Prices

February 26, 2019

Flat Rolled Imports Tumbling

Written by Brett Linton

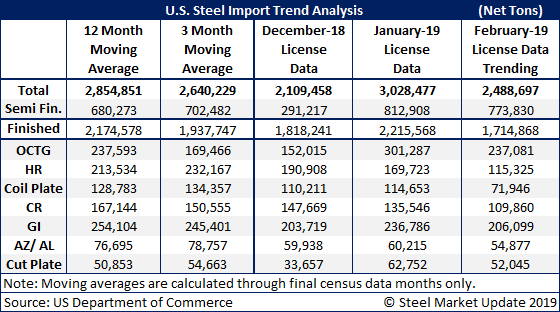

As of Feb. 26, with the month nearly complete, U.S. steel imports were trending at less than 2.5 million tons, based on license data from the U.S. Department of Commerce. February imports are likely to finish the month well below January and below the 3- and 12-month moving averages as well. Semi-finished steels continue to be the largest single product imported, as mill demand for slabs remains strong.

Among the other products, oil country tubular goods and galvanized sheet are likely to top the imports in February, though every product category is down from January.

If the numbers shown in our table (which is the trend, not final numbers) hold true through the end of the month, we will see significant declines in hot rolled, coiled plate, cold rolled and galvanized. Basically, all of the flat rolled items are trending much lower than their 3- and 12-month moving averages. They are also lower than what we saw for December and January imports. KEEP AN EYE ON THIS DATA – IT WILL BE IMPORTANT IN THE COMING MONTHS.

The tonnages shown in the table are net tons, not metric, which is how the DOC reports the data. The February numbers are not actual tonnages, but rather the trend based on the daily license average, which is then projected to remain the same for the balance of the month. This give us the “trend,” which at this point in the month can vary by +/- 200,000 net tons or more.