Prices

January 24, 2019

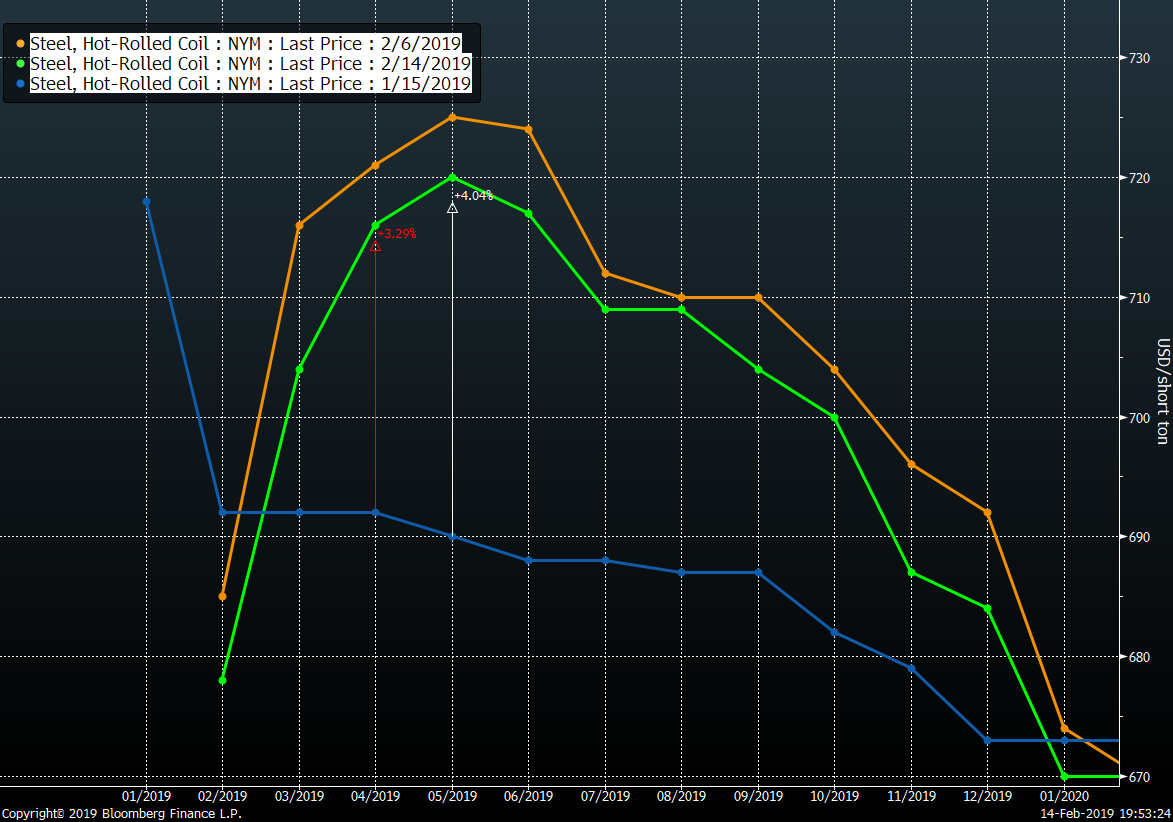

HRC Futures: Markets Fairly Volatile

Written by Gaurav Chhibbar

Gaurav Chhibbar is a partner at Metal Edge Partners, a firm engaged in Risk Management and Strategic Advisory. In this role, he and his firm design and execute risk management strategies for clients along with providing process and analytical support. In Gaurav’s previous role, he was a trader at Cargill spending time in Metal and Freight markets in Singapore before moving to the U.S. He can be reached at gaurav@metaledgepartners.com for queries/comments/questions.

Ferrous markets globally have been fairly volatile over the last few days. Let’s start with the iron ore market since the impact of its movement is also trickling over to our own backyard. The ore prices rallied hard post the news of Vale’s dam break and subsequent news of mine closures that created panic amongst traders. Many anticipated the post-holiday return to market by the Chinese to be marred with further scrambling to access ore supply.

However, market participants assessed the ore supply situation to be not as constrained as feared. The subsequent selling pressure brought the prices in the ore market down.

Meanwhile, the scrap market has remained well bid for the deep sea cargoes as Turkey’s appetite for scrap has picked up. Worsening weather conditions in the U.S. has meant that price sentiment on scrap has picked up. This is reflected in the near term for both the Turkish scrap curve as well as the Busheling scrap. A combination of higher scrap pricing and ~$88/mt for Iron Ore Fe 62% is leading pig iron exporters to also consider raising prices higher.

All the above factors have translated into the U.S. HRC market trading up on the front months as participants anticipate short-term tightness with stronger international markets, lower U.S. imports and an improved raw material outlook.

The key flags to watch out for in the coming days will be mill lead times on finished products, pace of imports and sentiment in China. Of the aforementioned, I’d identify mill lead times as a key measure that many in the futures market are watching like a hawk. Any pickup in order activity at the mills is likely to show up via promise dates from the mills as well as their resulting reluctance to negotiate on price.

——————–

Disclaimer: The information in this write-up does not constitute “investment service,” “investment advice” or “financial product advice” as defined by laws and/or regulations in any jurisdiction. Neither does it constitute nor should it be considered as any form of financial opinion or recommendation. The views expressed in the above article by Metal Edge Partners are subject to change based on market and other conditions. The information given above must be independently verified, and Metal Edge Partners does not assume responsibility for the accuracy of the information.