Market Data

February 12, 2019

SMU Market Trends: Will Price Hike Stick?

Written by Tim Triplett

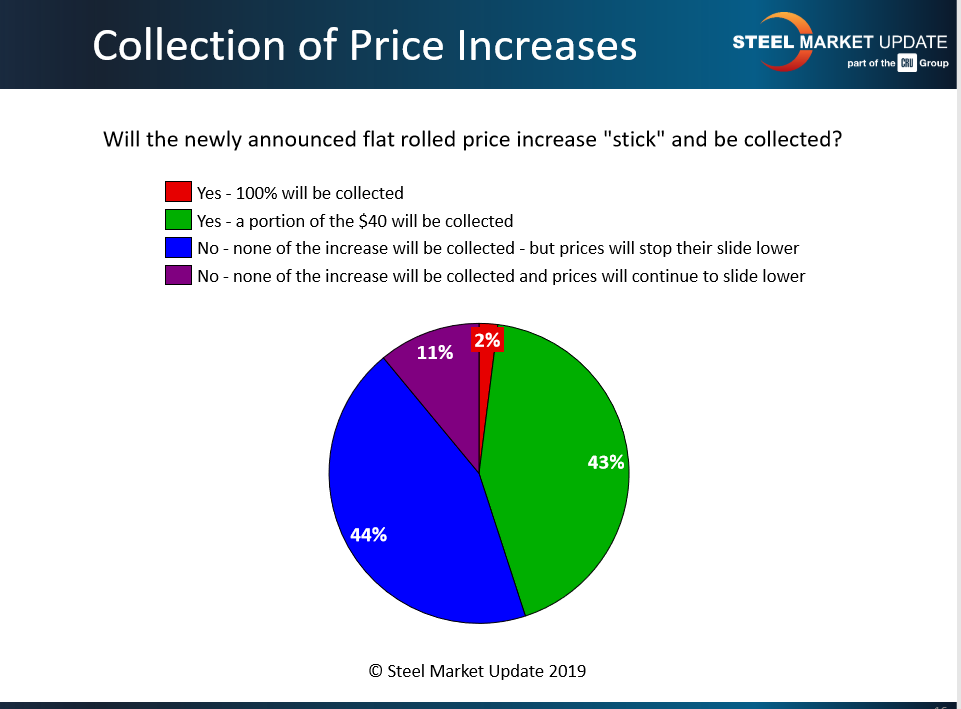

Steel Market Update asked: Will the newly announced flat rolled price increase “stick” and be collected? Maybe not, said most respondents to SMU’s market trends questionnaire last week, but it will at least stop the slide.

Looking at the data, very few expect the mills to collect the full $40 per ton increase they announced last month. More than 11 percent expect the announcement to have no effect at all and that steel prices will continue declining.

The vast majority in between, however, do expect the mills’ move to have an impact. Forty-four percent of those responding believe the mills’ price hike will at least put an end to the seven-month downtrend that has cut 25 percent from the price of hot rolled steel. Another 43 percent predict that not only will the announcement stem the bleeding, but the mills will manage to collect at least a portion of the increase.

Following are some of the respondents’ more insightful comments:

“With service center margins squeezed due to the rapid decline in the cost of steel and foreign imports, there should be a unified producer and distributor effort to ensure some of the increase sticks.”

“It will stop the decrease for a very short period of time before it resumes.

“There appears to be excess domestic supply of HRC relative to demand. I suspect the gap between HRC and coated will widen and perhaps coated prices will stabilize with some further downside in HRC.”

“The Vale disaster [disrupting iron ore production in Brazil] will give the integrated mills something to point to as opposed to just saying that it was time for an increase.”

“The mills had to do something.”