Prices

December 18, 2018

December Steel Imports on Pace for 2.4 Million Ton Month

Written by Brett Linton

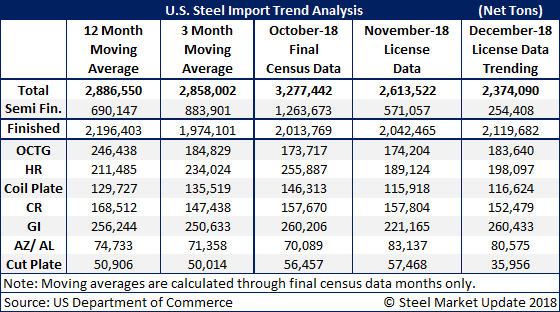

This afternoon, the U.S. Department of Commerce released the latest license data for foreign steel imports arriving during the month of December. The trend is for imports to drop from 2.6 million net tons in November (after dropping from 3.2 million tons in October) to just shy of 2.4 million tons in December. This is based on import license data through the first 18 days of December.

Affecting the number is the limited tonnage coming in for semi-finished steels (mostly slabs). We believe the lack of slabs is due to Brazil having reached their quota for calendar year 2018.

When you look at finished steel, which is what the manufacturers and distributors actually buy (slabs go to steel mills), imports are trending toward the 12-month moving average of 2.1 million to 2.2 million tons.

The products we follow on a regular basis are shown below with no real surprises (up or down) in the trends for December.

To see an interactive history of total steel imports (through October final data), visit our website here. If you need assistance logging into or navigating the website, please contact info@SteelMarketUpdate.com.