Prices

February 15, 2019

Semi-Finished Steels Represent One-Third of February Licenses

Written by Brett Linton

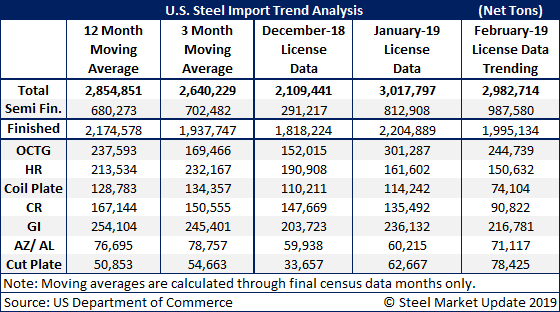

February imports are trending high, close to 3 million net tons, according to U.S. Department of Commerce license data released Feb. 12. However, looking at the data more closely, the domestic steel mills continue to bring in a tremendous amount of semi-finished steels (slabs, billets – but most are slabs). The mills are on pace to import 1 million net tons of slabs during the month of February if the trend continues. It used to be that one-quarter of the imports were slabs; this month it is on pace to be one-third of the total.

Among the other items, hot rolled is continuing to trend lower, coiled plate is trending lower, and cold rolled is trending lower as is galvanized. The only products trending above their 12-month and 3-month moving averages are oil country tubular goods (OCTG), Galvalume/Aluminized (close to the averages) and cut plate.

Steel Market Update has been hearing from trading companies that we should continue to expect lower flat rolled imports in the next couple of months.

Note: The February numbers are not official and only reflect the trend based on the first 12 days of the month. Tonnages shown are in net tons, not metric, which is how the data is shown on the government website.