Prices

February 5, 2019

Latest Import Data from Department of Commerce

Written by Brett Linton

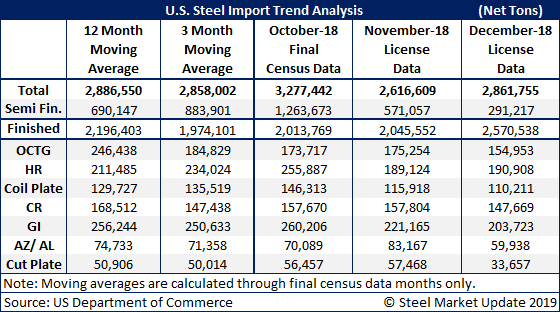

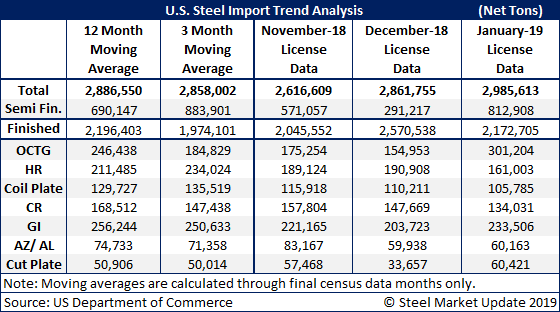

The U.S. Department of Commerce released all kinds of foreign steel import data late this afternoon. We are studying the numbers to see if they make sense, as one of the steel mills told SMU late today that the mechanical pipe and some of the other pipe categories appear to be out of whack. In the data shown below, we do see a large increase of oil country tubular goods (OCTG), but the other items appear to be in line with where we thought they would be.

If the license data is close to being correct (and we must be careful with the government shut down for 34 days), hot rolled is below the 3-month and 12-month moving averages as is coiled plate, cold rolled, galvanized and Galvalume/Aluminized.

The U.S. DOC also released Final Census Data for the month of October. The month came in heavy in imports at 3,277,442 net tons with semi-finished being more than one-third of the total. Semi-finished steels are only used by steel mills (mostly slabs, but it also includes blooms and billets).

The 3-month and 12-month moving averages are based on months where the Final Census data has been calculated (does not include November and December license data months).