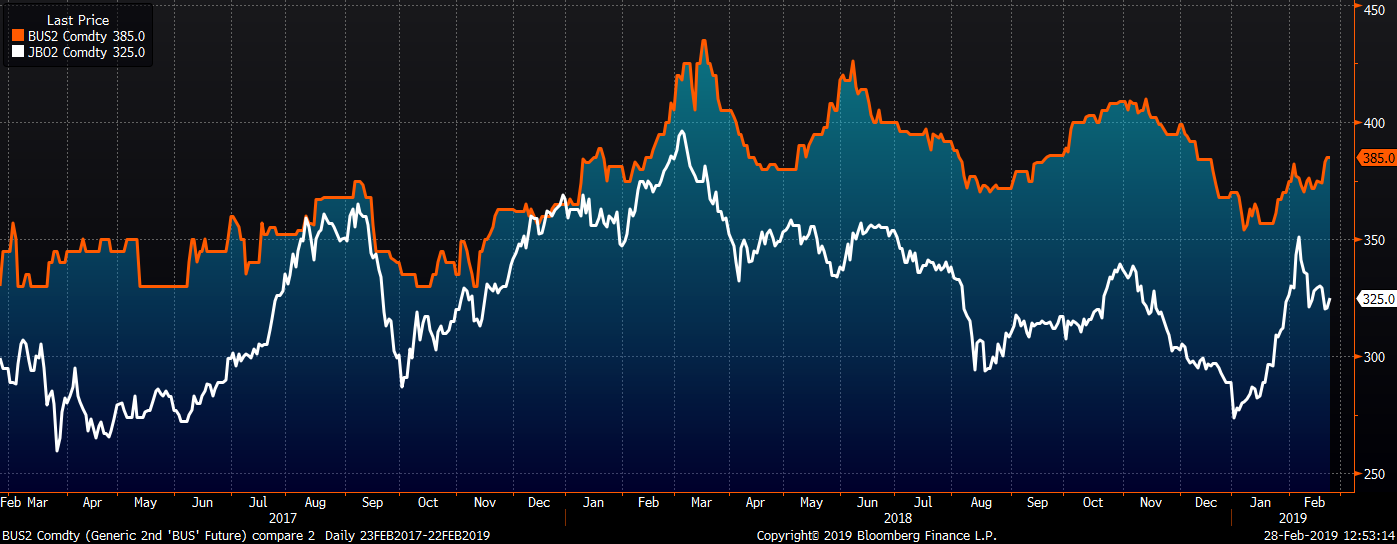

The rally in iron ore carried LME Turkish scrap futures higher. The second month LME Turkish scrap future gained $43 following the disaster, reaching a high of $351/t. Since then, Turkish scrap futures have retraced with April settling at $325/t today. CME Midwest busheling saw a more modest reaction to the disaster than LME Turkish futures, but unlike the reversal in LME Turkish scrap, the 2nd month busheling future has continued to rally, closing today at $385/t.

2nd Mo. LME Turkish Scrap & 2nd Mo. CME Busheling Futures

In the Week-Over-Week report, we have been recommending taking a prudent risk-averse approach waiting for further clarity regarding market direction.

Flat-rolled imports have fallen dramatically, service center inventories dropped sharply in January and rallying global flat rolled prices continue to keep import offers out of reach. However, this tightening of supply may not be enough to overcome increased domestic capacity/crude steel production, bloated inventory levels at domestic steel mills and a large decrease in flat rolled exports. Especially when juxtaposed against flat to down domestic manufacturing demand and global manufacturing weakness as evidenced by multiple countries with sub-50 manufacturing PMIs, particularly China.

Whether due to USMCA negotiations and/or the Bicameral Congressional Trade Authority Act, the binary downside price risk posed by the reversal of steel tariffs is weighing on buyers’ risk appetites. This is especially true for the service center collective still nursing wounds from the sharp price fall in the back half of 2018.

Chart patterns in flat rolled products, oil, interest rates and a diverse group of economic indicators appear to have shifted into a downtrend. Midwest HRC futures look to be in a bear market, but may be consolidating in a range until these issues are resolved.