Prices

February 19, 2019

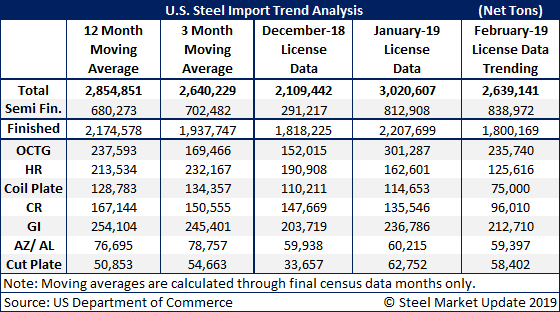

February Foreign Imports Trending to 2.6 Million Tons

Written by Brett Linton

The U.S. Department of Commerce released new license data through the 19th of February and the trend for imports is at 2.6 million net tons (+/- 200,000 tons). Semi-finished steels continue to be the largest single product imported, with most being slabs heading to mills like California Steel, NLMK USA, JSW USA and ArcelorMittal Mobile. Flat rolled tonnages continue to decline with hot rolled, coiled plate, cold rolled and galvanized all below their 12-month and 3-month moving averages. With service center inventories dropping and shipments remaining quite robust, steel buyers need to stay aware of possible storm clouds on the horizon due to tightening supply. This is not a warning, just something steel buyers need to watch closely.

The tonnages shown in our table are net tons, not metric, which is how the DOC reports the data. The February numbers are not actual tonnages, but rather the trend based on the daily license average, which is then projected to remain the same for the balance of the month. This give us the “trend,” which at this point in the month can vary by +/- 200,000 net tons or more.