Prices

January 25, 2019

Raw Material Prices: Iron Ore, Coking Coal, Pig Iron, Scrap and Zinc

Written by Peter Wright

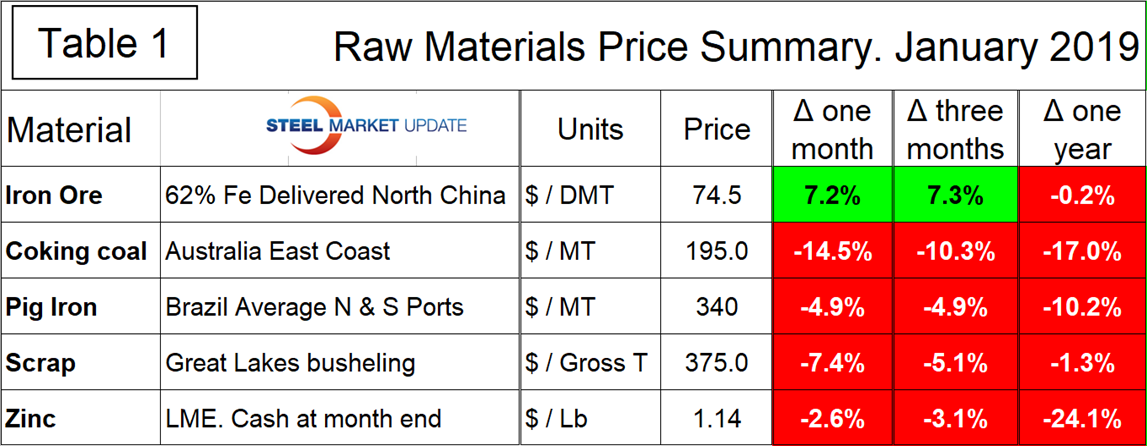

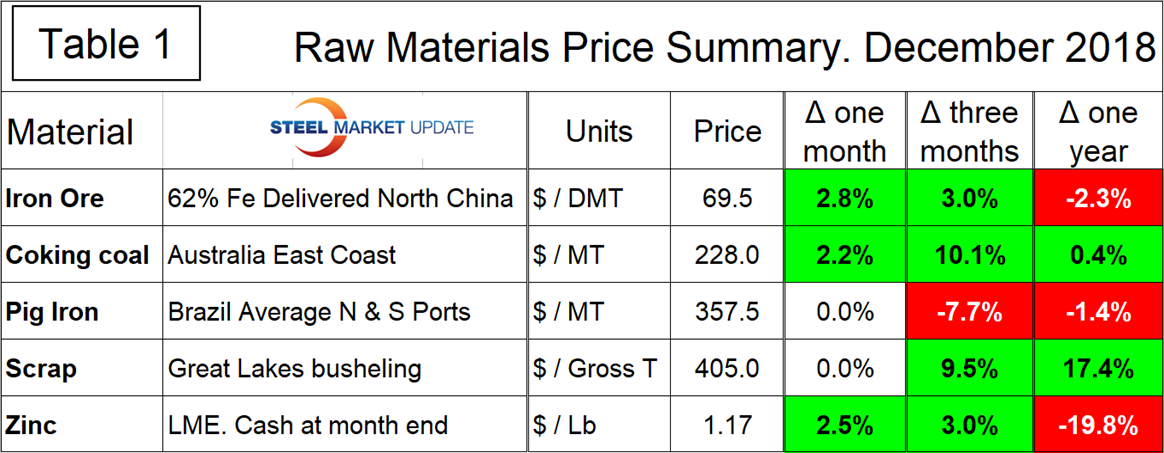

There has been a downward reversal in raw materials prices in the last month.

Table 1 summarizes the price changes through January of the five materials considered in this analysis. It reports the month/month, 3 months/3 months and 12 months/12 months changes and tells us that price movements have been negative for all materials except iron ore. To illustrate the magnitude of the change in the last month, we have included Table 1 December edition.

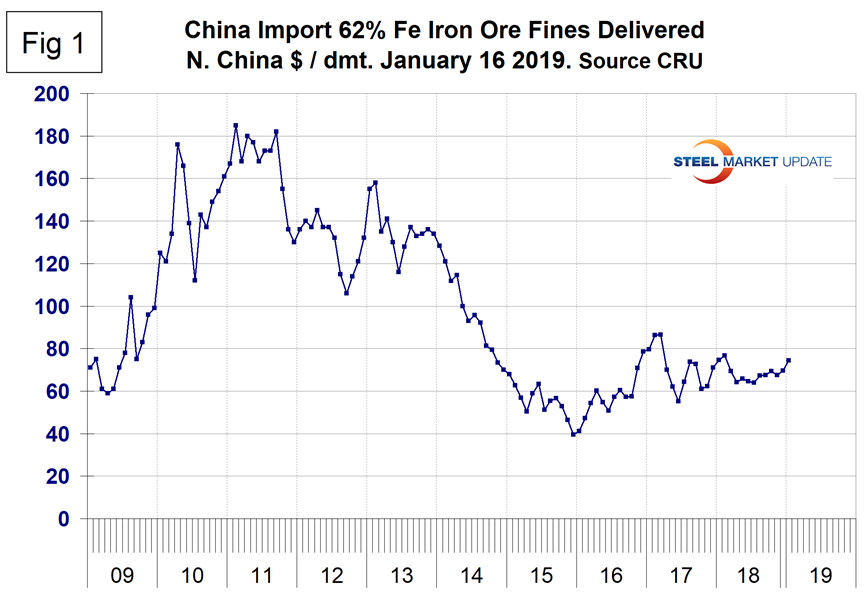

Iron Ore

Based on CRU’s data, the weekly average spot price of 62% fines delivered North China was $74.50 per dry metric ton on Jan. 16. The price was up in one month and three months, but down slightly year-over-year. Figure 1 shows the price of 62% Fe delivered North China since January 2009. Ore has been trading in a $20 range for a year and a half.

Mining.com reported that prices of steel and steel-making raw materials in China rose on Jan. 18, with iron ore hitting its highest value in more than 10 months and rebar posting the best week in more than a month, amid optimism over progress in the U.S.-Sino trade talks. U.S. Treasury Secretary Steven Mnuchin discussed lifting some or all tariffs imposed on Chinese imports and suggested offering a tariff rollback during trade discussions scheduled for Jan. 30, the Wall Street Journal reported on Jan. 16. China’s 2018 iron ore imports fell by 1 percent from the previous year, the first annual decline since 2010, according to data from the General Administration of Customs on Monday. Full-year iron ore imports fell to 1.064 billion metric tons in 2018 from an annual record of 1.075 billion tons in 2017, the data showed. The ore imports, though, still exceeded 1 billion metric tons for a third year running. “With lower profit margins this year, steel mills would increase consumption of lower-grade iron ore, while reducing demand for medium- and high-grade ore,” said Wang Yilin, an analyst at Sinosteel Futures. She also expected steel mills to cut output from electric arc furnaces, but maintain steady operation of blast furnaces, which will underpin support for iron ore.

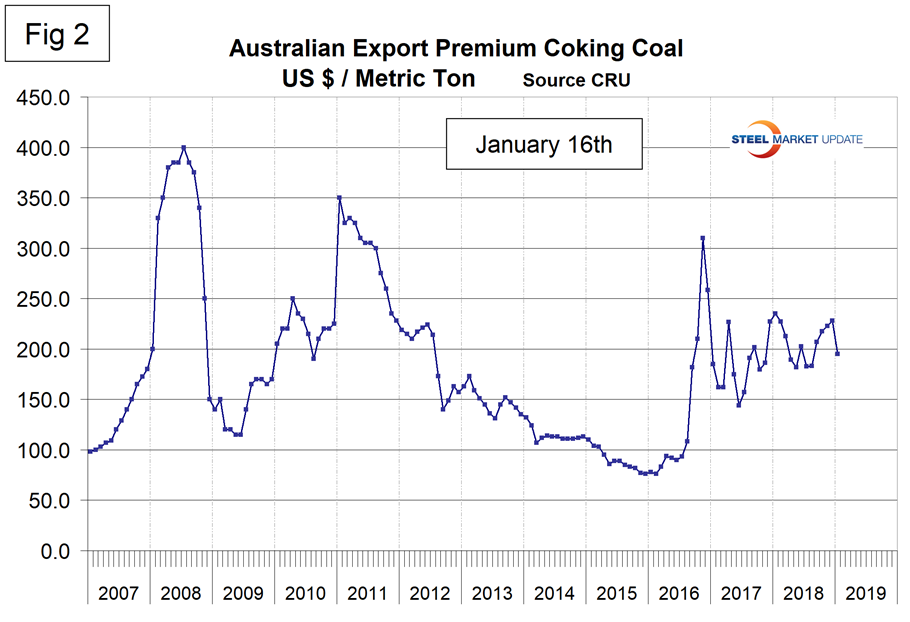

Coking Coal

The price of premium low volatile coking coal FOB east coast of Australia declined in January after rising for four straight months. On Jan. 16, the price stood at $195 per metric ton and has ranged between $179.50 and $235 per ton since October 2017. (Figure 2)

Last week, FocusEconomics reported: “Prices for coking coal have been on a general downward slope since early December amid fears of economic headwinds in China affecting demand. On 11 January, coking coal traded at USD 200 per metric ton, which was 12.0% lower than on the same day last month. The price was down 6.6% on a year-to-date basis and was 23.2% lower than on the same day last year. Economic growth slowed in China in the third quarter of 2018 and recent data suggested that in December the manufacturing sector entered contraction for the first time in nearly two years. China is the largest consumer of coking coal in the world, so a slowing domestic economy has stoked concerns over coking coal demand and likely weighed on prices in recent weeks.”

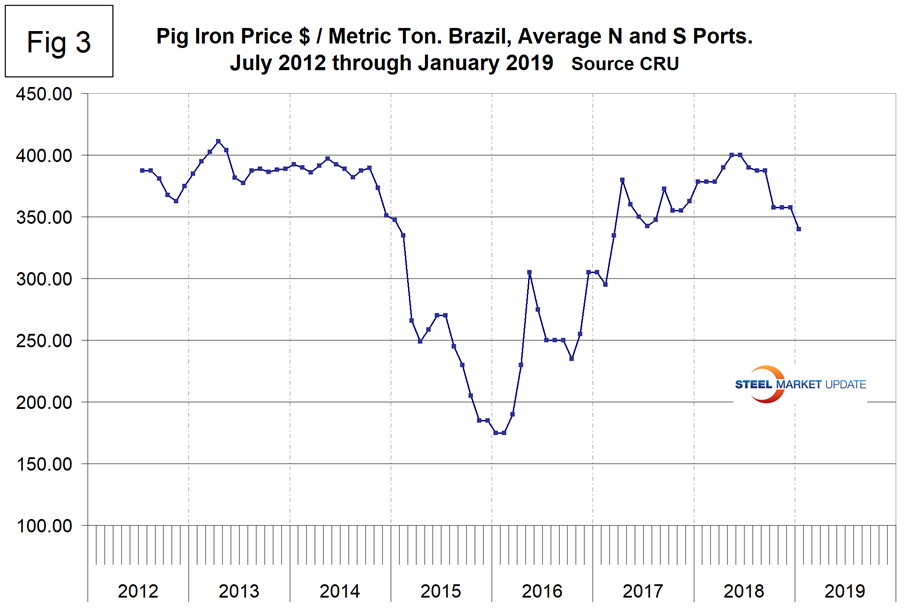

Pig Iron

Most of the pig iron imported to the U.S. currently comes from Russia, Ukraine and Brazil with additional material from South Africa and Latvia. In this report, we summarize prices out of Brazil and average the FOB value per ton from the north and south ports. The price steadily increased from the $175 low point in January and February 2016 to $400 in May and June 2018 before declining to $340 in January 2019. The average price in January was 10.2 percent lower than in January last year.

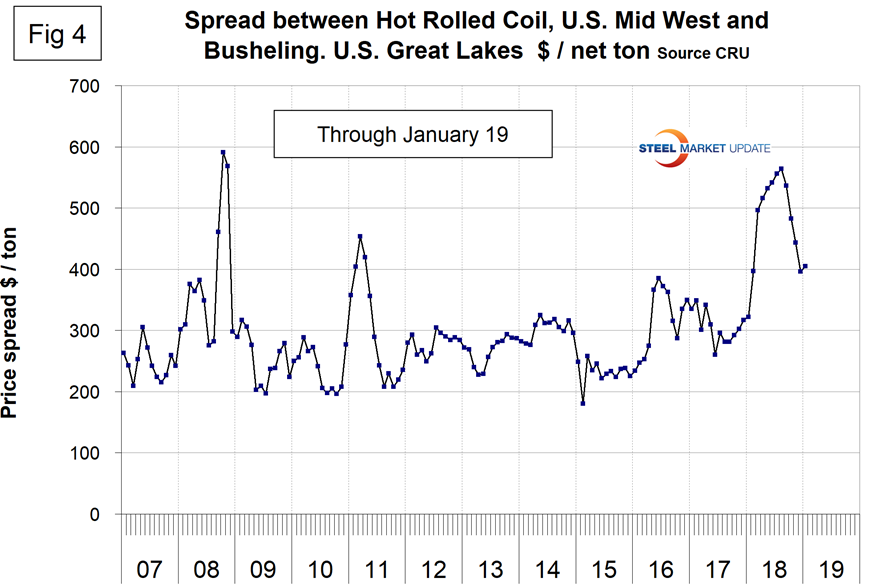

Scrap

To put this raw materials commentary into perspective, we include here Figure 4, which shows the spread between busheling in the Great Lakes region and hot rolled coil Midwest U.S. through mid-January 2019, both in dollars per net ton. The spread declined from $564 in August last year to $396 in December before increasing to $405 in January, but is still historically high, up from $260 in June 2017.

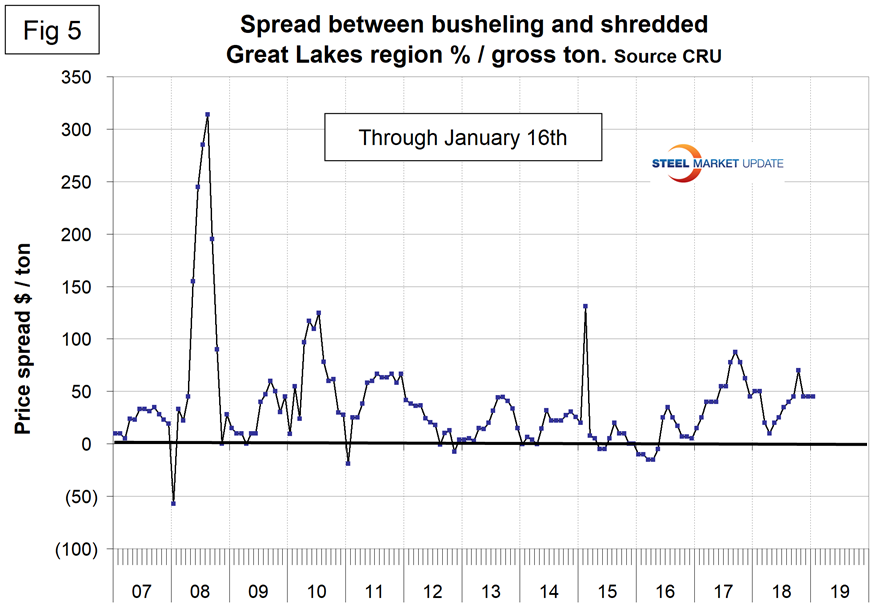

Figure 5 shows the relationship between shredded and busheling both priced in dollars per gross ton in the Great Lakes region. This spread has been unchanged at $45 for the last three months. The busheling premium over shredded rose from $10 in April to $70 in October before declining to $45 in November.

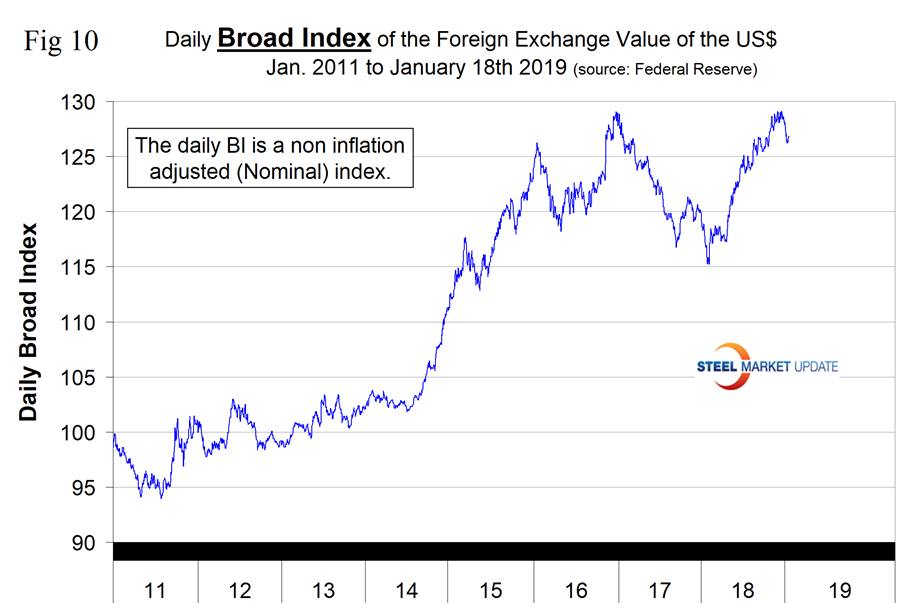

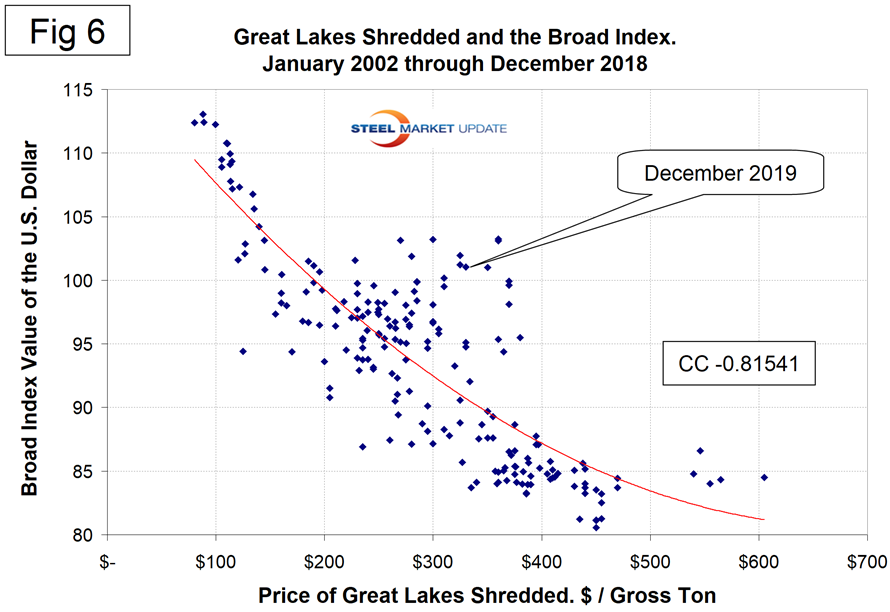

Figure 6 is a scatter gram of the price of Chicago shredded and the monthly Broad Index value of the U.S. dollar as reported by the Federal Reserve. The latest data for the monthly Broad Index was December. This is a causal relationship with a negative correlation of over 81 percent.

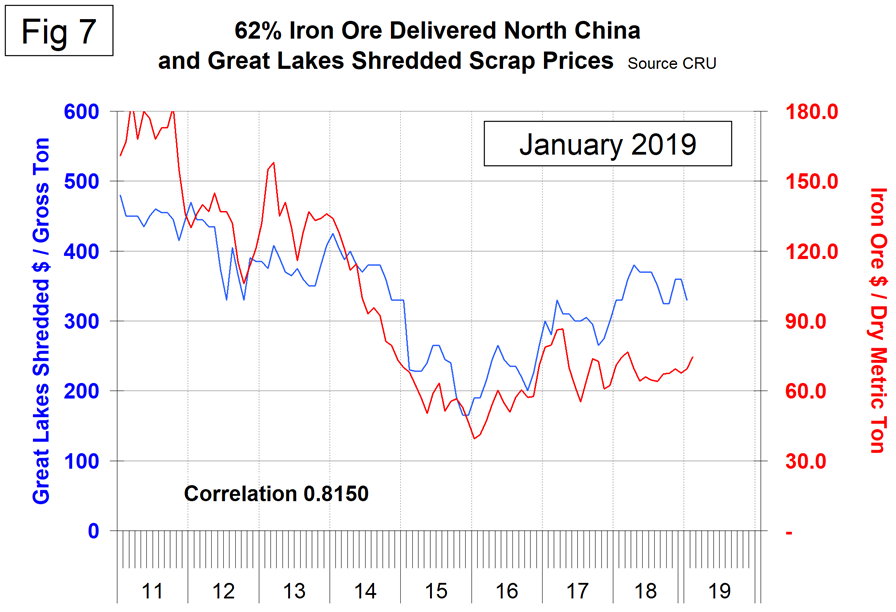

There is a long-term relationship between the prices of iron ore and scrap. Figure 7 shows the prices of 62% iron ore fines delivered North China and the price of shredded scrap in the Great Lakes region through mid-January 2019. The correlation since January 2006 has been 81.5 percent. There has been a very unusual divergence in these prices since Q2 2017.

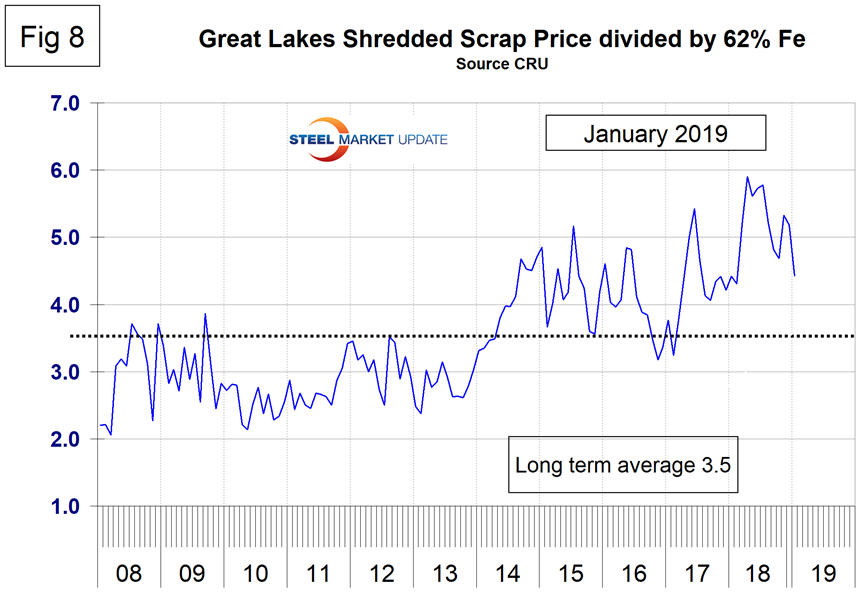

In the last 10 years, scrap in dollars per gross ton has been on average 3.4 times as expensive as ore in dollars per dry metric ton (dmt). The ratio has been erratic since mid-2014, but at 4.4 in January is beneficial to integrated producers (Figure 8). Since Chinese steel manufacture is 95 percent BOF, this ratio has allowed them to be more competitive on the global steel market. In the last four years, there have been times when China could supply semi-finished to the global market at prices competitive with scrap.

Zinc

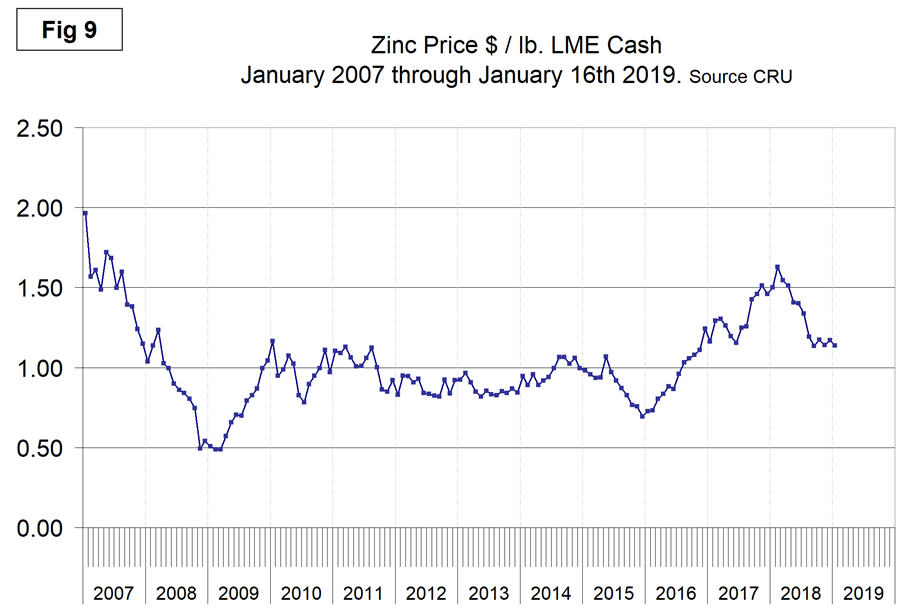

The LME cash price for zinc mid-month is shown in Figure 9. The latest data is for Jan. 16 when the price was $1.14 per pound and little changed in six months.

On Jan. 23, MoneyWeek reported: “At current rates of global consumption, there is only about a week’s worth of zinc supply held in visible stockpiles. That is quite something. World zinc mine production rose by about 1.7% last year, says the IZLSG, mainly due to increases in European production, especially in Finland, Greece, Macedonia and Russia. Output was lower in Canada, China, India and Mexico (which are among the larger producers). Chinese imports of zinc contained in zinc concentrate rose by 21.3% on the previous year, and its imports of refined zinc were up around 7%. Given all this, zinc “should” be priced higher. One can only assume either tariff concerns have suppressed the price, or perhaps increased mine supply or considerable growth in Chinese smelter production is anticipated. Nevertheless, the conditions are certainly there for a potential spike in the price. Perhaps a softening of the aggressive tariff narrative could be the trigger.”

Zinc is the fourth most widely used metal in the world after iron, aluminum and copper. Its primary uses are 60 percent for galvanizing steel, 15 percent for zinc-based die castings and about 14 percent in the production of brass and bronze alloys.

SMU Comment: There is an inverse relationship between commodity prices and the value of the U.S. dollar on the global currency markets. After falling for most of 2017 and through Feb. 1, 2018, the dollar experienced a sharp upward revival and through Dec. 14 was up by 12.1 percent. In the following 36 days to Jan. 18, the dollar declined by 1.8 percent (Figure 10). Note, this is the daily index, which is not inflation adjusted. The monthly index used in the scatter gram of Figure 6 is inflation adjusted and isn’t updated until late the following month. Supply and demand fundamentals are the primary drivers of raw materials prices, but a rising dollar acts as a headwind on the price of those global commodities that are priced in dollars. This effect is clearly shown by the relationship between scrap and the dollar index described above in Figure 6.